Hi I'm grandpa Buffett, I was born at the right time and in the right country and I started investing at the very bottom of the biggest bull market in human history.

The SnP 500 (drools a bit while mentionning it) returned bla bla bla so just buy and every american will become a decamillionaire with no effort.

Who will do all the work to product what we consume? I don't know what is work? I never worked in my life all I did was be a perma bull at the right time and give advice.

They call us perma bears. When nearly every stock goes to zero. When such bull markets have never lasted. Being bearish on a statistical anomaly.

Financial advisors warn common "investors" against us. Imagine going to university waste 5 years and all you know is "well stonks went up for a really long time so I reckon it will continue forever" and all your job consists of is reassuring investors and begging them to never sell because "well last time went up".

They would never dare offer short term advice "no one can predict the future" and "short term investing is very risky and for gamblers" but long term? "Oh ye don't worry prices always go up this is safe and time tested".

All of these investors are going to learn the most brutal lesson they ever learned.

On the bright side if growth halts and there is no more easy money, taxes have to go down.

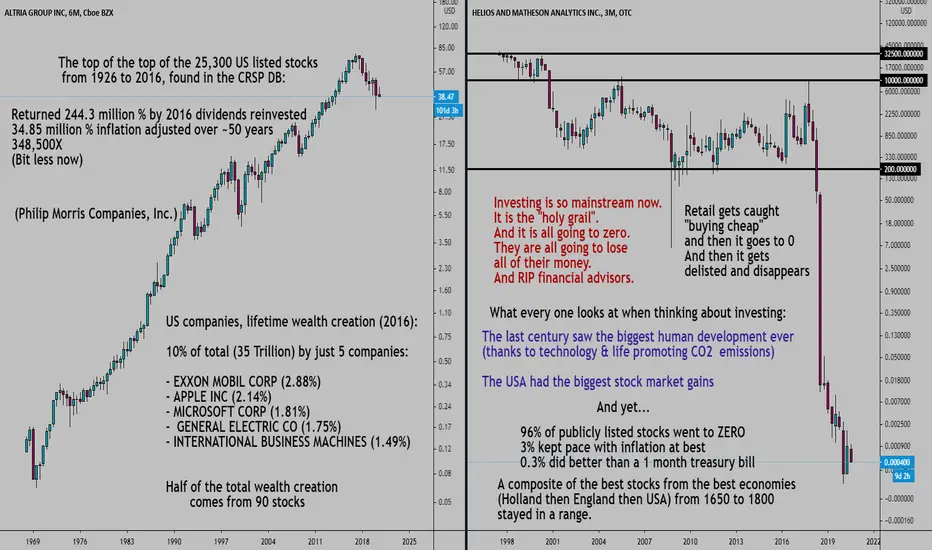

Even in the biggest bull market you had to pick the right 0.3% of stocks to get good returns and buying and holding "for the long run" "because I am not a speculator but a value investor" would have resulted in a total loss of everything 96% of the time.

The typical retail investor does not lose 96% of the time. They chase the worse stocks (please refer to Robintrack for proof) so they lose 100% of the time.

"But the SnP". Will wageslavery continue? I doubt it. The era of the 500 biggest companies controlling 80% or more of the economy is not a certitude.

Stocks used to stay up when they were up. Will this continue? Nope. Tech stocks have already started to show they come and go faster than companies before the dot com boom.

Just ask Japan investors in the last 40 years how well the top 225 companies did. And that was still in the big big growth period.

We already use up earth ressources faster than they regenerate. We hit the ceiling, what is going on in the head of those "infinite growth" people?

We got an ocean to clean up. We got land to take care of. Oil won't last forever. We cannot keep multiplying to 500 billion humans.

I do not believe in the ridiculous CO2 scare but not because I don't believe in any "green" issues, rather it's because I have a brain.

What will follow the biggest easy money bull market in history?

"Investors" will turn into the biggest delusional bagholders in history. Yes even worse than crypto. Not even close.

All of these economists and "experts" and fast money hosts and financial advisors literally treating investing as a holy grail.

Pathetic. Clueless. They do not even realize they are doing it.

We are seeing once again the rise of the day traders "the power of compounding", and some swing traders "I did not say buy every bottom sell every top no problem that is ridiculous I said just use support and confirmation to buy every bottom and sell every top".

The top of this 80 years of extreme growth is upon us.

Investing is not a holy grail for every novice to make easy money. It should be complicated, and it is about to be.

Investing should be left to professionals. The returns of the last 80 years are not "the new normal".

You'd have better odds at a roulette table (1/36 odds of getting a 35X return).

For people with another occupation, there are government securities. Or starting a business with decent success rate and putting the hours in.

I am not going to cry for all the greedy lazy passive "actionnaires" (stockholders in french) that always demand more returns for the quarter.

The rektage will be biblical.

They are all going to learn to fear the bear.

Let's see if the word perma bears makes them laugh so much in the rest of this century.

🐻🐻🐻🐻🐻🐻🐻🐻🐻🐻🐻🐻🐻🐻🐻🐻🐻🐻🐻🐻🐻🐻

The SnP 500 (drools a bit while mentionning it) returned bla bla bla so just buy and every american will become a decamillionaire with no effort.

Who will do all the work to product what we consume? I don't know what is work? I never worked in my life all I did was be a perma bull at the right time and give advice.

They call us perma bears. When nearly every stock goes to zero. When such bull markets have never lasted. Being bearish on a statistical anomaly.

Financial advisors warn common "investors" against us. Imagine going to university waste 5 years and all you know is "well stonks went up for a really long time so I reckon it will continue forever" and all your job consists of is reassuring investors and begging them to never sell because "well last time went up".

They would never dare offer short term advice "no one can predict the future" and "short term investing is very risky and for gamblers" but long term? "Oh ye don't worry prices always go up this is safe and time tested".

All of these investors are going to learn the most brutal lesson they ever learned.

On the bright side if growth halts and there is no more easy money, taxes have to go down.

Even in the biggest bull market you had to pick the right 0.3% of stocks to get good returns and buying and holding "for the long run" "because I am not a speculator but a value investor" would have resulted in a total loss of everything 96% of the time.

The typical retail investor does not lose 96% of the time. They chase the worse stocks (please refer to Robintrack for proof) so they lose 100% of the time.

"But the SnP". Will wageslavery continue? I doubt it. The era of the 500 biggest companies controlling 80% or more of the economy is not a certitude.

Stocks used to stay up when they were up. Will this continue? Nope. Tech stocks have already started to show they come and go faster than companies before the dot com boom.

Just ask Japan investors in the last 40 years how well the top 225 companies did. And that was still in the big big growth period.

We already use up earth ressources faster than they regenerate. We hit the ceiling, what is going on in the head of those "infinite growth" people?

We got an ocean to clean up. We got land to take care of. Oil won't last forever. We cannot keep multiplying to 500 billion humans.

I do not believe in the ridiculous CO2 scare but not because I don't believe in any "green" issues, rather it's because I have a brain.

What will follow the biggest easy money bull market in history?

"Investors" will turn into the biggest delusional bagholders in history. Yes even worse than crypto. Not even close.

All of these economists and "experts" and fast money hosts and financial advisors literally treating investing as a holy grail.

Pathetic. Clueless. They do not even realize they are doing it.

We are seeing once again the rise of the day traders "the power of compounding", and some swing traders "I did not say buy every bottom sell every top no problem that is ridiculous I said just use support and confirmation to buy every bottom and sell every top".

The top of this 80 years of extreme growth is upon us.

Investing is not a holy grail for every novice to make easy money. It should be complicated, and it is about to be.

Investing should be left to professionals. The returns of the last 80 years are not "the new normal".

You'd have better odds at a roulette table (1/36 odds of getting a 35X return).

For people with another occupation, there are government securities. Or starting a business with decent success rate and putting the hours in.

I am not going to cry for all the greedy lazy passive "actionnaires" (stockholders in french) that always demand more returns for the quarter.

The rektage will be biblical.

They are all going to learn to fear the bear.

Let's see if the word perma bears makes them laugh so much in the rest of this century.

🐻🐻🐻🐻🐻🐻🐻🐻🐻🐻🐻🐻🐻🐻🐻🐻🐻🐻🐻🐻🐻🐻

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.