Long

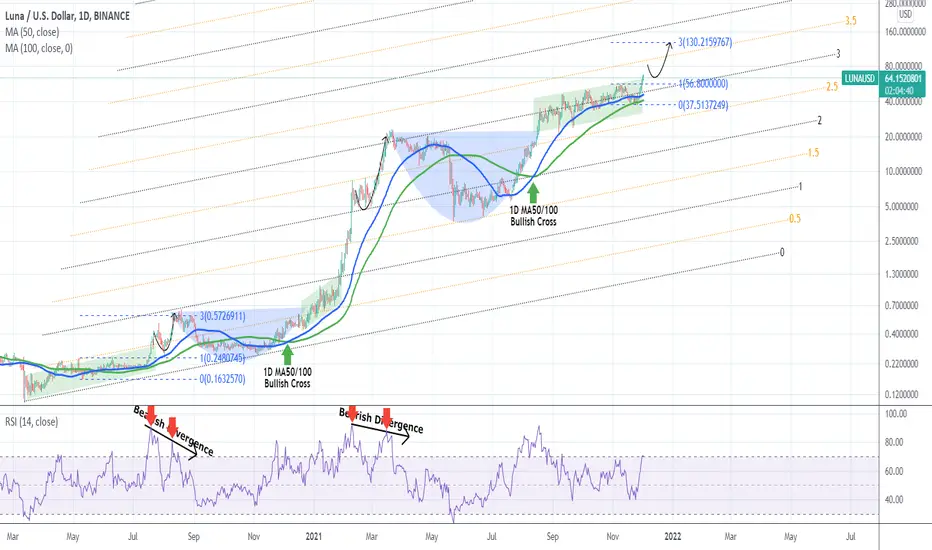

LUNAUSD Worst case scenario = $130

LUNA is having a strong rebound in the past week or so but based on this long-term pattern, not as strong as the one that is about to come.

According to this, the worst case scenario for LUNAUSD is to be trading within a (green) Channel Up, which on its more modest outcome in August 2020, it made a rally and peaked just above the 3.0 Fibonacci extension. That means a price target of at least $130 on the short-term. If on the other hand it follows the more optimistic scenario of January 2021, then the rally that is about to start may take a huge parabolic turn but of course that would suggest a market cap for LUNA that many in the market would deem unrealistic at this stage. In either case, our exit signal should be when we see the 1D RSI forming a Lower Highs bearish divergence similar to July - August 2020 and February - March 2021.

Which of the two paths do you think it will follow?

--------------------------------------------------------------------------------------------------------

** Please support this idea with your likes and comments, it is the best way to keep it relevant and support me. **

--------------------------------------------------------------------------------------------------------

According to this, the worst case scenario for LUNAUSD is to be trading within a (green) Channel Up, which on its more modest outcome in August 2020, it made a rally and peaked just above the 3.0 Fibonacci extension. That means a price target of at least $130 on the short-term. If on the other hand it follows the more optimistic scenario of January 2021, then the rally that is about to start may take a huge parabolic turn but of course that would suggest a market cap for LUNA that many in the market would deem unrealistic at this stage. In either case, our exit signal should be when we see the 1D RSI forming a Lower Highs bearish divergence similar to July - August 2020 and February - March 2021.

Which of the two paths do you think it will follow?

--------------------------------------------------------------------------------------------------------

** Please support this idea with your likes and comments, it is the best way to keep it relevant and support me. **

--------------------------------------------------------------------------------------------------------

👑Best Signals (Forex/Crypto+70% accuracy) & Account Management (+20% profit/month on 10k accounts)

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

👑Best Signals (Forex/Crypto+70% accuracy) & Account Management (+20% profit/month on 10k accounts)

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.