Moderna Inc. (NASDAQ:  MRNA) has once again reported a quarterly loss, reflecting the continued decline in COVID-19 vaccine sales and an unexpected charge related to a canceled manufacturing contract. Despite this, shares of the biotech giant saw a 3.35% uptick, signaling a mixed sentiment among investors.

MRNA) has once again reported a quarterly loss, reflecting the continued decline in COVID-19 vaccine sales and an unexpected charge related to a canceled manufacturing contract. Despite this, shares of the biotech giant saw a 3.35% uptick, signaling a mixed sentiment among investors.

Weighing the Challenges and Opportunities

On Friday, Moderna disclosed a Q4 2024 revenue of $966 million, marking a sharp 65% year-over-year decline. The loss per share stood at $2.91, exceeding the analyst projection of $2.73 per share. More concerning for investors was the company’s forecast for 2025 sales, estimated between $1.5 billion and $2.5 billion—significantly below the $3.26 billion consensus estimate.

CEO Stéphane Bancel reaffirmed Moderna’s focus on cutting costs and streamlining its research and development (R&D) efforts. The company plans to reduce R&D expenses by up to $1.1 billion by 2027, primarily by halting early-stage projects and prioritizing late-stage drug approvals. Moderna has already trimmed $1 billion in costs, positioning itself for leaner operations in the coming years.

Technical Analysis: Key Levels to Watch

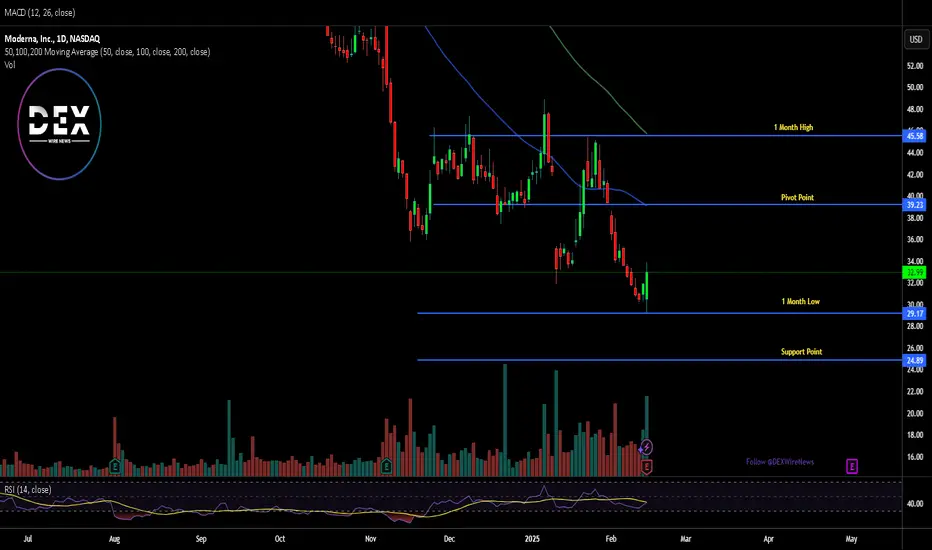

From a technical perspective, MRNA shares closed Friday’s session down 0.38%, showing hesitation despite the broader market’s strength. The stock is currently hovering near a critical support zone—the one-month low. Should this level fail to hold, a further decline towards the $25 region could be the next stop.

MRNA shares closed Friday’s session down 0.38%, showing hesitation despite the broader market’s strength. The stock is currently hovering near a critical support zone—the one-month low. Should this level fail to hold, a further decline towards the $25 region could be the next stop.

On the upside, a breakout above the 38.2% Fibonacci retracement level could alter the trajectory for Moderna’s stock, potentially signaling a bullish reversal. However, with the Relative Strength Index (RSI) at 41.46, the stock remains in weak momentum territory, suggesting that bullish conviction is still lacking.

Outlook: Can Moderna Reignite Investor Confidence?

Moderna’s near-term outlook remains uncertain, as the company grapples with declining COVID vaccine sales, weaker-than-expected 2025 revenue projections, and an ongoing shift in its R&D strategy. However, its pipeline of combination vaccines and upcoming approvals may offer a longer-term upside if execution is successful.

Technically, MRNA needs to hold its key support zone and break above the 38.2% Fibonacci retracement to shift market sentiment positively. Until then, investors should watch for further signals of strength, particularly in trading volume and RSI movement, before confirming a potential bullish turnaround.

MRNA needs to hold its key support zone and break above the 38.2% Fibonacci retracement to shift market sentiment positively. Until then, investors should watch for further signals of strength, particularly in trading volume and RSI movement, before confirming a potential bullish turnaround.

In the coming months, all eyes will be on Moderna’s next earnings report and the market’s reaction to its cost-cutting measures and pipeline advancements. The stock’s ability to sustain recent gains—or break lower—will depend on whether the company can deliver on its strategic shifts and stabilize its revenue trajectory.

Weighing the Challenges and Opportunities

On Friday, Moderna disclosed a Q4 2024 revenue of $966 million, marking a sharp 65% year-over-year decline. The loss per share stood at $2.91, exceeding the analyst projection of $2.73 per share. More concerning for investors was the company’s forecast for 2025 sales, estimated between $1.5 billion and $2.5 billion—significantly below the $3.26 billion consensus estimate.

CEO Stéphane Bancel reaffirmed Moderna’s focus on cutting costs and streamlining its research and development (R&D) efforts. The company plans to reduce R&D expenses by up to $1.1 billion by 2027, primarily by halting early-stage projects and prioritizing late-stage drug approvals. Moderna has already trimmed $1 billion in costs, positioning itself for leaner operations in the coming years.

Technical Analysis: Key Levels to Watch

From a technical perspective,

On the upside, a breakout above the 38.2% Fibonacci retracement level could alter the trajectory for Moderna’s stock, potentially signaling a bullish reversal. However, with the Relative Strength Index (RSI) at 41.46, the stock remains in weak momentum territory, suggesting that bullish conviction is still lacking.

Outlook: Can Moderna Reignite Investor Confidence?

Moderna’s near-term outlook remains uncertain, as the company grapples with declining COVID vaccine sales, weaker-than-expected 2025 revenue projections, and an ongoing shift in its R&D strategy. However, its pipeline of combination vaccines and upcoming approvals may offer a longer-term upside if execution is successful.

Technically,

In the coming months, all eyes will be on Moderna’s next earnings report and the market’s reaction to its cost-cutting measures and pipeline advancements. The stock’s ability to sustain recent gains—or break lower—will depend on whether the company can deliver on its strategic shifts and stabilize its revenue trajectory.

⭐⭐⭐ Sign Up for Free ⭐⭐⭐

1) Download our Mobile App >> link-to.app/dexwirenews

2) Join our Telegram >> t.me/DEXWireNews

3) Sign Up for Text Alerts >>

dexwirenews.com/TEXT

4) Follow @DEXWireNews on Social Media

1) Download our Mobile App >> link-to.app/dexwirenews

2) Join our Telegram >> t.me/DEXWireNews

3) Sign Up for Text Alerts >>

dexwirenews.com/TEXT

4) Follow @DEXWireNews on Social Media

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

⭐⭐⭐ Sign Up for Free ⭐⭐⭐

1) Download our Mobile App >> link-to.app/dexwirenews

2) Join our Telegram >> t.me/DEXWireNews

3) Sign Up for Text Alerts >>

dexwirenews.com/TEXT

4) Follow @DEXWireNews on Social Media

1) Download our Mobile App >> link-to.app/dexwirenews

2) Join our Telegram >> t.me/DEXWireNews

3) Sign Up for Text Alerts >>

dexwirenews.com/TEXT

4) Follow @DEXWireNews on Social Media

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.