🧠 GEX-Based Options Sentiment:

META is currently hovering right under a dense gamma cluster. The $735–$740 range includes the highest positive GEX level, the CALL wall, and a major resistance zone. Bulls will need strong momentum to break through this level.

The key gamma magnet below is around $722–$720, where GEX6 and GEX8 levels cluster. Below that, the $697.50 HVL and $690 zone offer strong gamma support. If the price unwinds, it could fall quickly through this air pocket.

IVR is sitting at 13.1, which is relatively low, and options are cheap. This favors buying directional premium, especially since calls are showing a high 10.3% flow bias — a sign that traders are still leaning bullish, but that can unwind fast.

🔧 Options Setup for Monday–Wednesday:

Bullish Setup: If META can break and hold above $735, this opens the door to a push toward $740 and possibly $749. Consider a CALL debit spread, such as 735c/745c for July 3 or July 5 expiration. Exit if price fails to hold $731.

Bearish Setup: If META fails to hold $731 and confirms below $726, there’s high probability of a gamma-driven fade into $722 and then $717 or $705. Consider 725p or 720p with July 3 expiry. Stop-loss on this idea is above $735 reclaim.

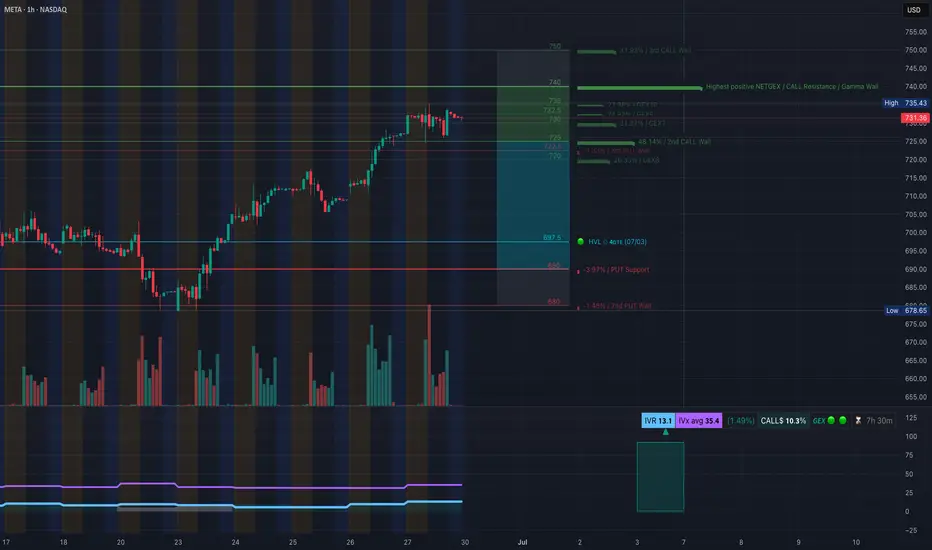

📉 Intraday Technical Breakdown (1H Chart):

META is flashing warning signs.

We’ve had a BOS earlier in the rally, but now we’ve seen a CHoCH beneath the rising wedge structure. Friday’s session ended with price stalling at the supply zone around $733–$735, unable to break the trendline overhead.

Volume is dropping, and we may be witnessing early distribution before the holiday week. Price is sitting on the edge of a decision zone — break above and squeeze, or roll over and fade.

📌 Key Intraday Levels:

$735 – Immediate overhead resistance (GEX + Supply zone) $740 – Gamma extension / 3rd CALL Wall — breakout target if bulls take over $726 – CHoCH / structure support $720 – Gamma magnet zone $705–703 – Final demand support from BOS base $697.50 – HVL zone and gamma reversal area $678 – Last line of defense before major unwinding

✅ Thoughts and Monday Game Plan:

META is compressing beneath a heavy resistance cluster. The options market is pricing for a possible breakout, but the technicals show a potential trap if bulls don’t follow through quickly. A clean break above $735 with volume could send META to $740+ by Tuesday. But a failed breakout or rejection back under $726 could lead to a swift fade toward $705–$697 zone.

Patience is key. Let Monday’s opening hour set the tone — don’t rush in. Fade weak breakouts, and favor direction once price confirms above or below the gamma bands.

Disclaimer: This breakdown is for educational purposes only and not financial advice. Trade your plan, not your emotions. Always manage risk.

META is currently hovering right under a dense gamma cluster. The $735–$740 range includes the highest positive GEX level, the CALL wall, and a major resistance zone. Bulls will need strong momentum to break through this level.

The key gamma magnet below is around $722–$720, where GEX6 and GEX8 levels cluster. Below that, the $697.50 HVL and $690 zone offer strong gamma support. If the price unwinds, it could fall quickly through this air pocket.

IVR is sitting at 13.1, which is relatively low, and options are cheap. This favors buying directional premium, especially since calls are showing a high 10.3% flow bias — a sign that traders are still leaning bullish, but that can unwind fast.

🔧 Options Setup for Monday–Wednesday:

Bullish Setup: If META can break and hold above $735, this opens the door to a push toward $740 and possibly $749. Consider a CALL debit spread, such as 735c/745c for July 3 or July 5 expiration. Exit if price fails to hold $731.

Bearish Setup: If META fails to hold $731 and confirms below $726, there’s high probability of a gamma-driven fade into $722 and then $717 or $705. Consider 725p or 720p with July 3 expiry. Stop-loss on this idea is above $735 reclaim.

📉 Intraday Technical Breakdown (1H Chart):

META is flashing warning signs.

We’ve had a BOS earlier in the rally, but now we’ve seen a CHoCH beneath the rising wedge structure. Friday’s session ended with price stalling at the supply zone around $733–$735, unable to break the trendline overhead.

Volume is dropping, and we may be witnessing early distribution before the holiday week. Price is sitting on the edge of a decision zone — break above and squeeze, or roll over and fade.

📌 Key Intraday Levels:

$735 – Immediate overhead resistance (GEX + Supply zone) $740 – Gamma extension / 3rd CALL Wall — breakout target if bulls take over $726 – CHoCH / structure support $720 – Gamma magnet zone $705–703 – Final demand support from BOS base $697.50 – HVL zone and gamma reversal area $678 – Last line of defense before major unwinding

✅ Thoughts and Monday Game Plan:

META is compressing beneath a heavy resistance cluster. The options market is pricing for a possible breakout, but the technicals show a potential trap if bulls don’t follow through quickly. A clean break above $735 with volume could send META to $740+ by Tuesday. But a failed breakout or rejection back under $726 could lead to a swift fade toward $705–$697 zone.

Patience is key. Let Monday’s opening hour set the tone — don’t rush in. Fade weak breakouts, and favor direction once price confirms above or below the gamma bands.

Disclaimer: This breakdown is for educational purposes only and not financial advice. Trade your plan, not your emotions. Always manage risk.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.