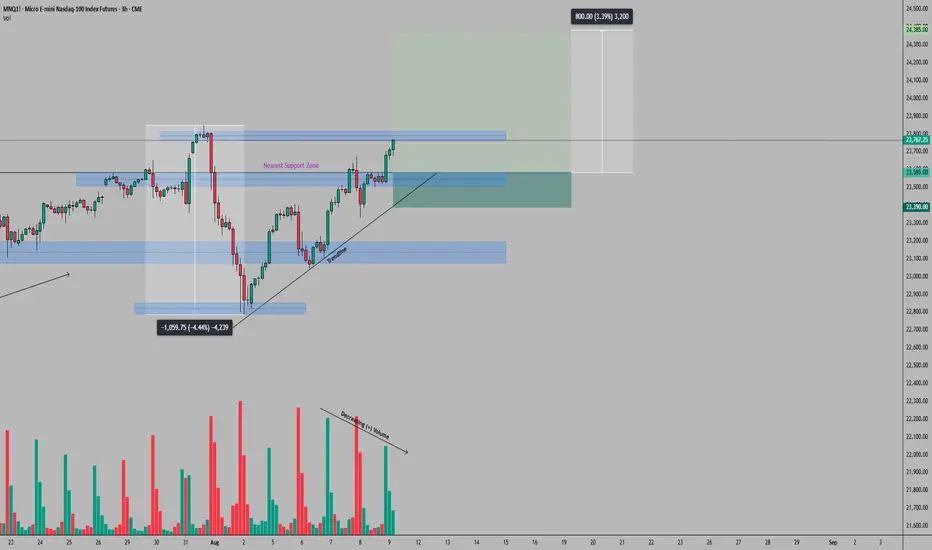

MNQ (Micro Nasdaq 100 Futures) Trade Setup – 3H Timeframe

On the 3-hour timeframe, MNQ has reached a critical juncture after establishing a new all-time high above the 23,800 mark on July 31, 2025. The subsequent sharp correction to the 22,800 zone and equally sharp V-shape recovery demonstrates strong underlying market dynamics. However, the declining positive volume during the recent upward movement suggests waning bullish momentum, even as price approaches the previous highs.

The market structure remains constructively bullish with higher lows and higher highs, but the volume pattern raises concerns about sustainability at these levels. The confluence of the previous all-time high area and declining volume creates conditions favorable for a tactical pullback to nearby support before any sustained breakout attempt.

Illustrative Setup: A Buy Limit order at 23,585 aligns with the upper boundary of the nearest support zone. The Stop Loss placement at 23,390 sits below both the support zone and the recent trendline, providing clear invalidation if breached. The Take Profit target at 24,385 represents a 76% recovery level from the recent 4.44% decline, offering an attractive risk-reward ratio of 4.1:1.

Key caution: While a break above 23,800 remains possible, the declining volume suggests potential for a bull trap. Traders should resist FOMO-driven entries above resistance and instead maintain discipline in waiting for a pullback to materialize a low-risk, high-probability setup.

This analysis is provided solely for educational and entertainment purposes and does not constitute any form of financial or investment advice. Always manage your risk and trade responsibly.

The market structure remains constructively bullish with higher lows and higher highs, but the volume pattern raises concerns about sustainability at these levels. The confluence of the previous all-time high area and declining volume creates conditions favorable for a tactical pullback to nearby support before any sustained breakout attempt.

Illustrative Setup: A Buy Limit order at 23,585 aligns with the upper boundary of the nearest support zone. The Stop Loss placement at 23,390 sits below both the support zone and the recent trendline, providing clear invalidation if breached. The Take Profit target at 24,385 represents a 76% recovery level from the recent 4.44% decline, offering an attractive risk-reward ratio of 4.1:1.

Key caution: While a break above 23,800 remains possible, the declining volume suggests potential for a bull trap. Traders should resist FOMO-driven entries above resistance and instead maintain discipline in waiting for a pullback to materialize a low-risk, high-probability setup.

This analysis is provided solely for educational and entertainment purposes and does not constitute any form of financial or investment advice. Always manage your risk and trade responsibly.

Order cancelled

Entry was missed by 2 ticks on August 12 and on same day, price broke the 23,800 zone to the upside on high volume further to the release of major news. It is therefore reasonable to say that the initial trade idea is now invalidated and shall be discarded.Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.