MYM (Micro Dow Jones Index Futures) Trade Setup – 3H Timeframe

MYM: Bearish Setup at Major Resistance with Fading Bullish Momentum

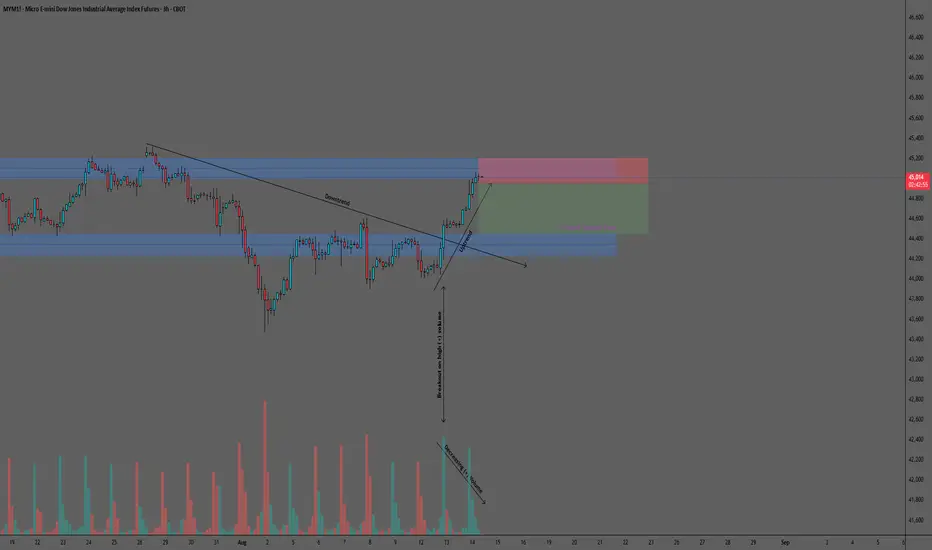

MYM has recently broken above the 44,230–44,450 support-turned-resistance zone and the downtrend line originating from its July 28, 2025 all-time high. This bullish move, triggered in part by the August 12 major news release, extended into the 45,000–45,200 resistance area—a historically strong supply zone.

The 3-hour chart highlights that, while the breakout was fueled by strong initial volume, the subsequent advance toward resistance has been accompanied by gradually declining positive volume. This pattern suggests waning buying pressure and a potential shift in control toward sellers at current levels.

Illustrative Setup: A Sell Stop order at 44,960 positions the entry just below the psychological 45,000 mark, aiming to capture a reversal from the current resistance zone. A Stop Loss at 45,200 is placed above the upper boundary of resistance, providing a clear invalidation point for the bearish thesis. The Take Profit target at 44,450 aligns with the top of the nearest support zone (44,230–44,450), offering an attractive 2.13:1 reward-risk ratio.

Key considerations: The confluence of a major resistance zone and fading bullish volume provides multiple technical factors supporting a pullback scenario. However, given the psychological weight of the 45,000 level, some consolidation may occur before any decisive move. Traders should closely monitor price behavior at resistance for confirmation and remain mindful of broader market sentiment.

This analysis is provided solely for educational and entertainment purposes and does not constitute any form of financial or investment advice. Always manage your risk and trade responsibly.

MYM has recently broken above the 44,230–44,450 support-turned-resistance zone and the downtrend line originating from its July 28, 2025 all-time high. This bullish move, triggered in part by the August 12 major news release, extended into the 45,000–45,200 resistance area—a historically strong supply zone.

The 3-hour chart highlights that, while the breakout was fueled by strong initial volume, the subsequent advance toward resistance has been accompanied by gradually declining positive volume. This pattern suggests waning buying pressure and a potential shift in control toward sellers at current levels.

Illustrative Setup: A Sell Stop order at 44,960 positions the entry just below the psychological 45,000 mark, aiming to capture a reversal from the current resistance zone. A Stop Loss at 45,200 is placed above the upper boundary of resistance, providing a clear invalidation point for the bearish thesis. The Take Profit target at 44,450 aligns with the top of the nearest support zone (44,230–44,450), offering an attractive 2.13:1 reward-risk ratio.

Key considerations: The confluence of a major resistance zone and fading bullish volume provides multiple technical factors supporting a pullback scenario. However, given the psychological weight of the 45,000 level, some consolidation may occur before any decisive move. Traders should closely monitor price behavior at resistance for confirmation and remain mindful of broader market sentiment.

This analysis is provided solely for educational and entertainment purposes and does not constitute any form of financial or investment advice. Always manage your risk and trade responsibly.

Trade closed: stop reached

Entry was executed as initially planned on a pullback from the 45,000 - 45,200 resistance, but price reversed sharply (though on shallow, decreasing positive volume) and broke out of the 45,000 - 45,200 resistance to the upside, taking out the protective stop set at 45,200 for a loss of -1R. This trade is over.Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.