📌 MOG.A | Long Setup | Mid-Cycle Aerospace Accumulation Breakout | Aug 20, 2025

🔹 Thesis Summary

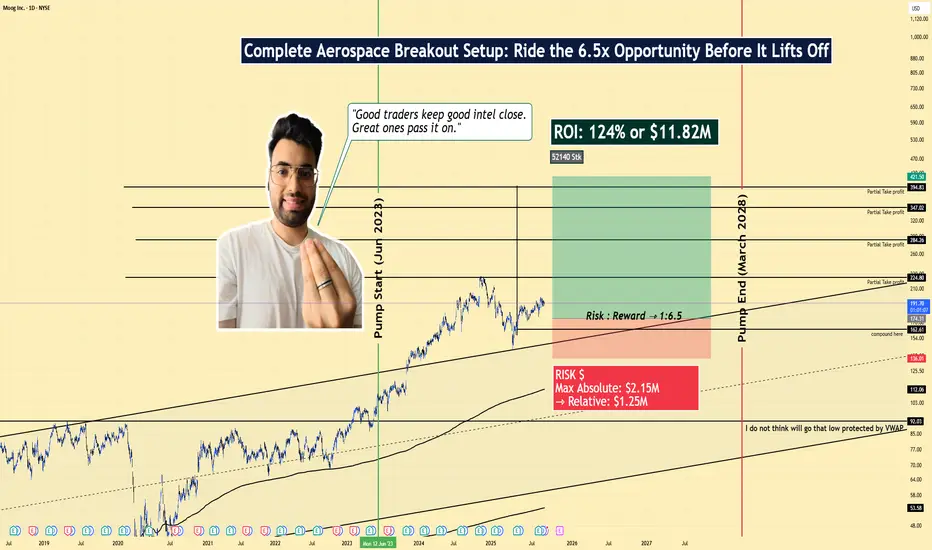

Moog Inc. (MOG.A) presents a rare mid-cycle breakout opportunity in the aerospace/defense sector, with strong institutional accumulation since mid-2023 and a clean structural setup offering a 6.5:1 reward-to-risk ratio into 2028. Recent earnings strength and sector tailwinds support long-duration positioning.

🔹 Trade Setup

Bias: Long

Entry Zone: $174–$192

Stop Loss: Below $133

Take-Profits:

• TP1: $224

• TP2: $284

• TP3: $394

• Max Target: $421+ (cycle extension target)

Risk/Reward: Approx. 1:6.5

Capital Model: $2.15M max exposure, $1.25M active risk

🔹 Narrative & Context

Moog has been in a controlled uptrend since the June 2023 accumulation pivot, now confirmed by repeated support around the mid-channel and higher-volume continuation post-Q3 earnings. Price is compressing just beneath prior local highs and showing signs of a compound breakout structure.

Structurally, this setup mirrors late-stage channel expansions observed in industrials during past rate-cycle transitions. The combination of:

Consistent institutional volume since 2023

Strong revenue/EPS beats in Q3 2025

Relative strength within aerospace peers

...positions this as a strategic mid-term allocation.

Additionally, the stock’s premium P/E and PEG suggest market pricing for longer-term growth—a bet that aligns with defense sector rearmament cycles and high-value motion systems adoption.

🔹 Macro Considerations

BTC/ETH risk-on correlation: supportive but not critical to this setup

Market Volatility: VIX below 16, favorable for equities with extended price targets

Sector Flows: Capital rotating back into defense/aero-industrials post-Q2 tech unwind

Bear Case: Break below $133 would invalidate the multi-year channel and suggest rotation out of premium industrial names

🔹 Forward Path

If this idea gains traction, I’ll post a follow-up with:

Multi-year chart structure (log scale)

Relative valuation vs peers (e.g. LHX, TDG, HII)

Updated PT revisions based on EPS guidance and flow

💼 Like & Follow for structured ideas, not signals. I post high-conviction setups here before broader narratives play out.

⚠️ Disclaimer: This is not financial advice. Always do your own research. Charts and visuals may include AI enhancements.

🔹 Thesis Summary

Moog Inc. (MOG.A) presents a rare mid-cycle breakout opportunity in the aerospace/defense sector, with strong institutional accumulation since mid-2023 and a clean structural setup offering a 6.5:1 reward-to-risk ratio into 2028. Recent earnings strength and sector tailwinds support long-duration positioning.

🔹 Trade Setup

Bias: Long

Entry Zone: $174–$192

Stop Loss: Below $133

Take-Profits:

• TP1: $224

• TP2: $284

• TP3: $394

• Max Target: $421+ (cycle extension target)

Risk/Reward: Approx. 1:6.5

Capital Model: $2.15M max exposure, $1.25M active risk

🔹 Narrative & Context

Moog has been in a controlled uptrend since the June 2023 accumulation pivot, now confirmed by repeated support around the mid-channel and higher-volume continuation post-Q3 earnings. Price is compressing just beneath prior local highs and showing signs of a compound breakout structure.

Structurally, this setup mirrors late-stage channel expansions observed in industrials during past rate-cycle transitions. The combination of:

Consistent institutional volume since 2023

Strong revenue/EPS beats in Q3 2025

Relative strength within aerospace peers

...positions this as a strategic mid-term allocation.

Additionally, the stock’s premium P/E and PEG suggest market pricing for longer-term growth—a bet that aligns with defense sector rearmament cycles and high-value motion systems adoption.

🔹 Macro Considerations

BTC/ETH risk-on correlation: supportive but not critical to this setup

Market Volatility: VIX below 16, favorable for equities with extended price targets

Sector Flows: Capital rotating back into defense/aero-industrials post-Q2 tech unwind

Bear Case: Break below $133 would invalidate the multi-year channel and suggest rotation out of premium industrial names

🔹 Forward Path

If this idea gains traction, I’ll post a follow-up with:

Multi-year chart structure (log scale)

Relative valuation vs peers (e.g. LHX, TDG, HII)

Updated PT revisions based on EPS guidance and flow

💼 Like & Follow for structured ideas, not signals. I post high-conviction setups here before broader narratives play out.

⚠️ Disclaimer: This is not financial advice. Always do your own research. Charts and visuals may include AI enhancements.

2 Ways I Help Serious Traders Win | Real Trades. Ruthless Edge.

1️⃣ Fix Your Trading Fast – My 4-step:

tradinggen.services/mohamad-link/

2️⃣ Get My Weekly Recap and Setup Drops here:

t.me/TradeSimple_with_Mo

P.S. Mentor MO❤️

1️⃣ Fix Your Trading Fast – My 4-step:

tradinggen.services/mohamad-link/

2️⃣ Get My Weekly Recap and Setup Drops here:

t.me/TradeSimple_with_Mo

P.S. Mentor MO❤️

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

2 Ways I Help Serious Traders Win | Real Trades. Ruthless Edge.

1️⃣ Fix Your Trading Fast – My 4-step:

tradinggen.services/mohamad-link/

2️⃣ Get My Weekly Recap and Setup Drops here:

t.me/TradeSimple_with_Mo

P.S. Mentor MO❤️

1️⃣ Fix Your Trading Fast – My 4-step:

tradinggen.services/mohamad-link/

2️⃣ Get My Weekly Recap and Setup Drops here:

t.me/TradeSimple_with_Mo

P.S. Mentor MO❤️

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.