## 🧠 META Earnings Trade Setup — July 30 (AMC)

📈 **META (Meta Platforms Inc.)**

💥 **Confidence**: 85% Bullish

💡 **Play Type**: Pre-earnings call option

📊 **Fundamentals + Flow + Setup = High Conviction Swing**

---

### 📊 FUNDAMENTALS SNAPSHOT

✅ **Revenue Growth**: +16.1% YoY

✅ **Profit Margin**: 39.1%

✅ **Gross Margin**: 81.8%

📈 **8/8 EPS Beats** — Avg Surprise: +13%

🧠 **Digital Ad Rebound + AI Integration = Growth Engine**

🟢 **Score: 9/10**

📌 Bottom line: Elite execution + consistent guidance beats

---

### 🔥 OPTIONS FLOW CHECK

💰 **Call Walls**: \$720 / \$730

📈 **Call/Put Skew**: Bullish tilt

🔎 **IV Rank**: 0.65 — High enough for a move, not extreme

📈 **Market Expectation**: \~6% move

🟢 **Score: 8/10**

📌 Institutional flow leans long — smart money eyes upside

---

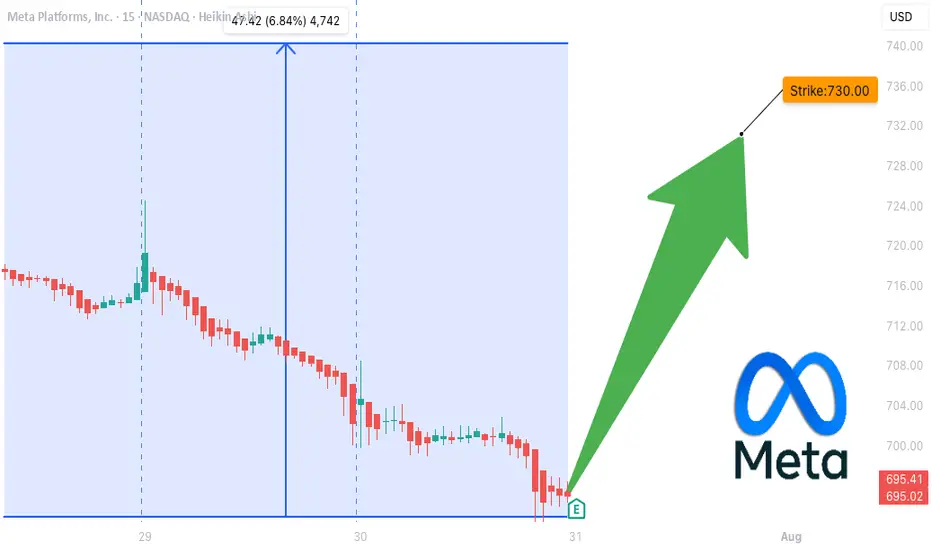

### 📉 TECHNICAL SETUP

📍 **Price**: \~\$700

📉 RSI: 34.34 → OVERSOLD

📉 20D MA: \$713.27 (near-term bounce target)

📌 Support: \$692.50 | Resistance: \$720

🟡 **Score: 7/10**

📌 Post-consolidation rebound setup into earnings

---

### 🌎 MACRO CONTEXT

💡 Growth + AI names in focus

📢 Communication Sector → Risk-On Rotation

📌 META riding digital ad/AI secular trends

🟢 **Score: 8/10**

📌 Macro tailwinds match company strengths

---

## 🎯 TRADE IDEA

**META 08/01 \$730 CALL**

💵 Entry: \$10.00

🎯 Target: \$30.00 (300% ROI)

🛑 Stop: \$5.00 (50% loss cap)

⏰ Entry: Pre-close on July 30 (AMC earnings)

📏 Size: 1 Contract (Risk \$1,000 max)

### ⚖️ Risk/Reward

* Max Risk: \$1,000

* Target Profit: \$3,000

* IV Crush Protection: **Exit within 2 hours post-earnings**

---

## 📌 WHY IT WORKS

✅ Meta beats 8 straight quarters

✅ Fundamentals elite

✅ Bullish options stack

✅ Oversold tech setup

⚠️ Risk? Always — but *structured speculation wins* 📐

---

📣 Tag someone who trades earnings like a sniper 🎯

\#META #EarningsPlay #OptionsTrading #IVCrush #CallOptions #TechStocks #AIStocks #TradingView #DigitalAds #SwingTrade #StructuredRisk

Free Signals Based on Latest AI models💰: QuantSignals.xyz

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Free Signals Based on Latest AI models💰: QuantSignals.xyz

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.