Since mid-May, soybean prices have traded sideways, whipsawed by weather shifts, trade tensions, and fluctuating demand cues.

Soybean prices began rallying on May 19, driven by optimism over U.S. trade deals, crop damage in Argentina from heavy rains, and strong soybean oil prices.

However, the momentum soon faded as U.S.-EU trade tensions resurfaced. Prices came under further pressure from weak export demand, rising competition from South America, and bearish U.S. biofuel mandates.

By 02/Jun, soybeans had fallen to a six-week low, weighed down by favorable U.S. crop weather, improved Brazilian production forecasts, and renewed U.S.-China tensions.

Over the last week, Bean prices inched higher, supported by firmer soybean oil prices and hopes of renewed US-China trade talks.

However, sentiment remains cautious amid policy uncertainty and robust planting progress. According to USDA data, 84% of the U.S. soybean crop was planted as of 1/Jun, above the five-year average of 80%.

TECHNICALS SIGNAL PERSISTENT BEARISH TREND WITH SLIGHT CHANCES OF A REVERSAL

On 2/Jun, soybean futures formed a bearish death cross, signalling potential downside momentum. Although prices have since rebounded, bearishness persists with the 21-day MA acting as a strong resistance.

The MACD reflects ongoing but easing bearish momentum, while the RSI sits just below its 14-day average, close to the neutral zone. These indicators suggest that price momentum is currently subdued.

OPTIONS DATA POINT TO MIXED SENTIMENT

For the week ending 27/May, Managed Money’s net long positioning in soybean futures surged by 190%, reflecting a 12.9% gain in longs and a 10% fall in shorts.

Despite the recent pullback in futures, skew (Up Var minus Down Var) has reached a YTD high, signalling higher demand for calls relative to puts.

Source: CME CVOL

Open Interest (“OI”) trends over the past week point to increased bearish positioning, with near-term contracts showing a notable rise in put OI. Longer-dated contracts reflect a similar pattern, although contracts expiring in July (OZSN5) and September (OZSU5) were notable exceptions.

Source: CME QuikStrike

HYPOTHETICAL TRADE SETUP

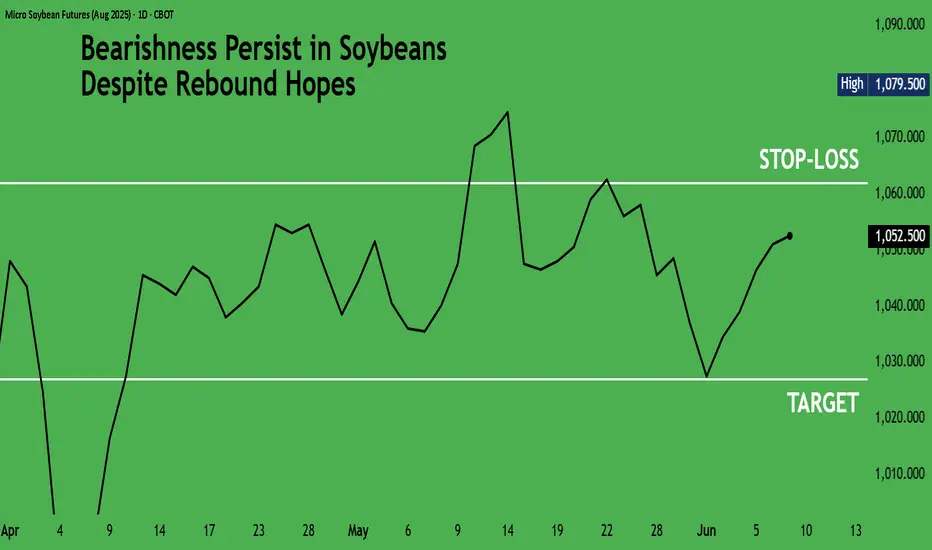

Despite some bullish drivers (US-China trade talks & Argentina crop risks), bearish forces prevail. These include strong US bean planting, improved Brazil forecasts, policy uncertainty, and rising put open interest in the near term.

Traders can express this view using CME Micro Soybean Futures, which are sized at one-tenth of standard contracts. This allows for a cost-effective way to express a short-term bullish stance.

Considering these dynamics, this paper posits a short position on CME Micro Soybean August futures (MZSQ25, expiring on 25/Jul).

• Entry: USc 1,048.5/Bushel

• Potential Profit: USc 1,027/Bushel (1,048.5 – 1,027 = 21.5) x 500/100 = USD 107.5

• Stop-Loss: USc 1,062/Bushel (1,048.5 – 1,062 = -13.5) x 500/100 = USD 67.5

• Reward-to-Risk Ratio: 1.6x

In collaboration with CME Group, TradingView has launched The Leap trading competition. Through this paper trading competition sponsored by CME Group using virtual money and real-time market data, new and upcoming traders can hone and refine their trading skills, test their trading strategies, and feel the thrill of futures trading with a vibrant global community.

The competition lasts another 21 days. Please join the other 42,700 participants who are actively honing their trading skills using virtual money. Click here to learn more.

#TheFuturesLeap #Microfutures

MARKET DATA

CME Real-time Market Data helps identify trading set-ups and express market views better. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs tradingview.com/cme.

DISCLAIMER

This case study is for educational purposes only and does not constitute investment recommendations or advice. Nor are they used to promote any specific products, or services.

Trading or investment ideas cited here are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management or trading under the market scenarios being discussed. Please read the FULL DISCLAIMER, the link to which is provided in our profile description.

Soybean prices began rallying on May 19, driven by optimism over U.S. trade deals, crop damage in Argentina from heavy rains, and strong soybean oil prices.

However, the momentum soon faded as U.S.-EU trade tensions resurfaced. Prices came under further pressure from weak export demand, rising competition from South America, and bearish U.S. biofuel mandates.

By 02/Jun, soybeans had fallen to a six-week low, weighed down by favorable U.S. crop weather, improved Brazilian production forecasts, and renewed U.S.-China tensions.

Over the last week, Bean prices inched higher, supported by firmer soybean oil prices and hopes of renewed US-China trade talks.

However, sentiment remains cautious amid policy uncertainty and robust planting progress. According to USDA data, 84% of the U.S. soybean crop was planted as of 1/Jun, above the five-year average of 80%.

TECHNICALS SIGNAL PERSISTENT BEARISH TREND WITH SLIGHT CHANCES OF A REVERSAL

On 2/Jun, soybean futures formed a bearish death cross, signalling potential downside momentum. Although prices have since rebounded, bearishness persists with the 21-day MA acting as a strong resistance.

The MACD reflects ongoing but easing bearish momentum, while the RSI sits just below its 14-day average, close to the neutral zone. These indicators suggest that price momentum is currently subdued.

OPTIONS DATA POINT TO MIXED SENTIMENT

For the week ending 27/May, Managed Money’s net long positioning in soybean futures surged by 190%, reflecting a 12.9% gain in longs and a 10% fall in shorts.

Despite the recent pullback in futures, skew (Up Var minus Down Var) has reached a YTD high, signalling higher demand for calls relative to puts.

Source: CME CVOL

Open Interest (“OI”) trends over the past week point to increased bearish positioning, with near-term contracts showing a notable rise in put OI. Longer-dated contracts reflect a similar pattern, although contracts expiring in July (OZSN5) and September (OZSU5) were notable exceptions.

Source: CME QuikStrike

HYPOTHETICAL TRADE SETUP

Despite some bullish drivers (US-China trade talks & Argentina crop risks), bearish forces prevail. These include strong US bean planting, improved Brazil forecasts, policy uncertainty, and rising put open interest in the near term.

Traders can express this view using CME Micro Soybean Futures, which are sized at one-tenth of standard contracts. This allows for a cost-effective way to express a short-term bullish stance.

Considering these dynamics, this paper posits a short position on CME Micro Soybean August futures (MZSQ25, expiring on 25/Jul).

• Entry: USc 1,048.5/Bushel

• Potential Profit: USc 1,027/Bushel (1,048.5 – 1,027 = 21.5) x 500/100 = USD 107.5

• Stop-Loss: USc 1,062/Bushel (1,048.5 – 1,062 = -13.5) x 500/100 = USD 67.5

• Reward-to-Risk Ratio: 1.6x

In collaboration with CME Group, TradingView has launched The Leap trading competition. Through this paper trading competition sponsored by CME Group using virtual money and real-time market data, new and upcoming traders can hone and refine their trading skills, test their trading strategies, and feel the thrill of futures trading with a vibrant global community.

The competition lasts another 21 days. Please join the other 42,700 participants who are actively honing their trading skills using virtual money. Click here to learn more.

#TheFuturesLeap #Microfutures

MARKET DATA

CME Real-time Market Data helps identify trading set-ups and express market views better. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs tradingview.com/cme.

DISCLAIMER

This case study is for educational purposes only and does not constitute investment recommendations or advice. Nor are they used to promote any specific products, or services.

Trading or investment ideas cited here are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management or trading under the market scenarios being discussed. Please read the FULL DISCLAIMER, the link to which is provided in our profile description.

Full Disclaimer - linktr.ee/mintfinance

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Full Disclaimer - linktr.ee/mintfinance

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.