Bullish Setup at Key Support Level with Declining Selling Pressure

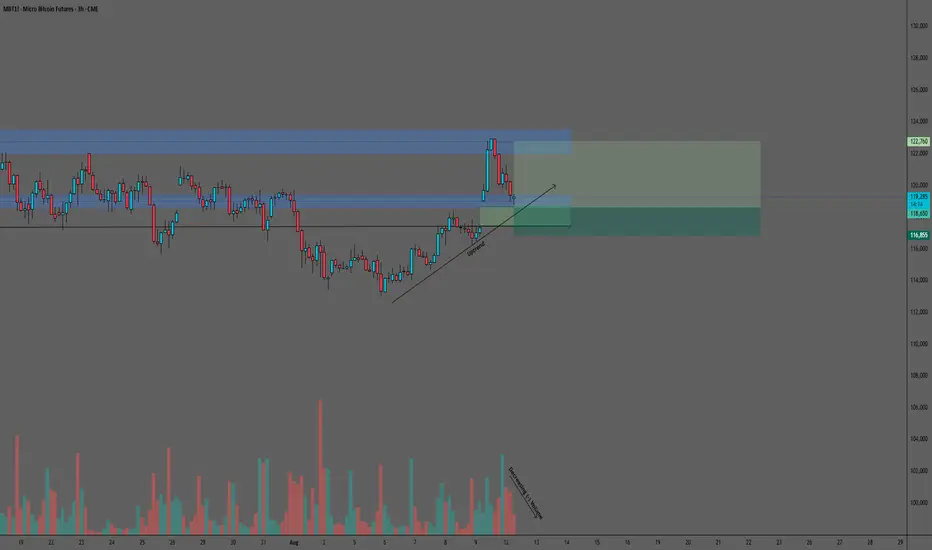

MBT has recently encountered resistance at the 122000-123500 zone, which previously marked its all-time high on July 14, 2025. The subsequent pullback to the 118650-119400 support area presents an intriguing bullish opportunity, particularly given the declining negative volume that suggests waning selling pressure.

The 3-hour chart reveals a compelling technical setup, with the current price action testing a crucial support zone. What makes this setup particularly interesting is the moderate but decreasing negative volume during the recent decline. This volume characteristic often indicates accumulation and suggests that buyers are defending this support level.

Illustrative Setup: A Buy Limit order positioned at 118650 capitalizes on the bottom of the current support zone. The Stop Loss at 116855 is strategically placed below both the August 9 price gap and the prevailing uptrend line, which would clearly invalidate the bullish thesis if breached conjointly. A Take Profit target at 122765, representing the midpoint of the recent high zone (122000-123500), offers an attractive 2.29:1 reward-risk ratio.

Key considerations: The combination of declining selling volume, clear support zone, and the presence of an upward trendline since August 6 provides multiple technical confirmations for this bullish setup. However, traders should remain vigilant of broader market conditions and consider implementing partial profit-taking strategies given the significant distance to the target.

This analysis is provided solely for educational and entertainment purposes and does not constitute any form of financial or investment advice. Always manage your risk and trade responsibly.

MBT has recently encountered resistance at the 122000-123500 zone, which previously marked its all-time high on July 14, 2025. The subsequent pullback to the 118650-119400 support area presents an intriguing bullish opportunity, particularly given the declining negative volume that suggests waning selling pressure.

The 3-hour chart reveals a compelling technical setup, with the current price action testing a crucial support zone. What makes this setup particularly interesting is the moderate but decreasing negative volume during the recent decline. This volume characteristic often indicates accumulation and suggests that buyers are defending this support level.

Illustrative Setup: A Buy Limit order positioned at 118650 capitalizes on the bottom of the current support zone. The Stop Loss at 116855 is strategically placed below both the August 9 price gap and the prevailing uptrend line, which would clearly invalidate the bullish thesis if breached conjointly. A Take Profit target at 122765, representing the midpoint of the recent high zone (122000-123500), offers an attractive 2.29:1 reward-risk ratio.

Key considerations: The combination of declining selling volume, clear support zone, and the presence of an upward trendline since August 6 provides multiple technical confirmations for this bullish setup. However, traders should remain vigilant of broader market conditions and consider implementing partial profit-taking strategies given the significant distance to the target.

This analysis is provided solely for educational and entertainment purposes and does not constitute any form of financial or investment advice. Always manage your risk and trade responsibly.

Trade closed: target reached

The trade idea played out as expected. Profit target was reached for a gain of +2.29R. The trade is over.Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.