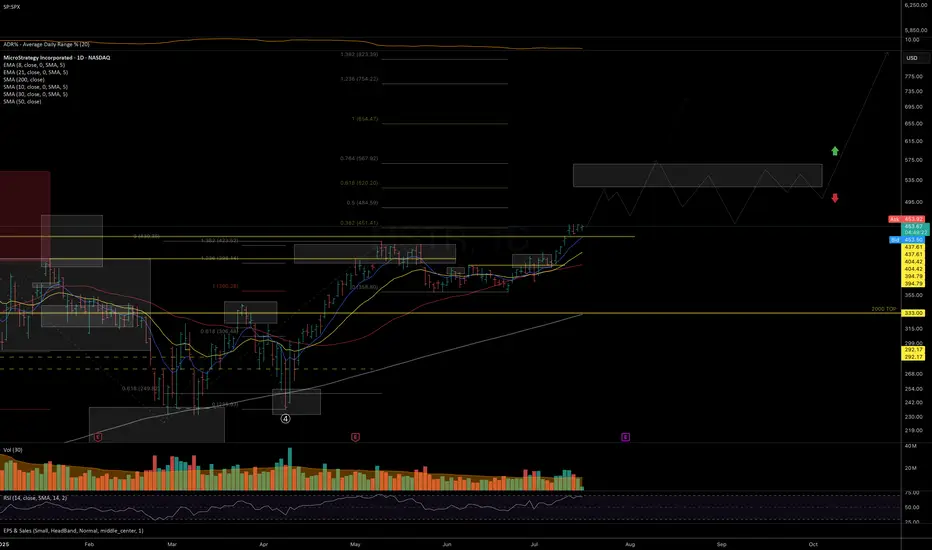

I was initially skeptical about the recovery structure unfolding since the April lows — it looked like a possible macro lower-high before deeper correction (as outlined in my previous idea).

However, given the strength in underlying #BTC price action (covered in my recent video-idea on crypto trend structure) and clear signs of constructive consolidation and accumulation during the July breakout, Isee strong odds for follow-through toward the 520–570 resistance zone in the coming weeks.

This move may align with BTC testing its macro resistance near 130K (see my macro BTC analysis on the idea section).

BTC testing its macro resistance near 130K (see my macro BTC analysis on the idea section).

If MSTR can break above 570 and sustain a close above it, it opens the door to a potential immediate follow-through toward the 650–755 macro resistance zone. But a scenario for more prolonged consolidation around 570 would in fact serve as a solid base for more stable and prolonged next long-term leg higher.

MSTR can break above 570 and sustain a close above it, it opens the door to a potential immediate follow-through toward the 650–755 macro resistance zone. But a scenario for more prolonged consolidation around 570 would in fact serve as a solid base for more stable and prolonged next long-term leg higher.

However, given the strength in underlying #BTC price action (covered in my recent video-idea on crypto trend structure) and clear signs of constructive consolidation and accumulation during the July breakout, Isee strong odds for follow-through toward the 520–570 resistance zone in the coming weeks.

This move may align with

If

Daily insights, trend analysis, set-ups and commentary on Crypto and U.S. equities

t.me/MarketArtistryENG

Личные размышления, комментарии о глобальных финансовых рынках и торговые идеи: t.me/marketartistry

t.me/MarketArtistryENG

Личные размышления, комментарии о глобальных финансовых рынках и торговые идеи: t.me/marketartistry

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Daily insights, trend analysis, set-ups and commentary on Crypto and U.S. equities

t.me/MarketArtistryENG

Личные размышления, комментарии о глобальных финансовых рынках и торговые идеи: t.me/marketartistry

t.me/MarketArtistryENG

Личные размышления, комментарии о глобальных финансовых рынках и торговые идеи: t.me/marketartistry

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.