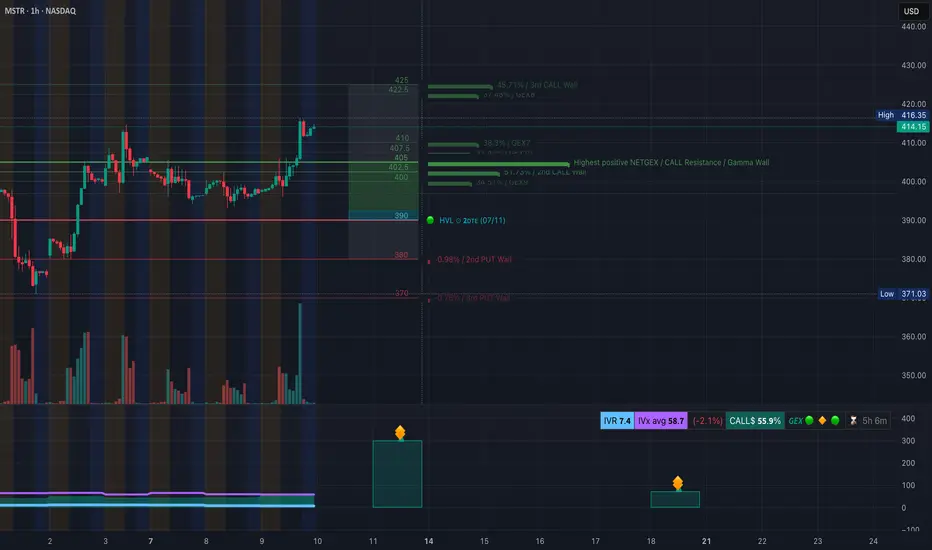

🔥GEX-Based Options Analysis (Macro Sentiment):

MSTR is showing strong bullish momentum fueled by aggressive options flow. The key GEX levels show:

* Gamma Wall / Max Resistance is at $405–$410, aligning with current price action.

* Positive GEX Flow continues to build up toward $425, where the 3rd CALL Wall sits.

* On the downside, minimal PUT Wall pressure is seen until $390, offering a strong base of support.

💡 Options Setup Ideas:

* Bullish Setup: If MSTR holds above $405–$410 zone, consider a 415C or 420C for 07/12 expiry, targeting a move to $422.50–$425.

* Bearish Reversal Risk: If MSTR breaks back below $400 with volume, risk shifts to downside with $390 PUTs back in play.

IV is still low (IVR 7.4, IVx below average), which supports buying premium over selling.

1H Price Action & Intraday Setup:

On the 1-hour chart, MSTR just broke out of a compression wedge after forming a clean CHoCH and BOS (Change of Character and Break of Structure). Price is now flagging just below the purple supply box, creating a textbook bullish continuation setup.

* Key Levels to Watch:

* Resistance: $414–$416 (if broken, opens room to $422+)

* Support: $404–$408 (recent CHoCH zone and breakout base)

* Deeper Support: $396–$400 (prior structure, invalidation if lost)

📈 Intraday Trade Plan:

* Bullish Scenario:

* Entry: Break and close above $416

* Target: $422.50–$425

* Stop: Below $408

* Pullback Long:

* Entry: Retest of $405 with bullish reaction

* Target: $415+

* Stop: Below $400

* Bearish Reversal (low probability):

* Entry: Breakdown below $400

* Target: $393–$390

* Stop: Above $405

My Thoughts: MSTR is building strength with both option sentiment and price structure aligning for continuation. It’s one of the cleanest bull flags on the board right now. Keep eyes on the breakout zone at $414–$416 — a push through with volume could trigger a gamma squeeze toward $425.

This analysis is for educational purposes only and not financial advice. Always manage risk before trading.

MSTR is showing strong bullish momentum fueled by aggressive options flow. The key GEX levels show:

* Gamma Wall / Max Resistance is at $405–$410, aligning with current price action.

* Positive GEX Flow continues to build up toward $425, where the 3rd CALL Wall sits.

* On the downside, minimal PUT Wall pressure is seen until $390, offering a strong base of support.

💡 Options Setup Ideas:

* Bullish Setup: If MSTR holds above $405–$410 zone, consider a 415C or 420C for 07/12 expiry, targeting a move to $422.50–$425.

* Bearish Reversal Risk: If MSTR breaks back below $400 with volume, risk shifts to downside with $390 PUTs back in play.

IV is still low (IVR 7.4, IVx below average), which supports buying premium over selling.

1H Price Action & Intraday Setup:

On the 1-hour chart, MSTR just broke out of a compression wedge after forming a clean CHoCH and BOS (Change of Character and Break of Structure). Price is now flagging just below the purple supply box, creating a textbook bullish continuation setup.

* Key Levels to Watch:

* Resistance: $414–$416 (if broken, opens room to $422+)

* Support: $404–$408 (recent CHoCH zone and breakout base)

* Deeper Support: $396–$400 (prior structure, invalidation if lost)

📈 Intraday Trade Plan:

* Bullish Scenario:

* Entry: Break and close above $416

* Target: $422.50–$425

* Stop: Below $408

* Pullback Long:

* Entry: Retest of $405 with bullish reaction

* Target: $415+

* Stop: Below $400

* Bearish Reversal (low probability):

* Entry: Breakdown below $400

* Target: $393–$390

* Stop: Above $405

My Thoughts: MSTR is building strength with both option sentiment and price structure aligning for continuation. It’s one of the cleanest bull flags on the board right now. Keep eyes on the breakout zone at $414–$416 — a push through with volume could trigger a gamma squeeze toward $425.

This analysis is for educational purposes only and not financial advice. Always manage risk before trading.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.