📐 Wedge Pattern — A Key to Trend Movements 📈

🔍 Introduction

The Wedge is a chart pattern that represents a phase of directional consolidation following a trending move. It can act as a continuation 🔄 or a reversal 🔃 signal, depending on the context. The structure consists of two converging trendlines, both sloping in the same direction.

🧩 Pattern Description

Unlike the Flag pattern 🚩, the Wedge has no flagpole and doesn’t depend on the direction of the previous move. The direction of the wedge body determines its type:

A falling wedge ⬇️ is bullish 🟢 (buy signal)

A rising wedge ⬆️ is bearish 🔴 (sell signal)

The breakout is the key point to watch. The two trendlines slope in the same direction but at different angles, causing them to converge. This reflects a loss of momentum ⚠️ and typically indicates that buyers or sellers are preparing to take control.

This pattern can act as:

A continuation signal 🧭 — appearing at the end of a correction

A reversal signal 🔄 — forming at the end of a strong trend

📉 Volume is usually low during the wedge and rises on breakout. A low-volume breakout increases the risk of a false breakout ❗. Often, price retests the breakout level 🔁, giving traders a second chance to enter.

🎯 Entry & Stop-Loss Strategy

📥 Entry: On breakout confirmation

🛑 Stop-loss: Below the pattern’s low (bullish) or above its high (bearish), or under/above the most recent local swing point

🎯 Target: Project the height of the widest part of the wedge from the breakout point. Alternatively, use key price levels 📊 or a trailing stop 🔂 to lock in profits.

💡 My Pro Tips for Trading the Wedge

✅ Pattern Criteria

Two converging trendlines ➡️➕➡️

Clearly defined structure ✏️

Prior trending move before the wedge 🚀

Low volume within the wedge 📉, high volume on breakout 📈

Retest of breakout level = confirmation 🔁

🔥 Factors That Strengthen the Signal

Breakout on strong volume 📊💥

Appears after an extended trend 🧭📉📈

More touches = stronger pattern ✍️

Breakout occurs close to the apex 🎯

⚠️ Factors That Weaken the Signal

Low volume on breakout 😐

Poorly defined trendlines 🫥

Few touches on lines

Early breakout (too far from apex) ⏱️

No prior trend / appears in a range-bound market 📏

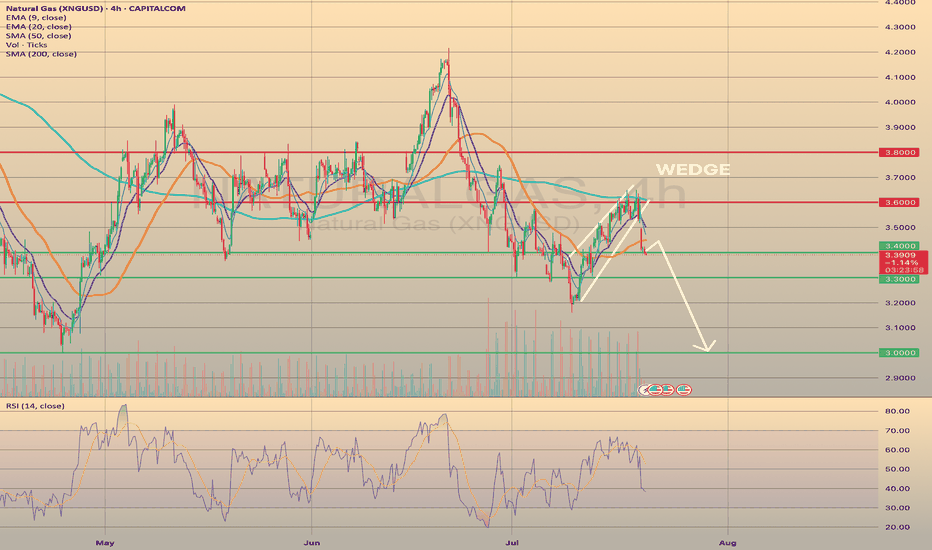

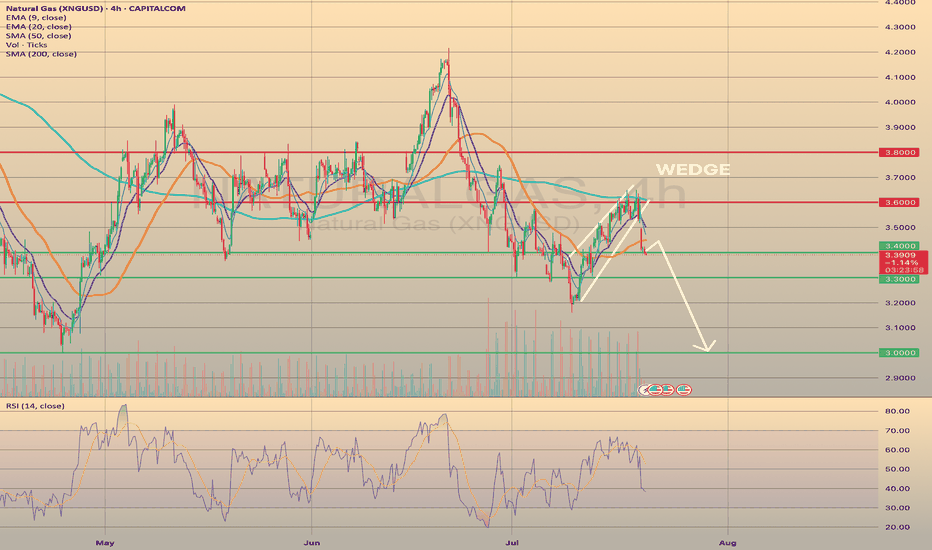

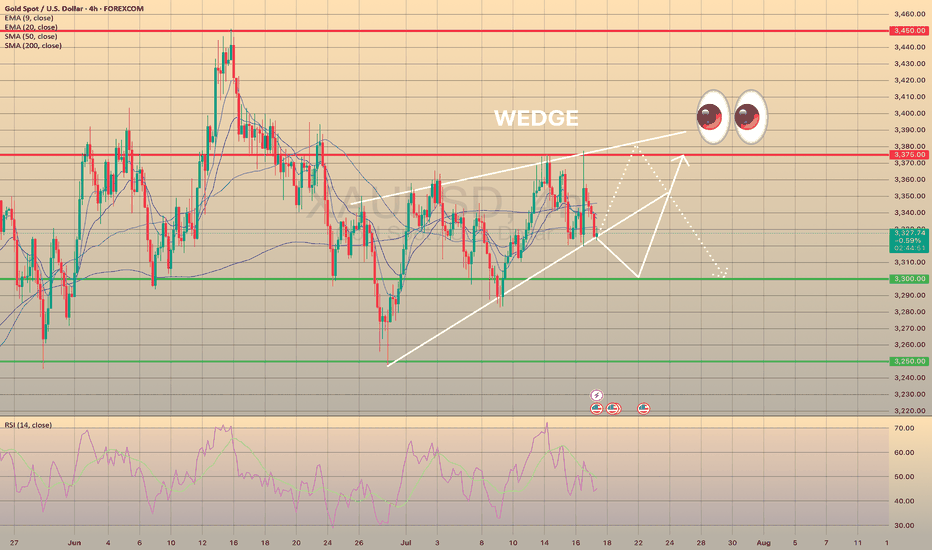

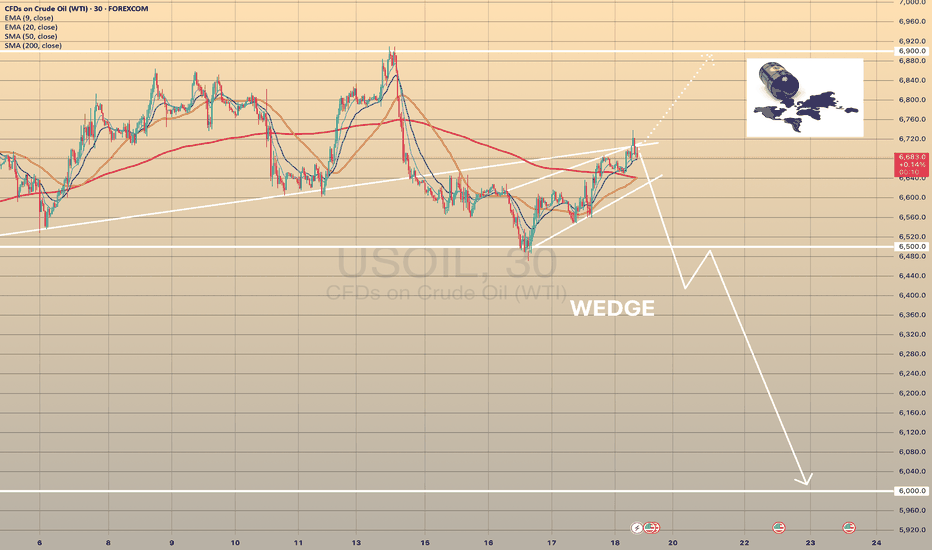

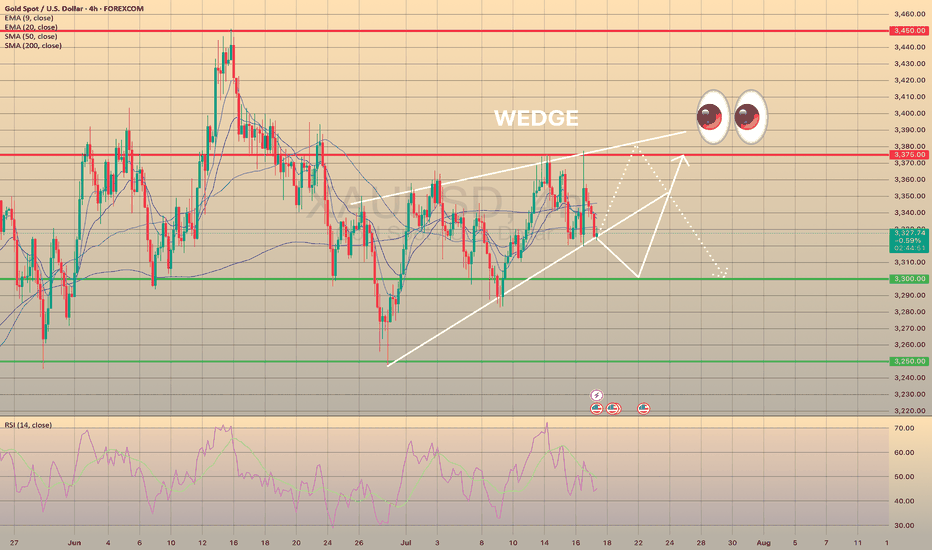

✅ Examples of My Successful Wedge Trades

📸

https://tradingview.sweetlogin.com/chart/NATURALGAS/dvw2GKJO-U-S-NATURAL-GAS-BEARISH-WEDGE-WORKED-OUT-WHAT-S-NEXT/

https://tradingview.sweetlogin.com/chart/NATURALGAS/dvw2GKJO-U-S-NATURAL-GAS-BEARISH-WEDGE-WORKED-OUT-WHAT-S-NEXT/

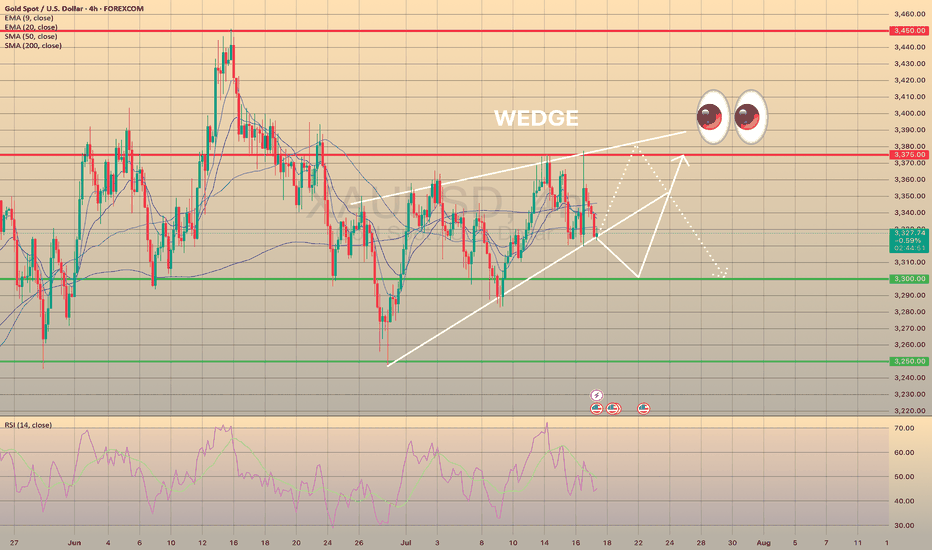

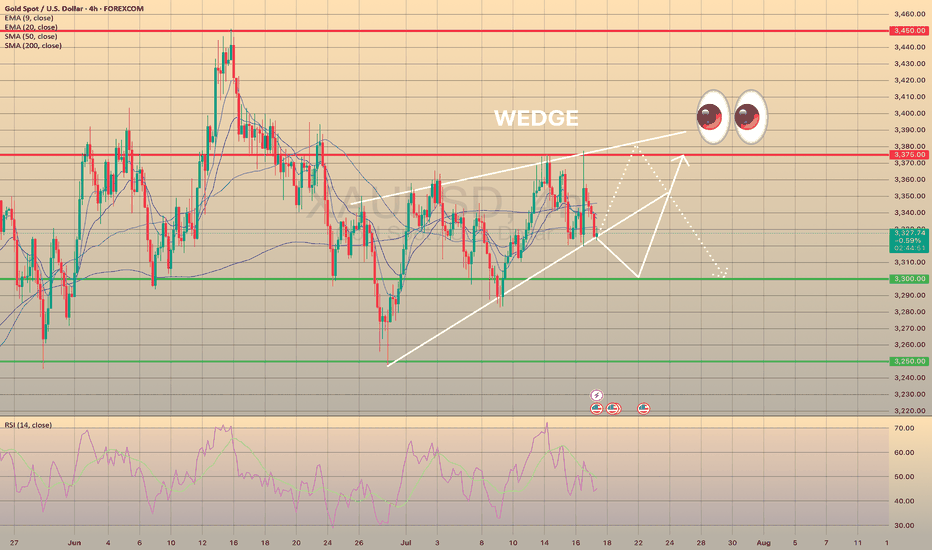

https://tradingview.sweetlogin.com/chart/XAUUSD/rEpYibOo-WEDGE-IN-XAUUSD-POSSIBLE-OUTCOMES/

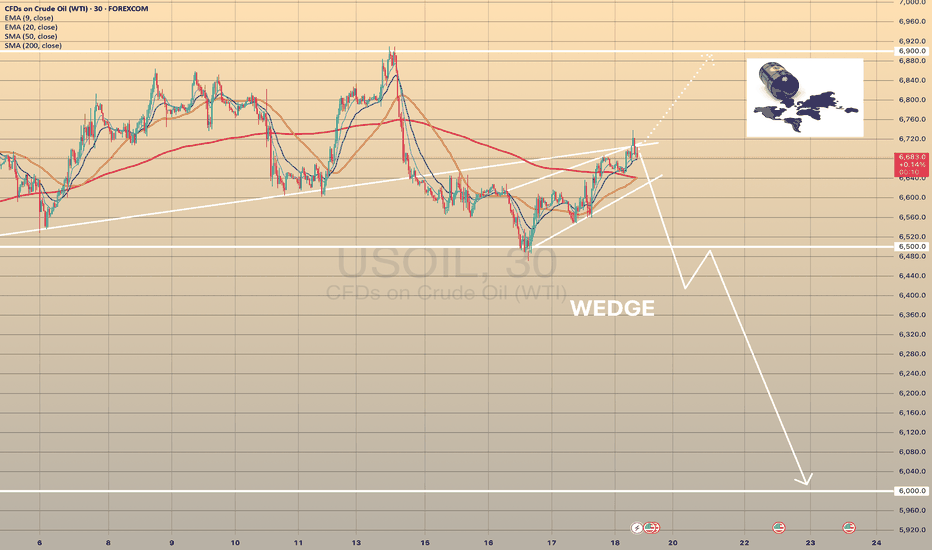

https://tradingview.sweetlogin.com/chart/USOIL/vAah8J9e-BRENT-CRUDE-OIL-FORMED-A-BEARISH-WEDGE-ANOTHER-POSSIBLE-DECLINE/

❌Examples of Failed Wedge Overview

💥

https://tradingview.sweetlogin.com/chart/XAUUSD/rEpYibOo-WEDGE-IN-XAUUSD-POSSIBLE-OUTCOMES/

https://tradingview.sweetlogin.com/chart/ETHUSD/QsWjpS0x-ETHUSD-FORMED-A-BEARISH-WEDGE-READY-TO-REVERSE/

💬 Do you use the wedge pattern in your trading?

It’s a powerful pattern, especially when confirmed by volume and market structure. Share your favorite wedge setups or ask questions below 👇👇

🔍 Introduction

The Wedge is a chart pattern that represents a phase of directional consolidation following a trending move. It can act as a continuation 🔄 or a reversal 🔃 signal, depending on the context. The structure consists of two converging trendlines, both sloping in the same direction.

🧩 Pattern Description

Unlike the Flag pattern 🚩, the Wedge has no flagpole and doesn’t depend on the direction of the previous move. The direction of the wedge body determines its type:

A falling wedge ⬇️ is bullish 🟢 (buy signal)

A rising wedge ⬆️ is bearish 🔴 (sell signal)

The breakout is the key point to watch. The two trendlines slope in the same direction but at different angles, causing them to converge. This reflects a loss of momentum ⚠️ and typically indicates that buyers or sellers are preparing to take control.

This pattern can act as:

A continuation signal 🧭 — appearing at the end of a correction

A reversal signal 🔄 — forming at the end of a strong trend

📉 Volume is usually low during the wedge and rises on breakout. A low-volume breakout increases the risk of a false breakout ❗. Often, price retests the breakout level 🔁, giving traders a second chance to enter.

🎯 Entry & Stop-Loss Strategy

📥 Entry: On breakout confirmation

🛑 Stop-loss: Below the pattern’s low (bullish) or above its high (bearish), or under/above the most recent local swing point

🎯 Target: Project the height of the widest part of the wedge from the breakout point. Alternatively, use key price levels 📊 or a trailing stop 🔂 to lock in profits.

💡 My Pro Tips for Trading the Wedge

✅ Pattern Criteria

Two converging trendlines ➡️➕➡️

Clearly defined structure ✏️

Prior trending move before the wedge 🚀

Low volume within the wedge 📉, high volume on breakout 📈

Retest of breakout level = confirmation 🔁

🔥 Factors That Strengthen the Signal

Breakout on strong volume 📊💥

Appears after an extended trend 🧭📉📈

More touches = stronger pattern ✍️

Breakout occurs close to the apex 🎯

⚠️ Factors That Weaken the Signal

Low volume on breakout 😐

Poorly defined trendlines 🫥

Few touches on lines

Early breakout (too far from apex) ⏱️

No prior trend / appears in a range-bound market 📏

✅ Examples of My Successful Wedge Trades

📸

https://tradingview.sweetlogin.com/chart/XAUUSD/rEpYibOo-WEDGE-IN-XAUUSD-POSSIBLE-OUTCOMES/

https://tradingview.sweetlogin.com/chart/USOIL/vAah8J9e-BRENT-CRUDE-OIL-FORMED-A-BEARISH-WEDGE-ANOTHER-POSSIBLE-DECLINE/

❌Examples of Failed Wedge Overview

💥

https://tradingview.sweetlogin.com/chart/XAUUSD/rEpYibOo-WEDGE-IN-XAUUSD-POSSIBLE-OUTCOMES/

https://tradingview.sweetlogin.com/chart/ETHUSD/QsWjpS0x-ETHUSD-FORMED-A-BEARISH-WEDGE-READY-TO-REVERSE/

💬 Do you use the wedge pattern in your trading?

It’s a powerful pattern, especially when confirmed by volume and market structure. Share your favorite wedge setups or ask questions below 👇👇

Join me, I'll guide you to PROFITABLE TRADING💵!

Telegram Channel: t.me/forextradersliveofficial

Telegram Channel: t.me/forextradersliveofficial

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Join me, I'll guide you to PROFITABLE TRADING💵!

Telegram Channel: t.me/forextradersliveofficial

Telegram Channel: t.me/forextradersliveofficial

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.