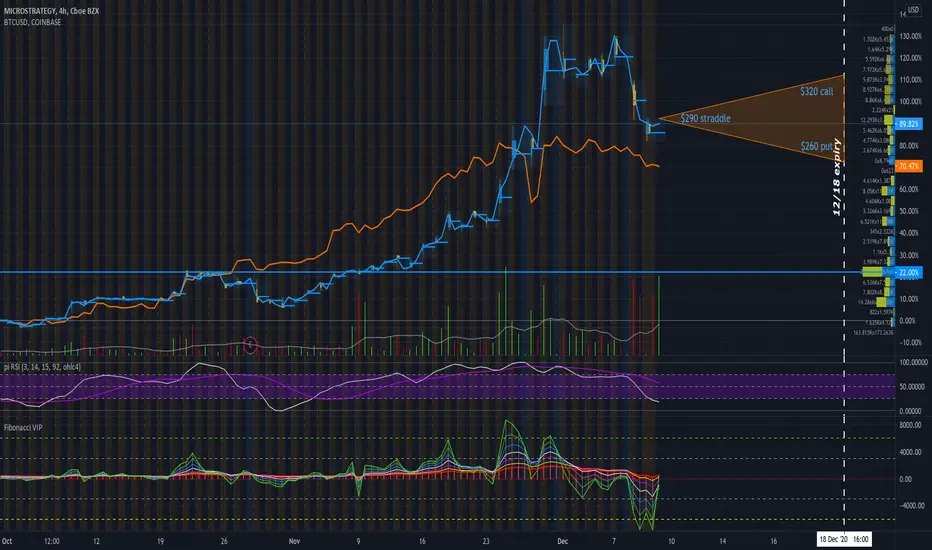

MicroStrategy said on Monday that it plans to offer $400 million of convertible bonds in order to buy more Bitcoin. They already own $50 million of Bitcoin on their balance sheet. It's core business is the provision of enterprise analytics and mobility software. But since the CEO, Michael Saylor, said they are holding 75% of their balance sheet in Bitcoin, this has become more of a proxy to trade BTC price action value recently. I see a good potential options play here with an iron butterfly 12/18 expiry.

buy $290 call = $14.60

buy $290 put = $19.15

sell $320 call = -$9.25

sell $260 put = -$7.20

total = $17.30

Do your own due diligence, your risk is 100% your responsibility. You win some or you learn some. Consider being charitable with some of your profit to help humankind. Small incremental steps work : If you double a penny for a month it = $5,368,709. Good luck and happy trading friends...

*3x lucky 7s of trading*

7pt Trading compass:

Price action, entry/exit

Volume average/direction

Trend, patterns, momentum

Newsworthy current events

Revenue

Earnings

Balance sheet

7 Common mistakes:

+5% portfolio trades, risk management

Beware of analysts motives

Emotions & Opinions

FOMO : bad timing

Lack of planning & discipline

Forgetting restraint

Obdurate repetitive errors

7 Important tools:

Trading View app!, Brokerage UI

Accurate indicators & settings

Wide screen monitor/s

Trading log (pencil & graph paper)

Big organized desk

Reading books, playing chess

Sorted watch-list

Checkout my indicators:

Fibonacci VIP - volume

Fibonacci MA7 - price

pi RSI - trend momentum

tradingview.com/u/growerik/

buy $290 call = $14.60

buy $290 put = $19.15

sell $320 call = -$9.25

sell $260 put = -$7.20

total = $17.30

Do your own due diligence, your risk is 100% your responsibility. You win some or you learn some. Consider being charitable with some of your profit to help humankind. Small incremental steps work : If you double a penny for a month it = $5,368,709. Good luck and happy trading friends...

*3x lucky 7s of trading*

7pt Trading compass:

Price action, entry/exit

Volume average/direction

Trend, patterns, momentum

Newsworthy current events

Revenue

Earnings

Balance sheet

7 Common mistakes:

+5% portfolio trades, risk management

Beware of analysts motives

Emotions & Opinions

FOMO : bad timing

Lack of planning & discipline

Forgetting restraint

Obdurate repetitive errors

7 Important tools:

Trading View app!, Brokerage UI

Accurate indicators & settings

Wide screen monitor/s

Trading log (pencil & graph paper)

Big organized desk

Reading books, playing chess

Sorted watch-list

Checkout my indicators:

Fibonacci VIP - volume

Fibonacci MA7 - price

pi RSI - trend momentum

tradingview.com/u/growerik/

Trading indicators:

tradingview.com/u/Options360/

tradingview.com/u/Options360/

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Trading indicators:

tradingview.com/u/Options360/

tradingview.com/u/Options360/

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.