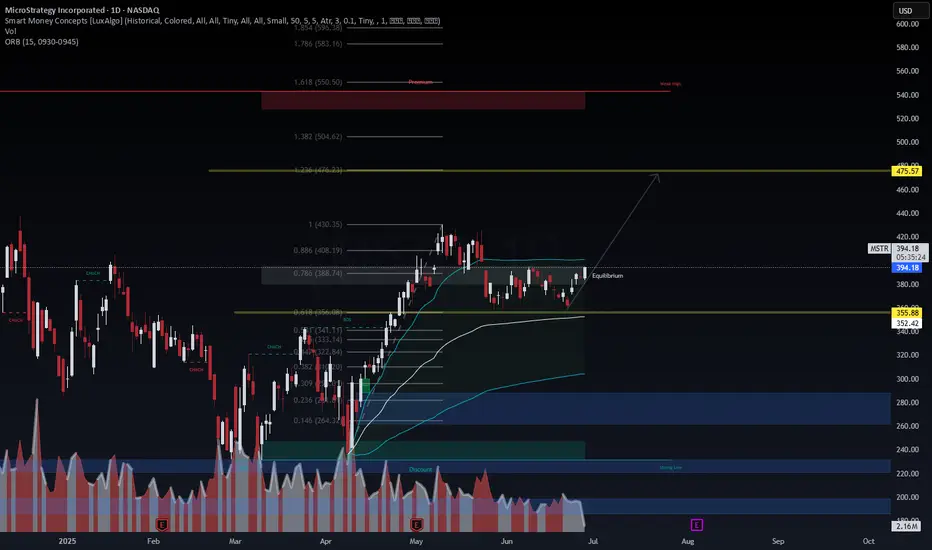

After consolidating above the 0.618–0.786 retracement zone,  MSTR shows signs of institutional reaccumulation. The daily chart highlights a breakout from equilibrium with bullish intent, supported by increasing volume and smart money concepts.

MSTR shows signs of institutional reaccumulation. The daily chart highlights a breakout from equilibrium with bullish intent, supported by increasing volume and smart money concepts.

📐 Technical Breakdown:

Price reclaimed the 0.786 retracement level ($388.74) and broke above equilibrium, suggesting bullish continuation.

Higher lows, BOS (Break of Structure), and CHoCH zones confirm smart money accumulation pattern.

Fib target remains at $475.57 (1.236 extension), with supply zones marked between $504–$550 (premium zone).

Volume profile shows a tapering discount zone—indicating sellers are drying up as value shifts higher.

🧠 Macro & Fundamental Context:

As a Bitcoin-proxy equity, MicroStrategy’s price is heavily correlated to digital asset flows.

Bitcoin ETF inflows have stabilized, and if BTC holds above $60K, MSTR could accelerate.

MSTR could accelerate.

Macro tailwinds: Continued Fed pause, easing liquidity stress, and rising appetite for risk-on assets support the upside thesis.

📌 Key Levels:

⚡ Breakout: $388–$394

🔍 Target: $475.57 (1.236 Fib)

🛑 Invalidation: Close below $355.88 (0.618 Fib and volume shelf)

📈 Bias: Bullish

🧭 Timeframe: Swing to Position

🔗 Posted by WaverVanir_International_LLC

This post is for informational and educational purposes only. Not financial advice.

(APA7: TradingView, 2025)

📐 Technical Breakdown:

Price reclaimed the 0.786 retracement level ($388.74) and broke above equilibrium, suggesting bullish continuation.

Higher lows, BOS (Break of Structure), and CHoCH zones confirm smart money accumulation pattern.

Fib target remains at $475.57 (1.236 extension), with supply zones marked between $504–$550 (premium zone).

Volume profile shows a tapering discount zone—indicating sellers are drying up as value shifts higher.

🧠 Macro & Fundamental Context:

As a Bitcoin-proxy equity, MicroStrategy’s price is heavily correlated to digital asset flows.

Bitcoin ETF inflows have stabilized, and if BTC holds above $60K,

Macro tailwinds: Continued Fed pause, easing liquidity stress, and rising appetite for risk-on assets support the upside thesis.

📌 Key Levels:

⚡ Breakout: $388–$394

🔍 Target: $475.57 (1.236 Fib)

🛑 Invalidation: Close below $355.88 (0.618 Fib and volume shelf)

📈 Bias: Bullish

🧭 Timeframe: Swing to Position

🔗 Posted by WaverVanir_International_LLC

This post is for informational and educational purposes only. Not financial advice.

(APA7: TradingView, 2025)

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.