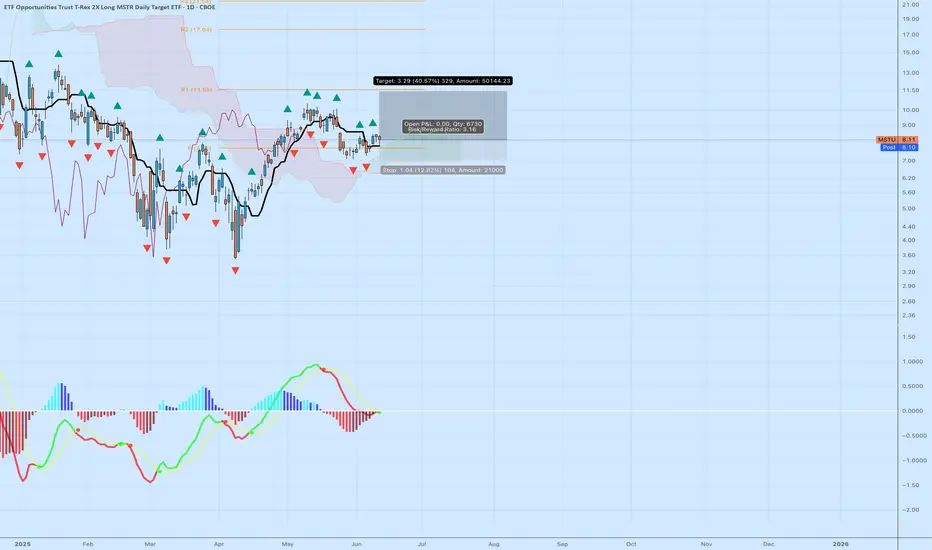

$MSTU – Breakout Brewing or Bull Trap? Here’s My Take

Swing Setup | Risk/Reward 3:1 | Watching MACD & Ichimoku

📊 This is a leveraged ETF that tracks MSTR, and it’s setting up for a potential breakout. Here’s the breakdown:

MSTR, and it’s setting up for a potential breakout. Here’s the breakdown:

🔍 Chart Context:

Price: $8.11 (as of June 11, 2025)

Target: $11.40 area (+40.57%)

Stop: $7.07 (–12.82%)

R:R: 3.16 – attractive setup for swing or momentum traders.

📈 Technical Breakdown:

✅ MACD Histogram just flipped positive. That’s a momentum shift after weeks of red. We’re at the zero line—any crossover here historically leads to explosive moves in leveraged ETFs like this.

✅ Ichimoku Cloud: Price is above the cloud, which is thin and transitioning to bullish. Lagging span (Chikou) is starting to clear previous price action. This is a classic bullish continuation signal—only if price confirms.

✅ Structure: Consolidation zone forming a base at ~$8.00. We've had several failed breakdowns, and bulls have absorbed the selling. If it clears $8.50 with volume, I expect short-covering and fresh entries to flood in.

⚠️ Resistance Zones:

$9.15: Local high and volume shelf

$11.40: Target based on prior impulse leg (April rally leg cloned)

💡 Strategy:

I’m long with size, aiming for a 40%+ move, using MSTR’s volatility as tailwind.

Stop is below recent higher low — invalidation is clean.

If it breaks $8.50 with strength and MSTR joins the move, I’ll consider adding.

🔄 This is a leveraged play—don’t diamond hand it. Monitor daily. It can move 10-15% in a single session.

Drop your thoughts or alternative plays. Are you using MSTU or trading MSTR directly?

MSTR directly?

📊 This is a leveraged ETF that tracks

🔍 Chart Context:

Price: $8.11 (as of June 11, 2025)

Target: $11.40 area (+40.57%)

Stop: $7.07 (–12.82%)

R:R: 3.16 – attractive setup for swing or momentum traders.

📈 Technical Breakdown:

✅ MACD Histogram just flipped positive. That’s a momentum shift after weeks of red. We’re at the zero line—any crossover here historically leads to explosive moves in leveraged ETFs like this.

✅ Ichimoku Cloud: Price is above the cloud, which is thin and transitioning to bullish. Lagging span (Chikou) is starting to clear previous price action. This is a classic bullish continuation signal—only if price confirms.

✅ Structure: Consolidation zone forming a base at ~$8.00. We've had several failed breakdowns, and bulls have absorbed the selling. If it clears $8.50 with volume, I expect short-covering and fresh entries to flood in.

⚠️ Resistance Zones:

$9.15: Local high and volume shelf

$11.40: Target based on prior impulse leg (April rally leg cloned)

💡 Strategy:

I’m long with size, aiming for a 40%+ move, using MSTR’s volatility as tailwind.

Stop is below recent higher low — invalidation is clean.

If it breaks $8.50 with strength and MSTR joins the move, I’ll consider adding.

🔄 This is a leveraged play—don’t diamond hand it. Monitor daily. It can move 10-15% in a single session.

Drop your thoughts or alternative plays. Are you using MSTU or trading

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.