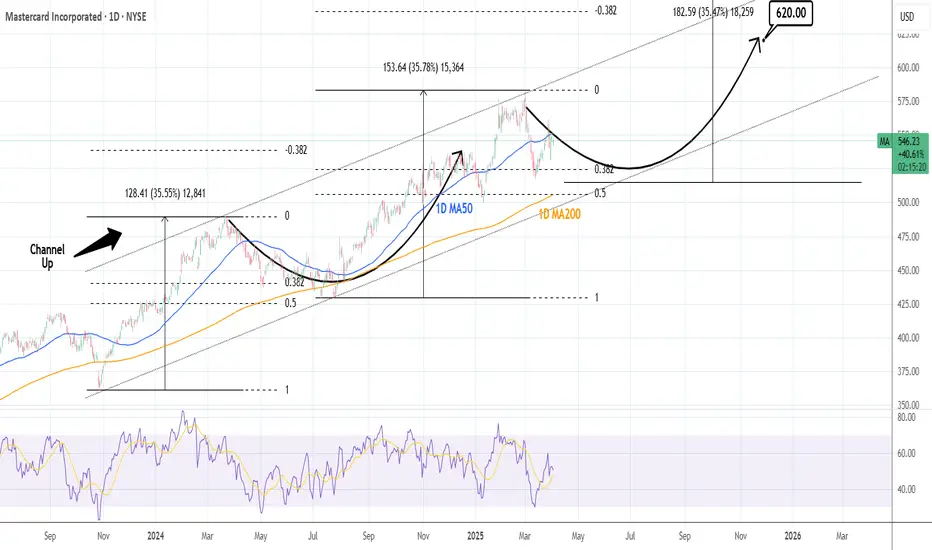

Mastercard is neutral on its 1D technical outlook (RSI = 52.317, MACD = -0.060, ADX = 29.709) having just recovered its 1D MA50 following the March 13th rebound. The pattern here is a Channel Up and March's bearish wave already hit the 0.382 Fibonacci retracement level much like the previous one did on May 1st 2024. That however went on to extend the decline to close to the 0.5 Fibonacci level and hit the 1D MA200. Consequently there is a chance of one more month of slow decline to the 1D MA200 but overall, this is a good enough level to buy again for the long term and aim for the -0.382 Fib extension (TP = 620.00).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Telegram: t.me/investingscope

investingscope.com

Over 65% accuracy on Private Signals Channel.

Over 15% return monthly on our Account Management Plan.

Account RECOVERY services.

Free Channel: t.me/investingscopeofficial

investingscope.com

Over 65% accuracy on Private Signals Channel.

Over 15% return monthly on our Account Management Plan.

Account RECOVERY services.

Free Channel: t.me/investingscopeofficial

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Telegram: t.me/investingscope

investingscope.com

Over 65% accuracy on Private Signals Channel.

Over 15% return monthly on our Account Management Plan.

Account RECOVERY services.

Free Channel: t.me/investingscopeofficial

investingscope.com

Over 65% accuracy on Private Signals Channel.

Over 15% return monthly on our Account Management Plan.

Account RECOVERY services.

Free Channel: t.me/investingscopeofficial

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.