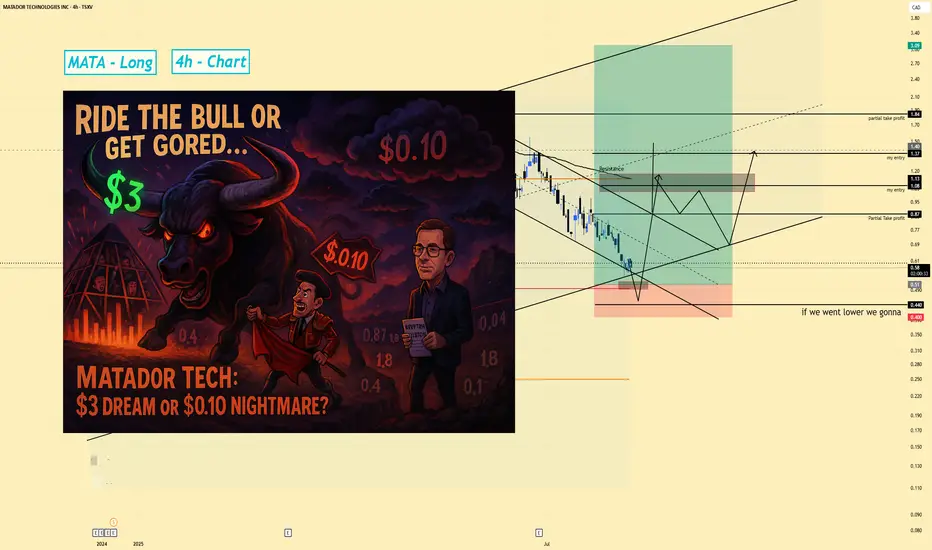

Matador Technology Inc. (Canada) | Long Swing Setup | Accumulation & Trapped Sellers (Aug 2025)

1️⃣ Short Insight Summary:

Matador Technology is an interesting small-cap play led by Mark Morris, who has a strong vision for tech innovation and market trends. Right now, price action shows signs of flushing out trapped traders, which could set up a big upside opportunity if we manage risk carefully.

2️⃣ Trade Parameters:

Bias: Long (Swing)

Entry: Watching accumulation zones between $0.50

Stop Loss: Below $0.40 (invalidates structure and opens downside risk)

TP1: $0.87 (initial target, partial exits recommended)

TP2: $1.80 (mid-term target)

Final TP: $3.00 (long-term aggressive target)

3️⃣ Key Notes:

Right now, the stock is extremely volatile. The goal is to buy where others are trapped and forced to sell. A clear break below $0.20 would be very dangerous and could push price as low as $0.10.

On the upside, we want to see the stock reclaim the $0.50 zone convincingly. This could build momentum towards $0.87 and beyond. Patience is key—this is a swing trade, not a quick scalp.

4️⃣ Follow-up:

I’ll monitor the price action around $0.40–$0.50 and update if we get a breakout from the current downtrend channel.

Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible.

Disclaimer: This is not financial advice. Always conduct your own research. This content may include enhancements made using AI.

1️⃣ Short Insight Summary:

Matador Technology is an interesting small-cap play led by Mark Morris, who has a strong vision for tech innovation and market trends. Right now, price action shows signs of flushing out trapped traders, which could set up a big upside opportunity if we manage risk carefully.

2️⃣ Trade Parameters:

Bias: Long (Swing)

Entry: Watching accumulation zones between $0.50

Stop Loss: Below $0.40 (invalidates structure and opens downside risk)

TP1: $0.87 (initial target, partial exits recommended)

TP2: $1.80 (mid-term target)

Final TP: $3.00 (long-term aggressive target)

3️⃣ Key Notes:

Right now, the stock is extremely volatile. The goal is to buy where others are trapped and forced to sell. A clear break below $0.20 would be very dangerous and could push price as low as $0.10.

On the upside, we want to see the stock reclaim the $0.50 zone convincingly. This could build momentum towards $0.87 and beyond. Patience is key—this is a swing trade, not a quick scalp.

4️⃣ Follow-up:

I’ll monitor the price action around $0.40–$0.50 and update if we get a breakout from the current downtrend channel.

Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible.

Disclaimer: This is not financial advice. Always conduct your own research. This content may include enhancements made using AI.

2 Ways I can help you | Real Trades. Real Edge

1️⃣ The 4 Steps to Improve Your Trading Immediately: tradinggen.services/mohamad-link/

2️⃣ Get trade setups & breakdowns Here: t.me/TradeSimple_with_Mo

1️⃣ The 4 Steps to Improve Your Trading Immediately: tradinggen.services/mohamad-link/

2️⃣ Get trade setups & breakdowns Here: t.me/TradeSimple_with_Mo

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

2 Ways I can help you | Real Trades. Real Edge

1️⃣ The 4 Steps to Improve Your Trading Immediately: tradinggen.services/mohamad-link/

2️⃣ Get trade setups & breakdowns Here: t.me/TradeSimple_with_Mo

1️⃣ The 4 Steps to Improve Your Trading Immediately: tradinggen.services/mohamad-link/

2️⃣ Get trade setups & breakdowns Here: t.me/TradeSimple_with_Mo

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.