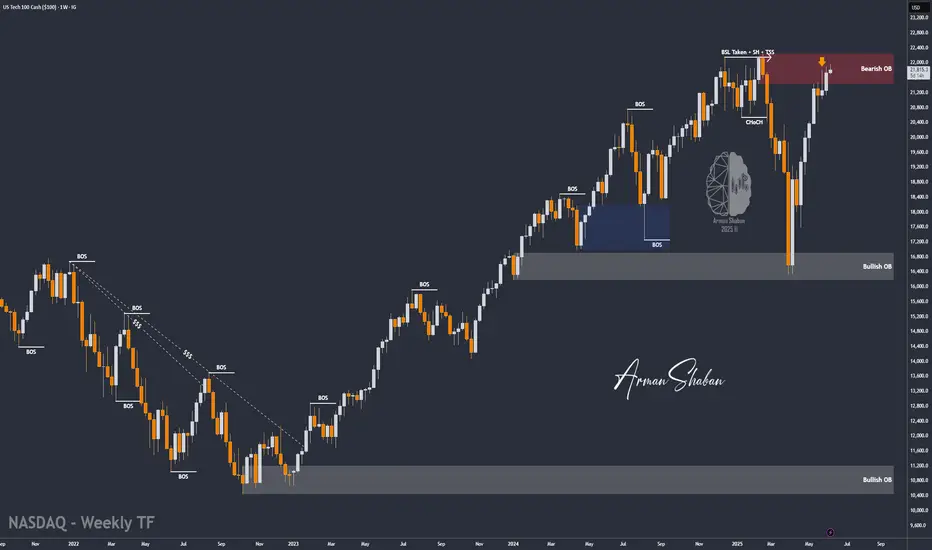

By examining the #Nasdaq chart on the weekly timeframe, we can see that the price is still trading within the supply zone around 21,850. We are still waiting for a strong rejection from this level, which could lead to a short-term price correction in this index.

The potential downside targets are:

21,000, 20,700, 20,200, and 19,150.

The key supply range lies between 21,400 and 22,200.

Additionally, there is a possibility of a liquidity grab or stop-hunt above 22,200 before any real drop begins.

This analysis will be considered invalid if price closes above 22,400 in the next three weeks.

On the fundamental side, there are several macro factors to watch:

Interest Rate Expectations:

Although inflation in the U.S. has cooled compared to last year, the Fed remains cautious. If upcoming CPI or PPI prints show unexpected resilience, the likelihood of rate cuts this year could diminish, pressuring tech-heavy indices like Nasdaq.

Tech Sector Valuations:

Valuations in major tech names — such as NVIDIA, Apple, and Microsoft — have reached historically high multiples. This makes Nasdaq particularly vulnerable to correction, especially if earnings disappoint or growth expectations soften.

Geopolitical Risks:

Ongoing tensions between the U.S. and China over trade and technology, as well as potential instability in the Middle East, could contribute to a risk-off sentiment — further supporting the case for a short-term pullback.

Earnings Season Ahead:

Q2 earnings season is around the corner. Any signs of slowing revenue growth or reduced forward guidance from major tech firms could act as a catalyst for the expected correction.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

The potential downside targets are:

21,000, 20,700, 20,200, and 19,150.

The key supply range lies between 21,400 and 22,200.

Additionally, there is a possibility of a liquidity grab or stop-hunt above 22,200 before any real drop begins.

This analysis will be considered invalid if price closes above 22,400 in the next three weeks.

On the fundamental side, there are several macro factors to watch:

Interest Rate Expectations:

Although inflation in the U.S. has cooled compared to last year, the Fed remains cautious. If upcoming CPI or PPI prints show unexpected resilience, the likelihood of rate cuts this year could diminish, pressuring tech-heavy indices like Nasdaq.

Tech Sector Valuations:

Valuations in major tech names — such as NVIDIA, Apple, and Microsoft — have reached historically high multiples. This makes Nasdaq particularly vulnerable to correction, especially if earnings disappoint or growth expectations soften.

Geopolitical Risks:

Ongoing tensions between the U.S. and China over trade and technology, as well as potential instability in the Middle East, could contribute to a risk-off sentiment — further supporting the case for a short-term pullback.

Earnings Season Ahead:

Q2 earnings season is around the corner. Any signs of slowing revenue growth or reduced forward guidance from major tech firms could act as a catalyst for the expected correction.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

⚜️ Free Telegram Channel : t.me/PriceAction_ICT

⚜️ JOIN THE VIP : t.me/PriceAction_ICT/5946

⚜️ Contact Me : t.me/ArmanShabanTrading

💥Join BitMart Exchange – Ultra Low Fees : bitmart.com/invite/c5JVJK/en-US

⚜️ JOIN THE VIP : t.me/PriceAction_ICT/5946

⚜️ Contact Me : t.me/ArmanShabanTrading

💥Join BitMart Exchange – Ultra Low Fees : bitmart.com/invite/c5JVJK/en-US

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

⚜️ Free Telegram Channel : t.me/PriceAction_ICT

⚜️ JOIN THE VIP : t.me/PriceAction_ICT/5946

⚜️ Contact Me : t.me/ArmanShabanTrading

💥Join BitMart Exchange – Ultra Low Fees : bitmart.com/invite/c5JVJK/en-US

⚜️ JOIN THE VIP : t.me/PriceAction_ICT/5946

⚜️ Contact Me : t.me/ArmanShabanTrading

💥Join BitMart Exchange – Ultra Low Fees : bitmart.com/invite/c5JVJK/en-US

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.