Soybean oil futures are easing after a stunning 24.5% rally from 24/Mar to 14/May. The surge was driven by rising biofuel mandates and renewable diesel output, which boosted domestic soybean crushing and tightened supplies.

Additionally, the May WASDE report highlighted soybean oil’s key role in renewable diesel growth. U.S. domestic use is projected to rise in 2025/26, with biofuel feedstock demand reaching 13.9 billion pounds, 44.7% of total supply.

Additionally, the May WASDE report highlighted soybean oil’s key role in renewable diesel growth. U.S. domestic use is projected to rise in 2025/26, with biofuel feedstock demand reaching 13.9 billion pounds, 44.7% of total supply.

The rally ended on 15/May, with soybean oil futures tanking 5.7% amid concerns over the EPA’s biofuel mandate.

Reports suggested the agency may propose a lower biomass-based diesel target of 4.6 billion gallons, well below the industry’s 5.25 billion request, raising fears of feeble future soybean oil demand.

Soybean oil prices extended losses during the last week of May as a sharp drop in crude oil prices threatened to reduce demand for biofuel, weakening the price support.

TECHNICAL SIGNALS CONFIRM BEARISH FUNDAMENTALS

Technical indicators point to growing bearish momentum in soybean oil futures. A death cross occurred on 28/May, with the 21-day MA crossing above the 9-day MA, while prices remain below the monthly pivot.

On 30/May, futures broke below the 50-day MA for the first time since 27/Mar, though they still trade above the 100- and 200-day MAs.

On 30/May, futures broke below the 50-day MA for the first time since 27/Mar, though they still trade above the 100- and 200-day MAs.

Momentum indicators suggest a weakening outlook for soybean oil prices, with the MACD signalling a bearish trend since 16 May and the RSI holding below both its neutral level and 14-day MA.

Momentum indicators suggest a weakening outlook for soybean oil prices, with the MACD signalling a bearish trend since 16 May and the RSI holding below both its neutral level and 14-day MA.

OPTIONS DATA POINT TO PERSISTENT BEARISHNESS IN THE NEAR TERM

For the week ending 20th May, Managed Money’s net long positioning in soybean oil futures fell by 15%, reflecting a 5.3% drop in longs and an 8.1% rise in shorts, signalling the beginning of a bearish sentiment.

Implied volatility hit its 2025 high on 15/May, reflecting heightened uncertainty around biofuel policy. While IV has eased since 27/May, it remains well above normal levels, pointing to continued risk of sharp price swings.

Implied volatility hit its 2025 high on 15/May, reflecting heightened uncertainty around biofuel policy. While IV has eased since 27/May, it remains well above normal levels, pointing to continued risk of sharp price swings.

Skew has declined but stays positive, suggesting traders are still pricing in greater demand for upside protection.

Over the past week, OI trends show bearish positioning in near to mid-term contracts except for options expiring on 30/May.

HYPOTHETICAL TRADE SETUP

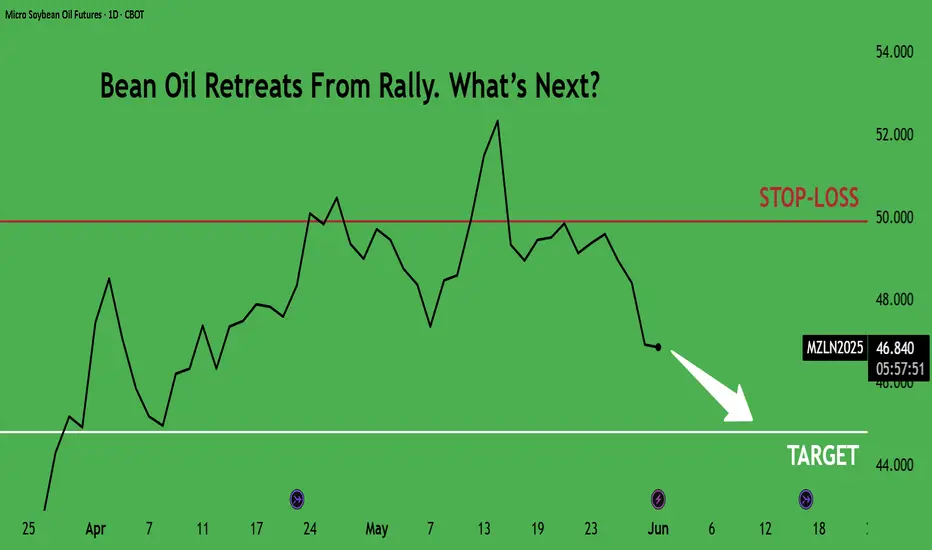

Bearish fundamentals driven by questionable demand for biofuels and feeble crude oil prices, paired with technical breakdowns and skewed option positioning, point to further downside in soybean oil futures.

This paper posits a tactical short on CME Micro Soybean Oil July futures (MZLN25 expiring on 20th June), targeting continued near-term weakness.

Investors can position against this backdrop using the CME Micro Soybean Oil Futures, which are sized at one-tenth (6,000 pounds) of standard contracts (which are 60,000 pounds). This allows for a cost-effective method to express a short-term bearish stance. As of 2nd June, the minimum exchange margin on this contract is USD 190 per lot.

• Entry: USc 48/Pound

• Entry: USc 48/Pound

• Potential Profit: USc 44.8/Pound (48 – 44.8 = 3.2) x 6000/100 = USD 192

• Stop-Loss: USc 49.9/Pound (48 – 49.9 = -1.9) x 6000/100 = USD 114

• Reward-to-Risk Ratio: 1.7x

In collaboration with the CME Group, TradingView has launched The Leap trading competition. New and upcoming traders can hone and refine their trading skills, test their trading strategies, and feel the thrill of futures trading with a vibrant global community through this paper trading competition sponsored by CME Group using virtual money and real time market data.

The competition lasts another 27 days. Please join the other 15,000 participants who are actively honing their trading skills using virtual money. Click here to learn more. #TheFuturesLeap

#Microfutures

MARKET DATA

CME Real-time Market Data helps identify trading set-ups and express market views better. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs tradingview.com/cme.

DISCLAIMER

This case study is for educational purposes only and does not constitute investment recommendations or advice. Nor are they used to promote any specific products, or services.

Trading or investment ideas cited here are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management or trading under the market scenarios being discussed. Please read the FULL DISCLAIMER, the link to which is provided in our profile description.

The rally ended on 15/May, with soybean oil futures tanking 5.7% amid concerns over the EPA’s biofuel mandate.

Reports suggested the agency may propose a lower biomass-based diesel target of 4.6 billion gallons, well below the industry’s 5.25 billion request, raising fears of feeble future soybean oil demand.

Soybean oil prices extended losses during the last week of May as a sharp drop in crude oil prices threatened to reduce demand for biofuel, weakening the price support.

TECHNICAL SIGNALS CONFIRM BEARISH FUNDAMENTALS

Technical indicators point to growing bearish momentum in soybean oil futures. A death cross occurred on 28/May, with the 21-day MA crossing above the 9-day MA, while prices remain below the monthly pivot.

OPTIONS DATA POINT TO PERSISTENT BEARISHNESS IN THE NEAR TERM

For the week ending 20th May, Managed Money’s net long positioning in soybean oil futures fell by 15%, reflecting a 5.3% drop in longs and an 8.1% rise in shorts, signalling the beginning of a bearish sentiment.

Source: CME CVOL

Skew has declined but stays positive, suggesting traders are still pricing in greater demand for upside protection.

Source: CME QuikStrike

Over the past week, OI trends show bearish positioning in near to mid-term contracts except for options expiring on 30/May.

HYPOTHETICAL TRADE SETUP

Bearish fundamentals driven by questionable demand for biofuels and feeble crude oil prices, paired with technical breakdowns and skewed option positioning, point to further downside in soybean oil futures.

This paper posits a tactical short on CME Micro Soybean Oil July futures (MZLN25 expiring on 20th June), targeting continued near-term weakness.

Investors can position against this backdrop using the CME Micro Soybean Oil Futures, which are sized at one-tenth (6,000 pounds) of standard contracts (which are 60,000 pounds). This allows for a cost-effective method to express a short-term bearish stance. As of 2nd June, the minimum exchange margin on this contract is USD 190 per lot.

• Potential Profit: USc 44.8/Pound (48 – 44.8 = 3.2) x 6000/100 = USD 192

• Stop-Loss: USc 49.9/Pound (48 – 49.9 = -1.9) x 6000/100 = USD 114

• Reward-to-Risk Ratio: 1.7x

In collaboration with the CME Group, TradingView has launched The Leap trading competition. New and upcoming traders can hone and refine their trading skills, test their trading strategies, and feel the thrill of futures trading with a vibrant global community through this paper trading competition sponsored by CME Group using virtual money and real time market data.

The competition lasts another 27 days. Please join the other 15,000 participants who are actively honing their trading skills using virtual money. Click here to learn more. #TheFuturesLeap

#Microfutures

MARKET DATA

CME Real-time Market Data helps identify trading set-ups and express market views better. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs tradingview.com/cme.

DISCLAIMER

This case study is for educational purposes only and does not constitute investment recommendations or advice. Nor are they used to promote any specific products, or services.

Trading or investment ideas cited here are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management or trading under the market scenarios being discussed. Please read the FULL DISCLAIMER, the link to which is provided in our profile description.

Full Disclaimer - linktr.ee/mintfinance

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Full Disclaimer - linktr.ee/mintfinance

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.