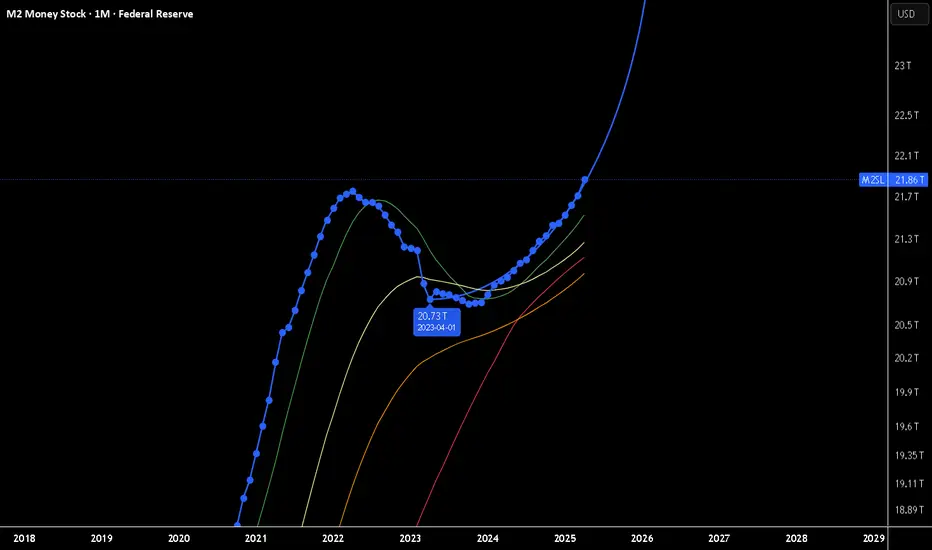

The Race to $25 Trillion: Why M2 Money Supply is My Key Market Indicator

In what seems like a relentless march, the US M2 money supply is closing in on the $25 trillion mark. While many focus on daily market noise, I believe this high-level metric is one of the most critical indicators for understanding the long-term picture for asset prices and currency risk.

The Logic is Simple:

If the economy is flooded with newly created US dollars, that capital has to go somewhere. Assuming the velocity of money (M2V) doesn't collapse, this liquidity injection naturally pushes up the prices of scarce assets like stocks, real estate, and cryptocurrencies.

The long-term risk of significant USD currency debasement and severe inflation keeps growing.

I'm not predicting hyperinflation tomorrow, but I am watching the train on the tracks. Direction is what matters most. This reminds me of how people view empires—they often focus on past strength and never expect a collapse until it's too late. The same is true for emerging powers, which are consistently underestimated. It's the direction of travel that matters most.

The key isn't to wait for a reason to panic, but to adjust your strategy to the changes as they happen.

Playing with the forecast tool I get this. I am not looking at it for anything other then pure amusement.

Disclaimer:

The information provided in this post is for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or a solicitation to buy or sell any financial instruments. All investments involve risk, and the past performance of a security, market, or trading strategy does not guarantee future results. I am not a financial advisor. Please conduct your own thorough research and consult with a qualified financial professional before making any investment decisions. You are solely responsible for any investment decisions you make.

In what seems like a relentless march, the US M2 money supply is closing in on the $25 trillion mark. While many focus on daily market noise, I believe this high-level metric is one of the most critical indicators for understanding the long-term picture for asset prices and currency risk.

The Logic is Simple:

If the economy is flooded with newly created US dollars, that capital has to go somewhere. Assuming the velocity of money (M2V) doesn't collapse, this liquidity injection naturally pushes up the prices of scarce assets like stocks, real estate, and cryptocurrencies.

The long-term risk of significant USD currency debasement and severe inflation keeps growing.

I'm not predicting hyperinflation tomorrow, but I am watching the train on the tracks. Direction is what matters most. This reminds me of how people view empires—they often focus on past strength and never expect a collapse until it's too late. The same is true for emerging powers, which are consistently underestimated. It's the direction of travel that matters most.

The key isn't to wait for a reason to panic, but to adjust your strategy to the changes as they happen.

Playing with the forecast tool I get this. I am not looking at it for anything other then pure amusement.

Disclaimer:

The information provided in this post is for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or a solicitation to buy or sell any financial instruments. All investments involve risk, and the past performance of a security, market, or trading strategy does not guarantee future results. I am not a financial advisor. Please conduct your own thorough research and consult with a qualified financial professional before making any investment decisions. You are solely responsible for any investment decisions you make.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.