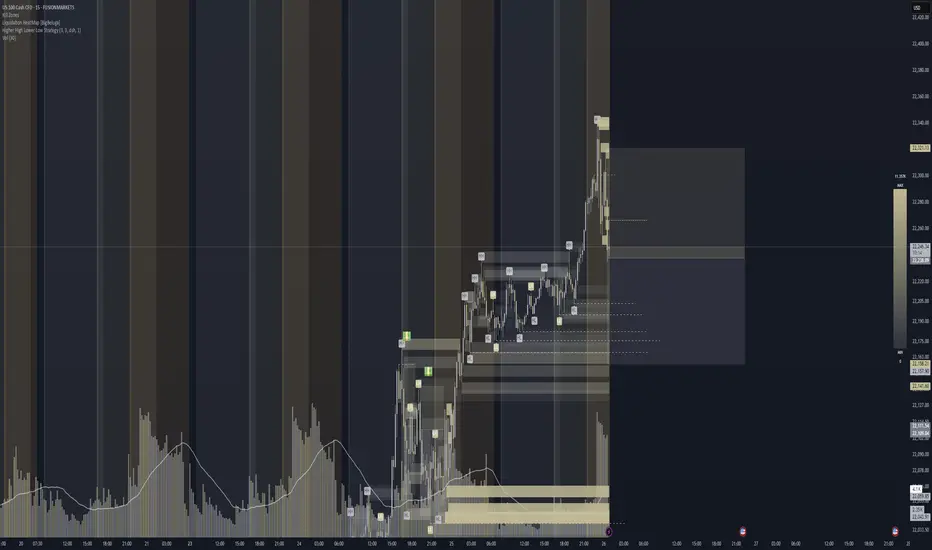

Tracked this trade live as price swept buyside liquidity at 22,300.59, forming a potential short-formed M pattern. Watched for confirmation and waited patiently through a small bullish pullback, identifying potential trap behavior rather than true continuation.

Once a bearish market structure shift (MSS) occurred—confirmed by a body close below the prior wick low—I executed a short position, targeting the sellside liquidity shelf at 22,166.92, aligned with Asian session lows. Dimmed HeatMap clusters beneath suggested institutional interest, supporting a high-probability setup.

Trade thesis:

- Liquidity sweep at 22,300.59

- Rejection with fading momentum and wick absorption

- MSS confirmation with strong-bodied candle

- Dimmed clusters and multiple marked sellside levels below

Execution: Sniper short after MSS confirmation. Trade is live and managed with defined targets and narrative context. Let’s see how deep this bleed runs.

Trade closed: stop reached

Ideally. I should put TP at either 1st or 2nd Sellside Liquidity Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.