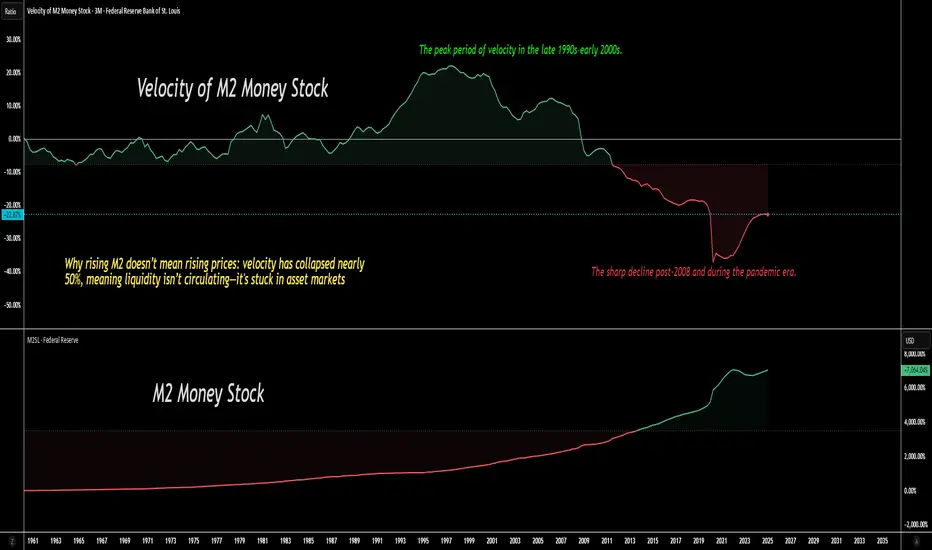

**Most traders see rising money supply (M2) and assume asset prices will soar.**

But they ignore the **Velocity of Money (M2V)**—and that’s where the real danger is hiding.

---

## **The Great Disconnect**

* **Money Supply (M2):** Central banks have flooded markets with liquidity since 2008 and again during the pandemic. Asset prices (tech, crypto, real estate) inflated as this money piled into financial markets.

* **Velocity (M2V):** Velocity has **collapsed to historic lows**, meaning money isn’t circulating in the real economy. It’s trapped in the hands of the wealthy and large institutions.

---

## **Why Velocity Matters**

* **Velocity = How fast money moves through the economy.**

A falling velocity means less economic activity and weaker fundamentals—even when money supply is high.

* **Wealth Concentration:** Most of the new money never reaches average consumers. Instead, it fuels speculative bubbles (AI stocks, meme coins, luxury assets) rather than real growth.

---

## **The Dangerous Assumption**

> “Money supply is up, so prices must keep rising.”

> **False.**

> Without velocity, rising M2 creates **fragile bubbles** that can collapse when sentiment shifts—just like 2000 and 2008.

---

## **What I’m Watching**

* **Rising M2 + Falling M2V = A warning sign.**

* **September 2025 could be a turning point.** Liquidity cracks or overextended bubbles may trigger a sharp unwind.

* Traders who ignore velocity risk being blindsided.

But they ignore the **Velocity of Money (M2V)**—and that’s where the real danger is hiding.

---

## **The Great Disconnect**

* **Money Supply (M2):** Central banks have flooded markets with liquidity since 2008 and again during the pandemic. Asset prices (tech, crypto, real estate) inflated as this money piled into financial markets.

* **Velocity (M2V):** Velocity has **collapsed to historic lows**, meaning money isn’t circulating in the real economy. It’s trapped in the hands of the wealthy and large institutions.

---

## **Why Velocity Matters**

* **Velocity = How fast money moves through the economy.**

A falling velocity means less economic activity and weaker fundamentals—even when money supply is high.

* **Wealth Concentration:** Most of the new money never reaches average consumers. Instead, it fuels speculative bubbles (AI stocks, meme coins, luxury assets) rather than real growth.

---

## **The Dangerous Assumption**

> “Money supply is up, so prices must keep rising.”

> **False.**

> Without velocity, rising M2 creates **fragile bubbles** that can collapse when sentiment shifts—just like 2000 and 2008.

---

## **What I’m Watching**

* **Rising M2 + Falling M2V = A warning sign.**

* **September 2025 could be a turning point.** Liquidity cracks or overextended bubbles may trigger a sharp unwind.

* Traders who ignore velocity risk being blindsided.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.