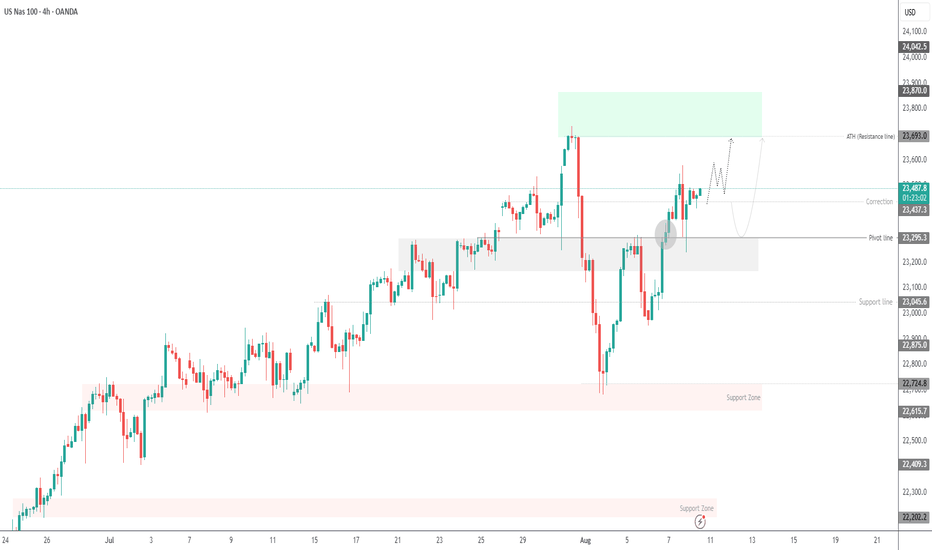

USNAS100 Overview

The index reached its all-time high ahead of recent speculation about a potential Fed rate cut. This week’s CPI data will be a key driver, indicating whether the Fed may cut rates in the near term.

Technical Outlook:

As long as the price trades below 23640–23690, a decline toward 23530–23435 is expected. A break below this zone could extend the drop toward 23295.

A 1H close above 23695 would turn the outlook bullish, targeting 23870.

Support: 23535, 23435, 23295

Resistance: 23870, 24040

previous idea:

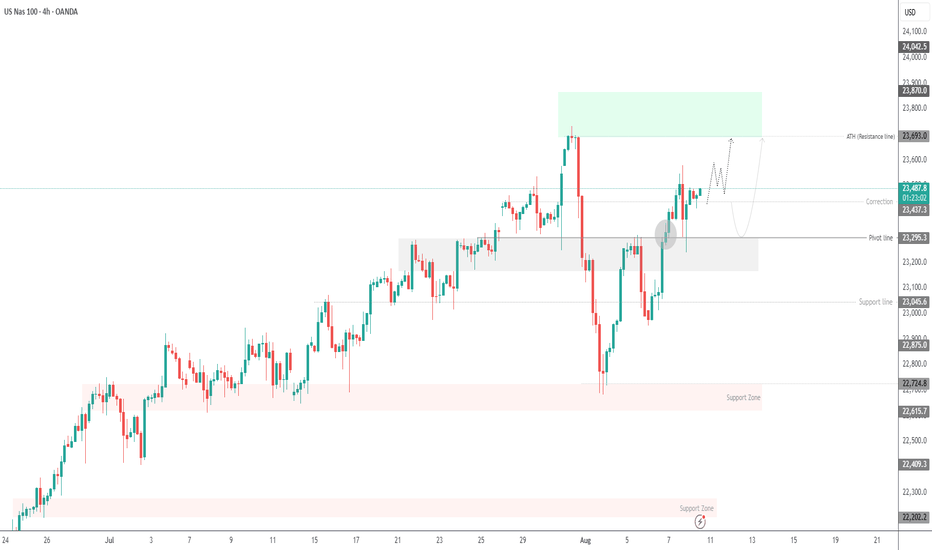

The index reached its all-time high ahead of recent speculation about a potential Fed rate cut. This week’s CPI data will be a key driver, indicating whether the Fed may cut rates in the near term.

Technical Outlook:

As long as the price trades below 23640–23690, a decline toward 23530–23435 is expected. A break below this zone could extend the drop toward 23295.

A 1H close above 23695 would turn the outlook bullish, targeting 23870.

Support: 23535, 23435, 23295

Resistance: 23870, 24040

previous idea:

Technical analyst focused on gold, indices, and forex.

Providing regular updates with structure, entry/exit clarity, and real-time outlooks.

More at: sroshmayi.com/

Providing regular updates with structure, entry/exit clarity, and real-time outlooks.

More at: sroshmayi.com/

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Technical analyst focused on gold, indices, and forex.

Providing regular updates with structure, entry/exit clarity, and real-time outlooks.

More at: sroshmayi.com/

Providing regular updates with structure, entry/exit clarity, and real-time outlooks.

More at: sroshmayi.com/

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.