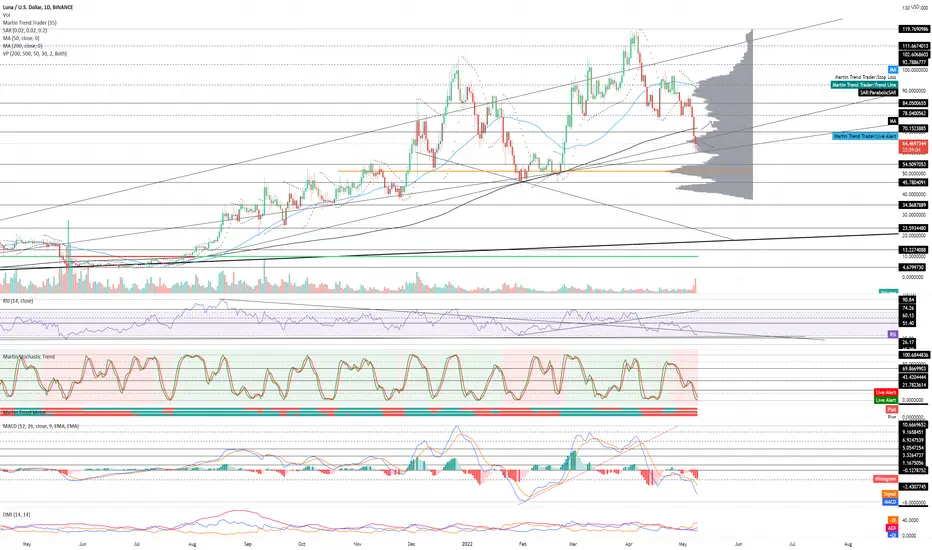

LUNA/USD Daily TA Cautiously Bearish

LUNA/USD Daily cautiously bearish. Recommended ratio: 20% LUNA, 80% cash. Price is currently testing the uptrend line from July 2021 as support at $65 after briefly touching the uptrend line from January 2021 at $60. Volume is moderate for the first time since December 2021 as recessionary fears are putting selling pressure on almost all assets and equities. Parabolic SAR flips bullish at $93.60, this margin is bullish. RSI is currently trending down at 32 and is beginning to form a trough as it approaches 26.17 support. Stochastic remains bearish and is currently trending down at 2 as it approaches max bottom (where it can coast for a while). MACD remains bearish and is trending down at -5.15 with no signs of trough formation; the next support is the ATL at -7.75. ADX is currently trending up at 19 as Price continues to fall, this is bearish. If Price is able to defend support at the uptrend line from July 2021 at $65, the next likely target is a test of $70.15 resistance before potentially going higher (200 MA at $72). However, if it breaks down below this uptrend line, it will have the uptrend line from January 2021 at $60 as the next area of support before potentially retesting $54.50 major resistance. Mental Stop Loss: (two consecutive closes above) $71.93 (200 MA).

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.