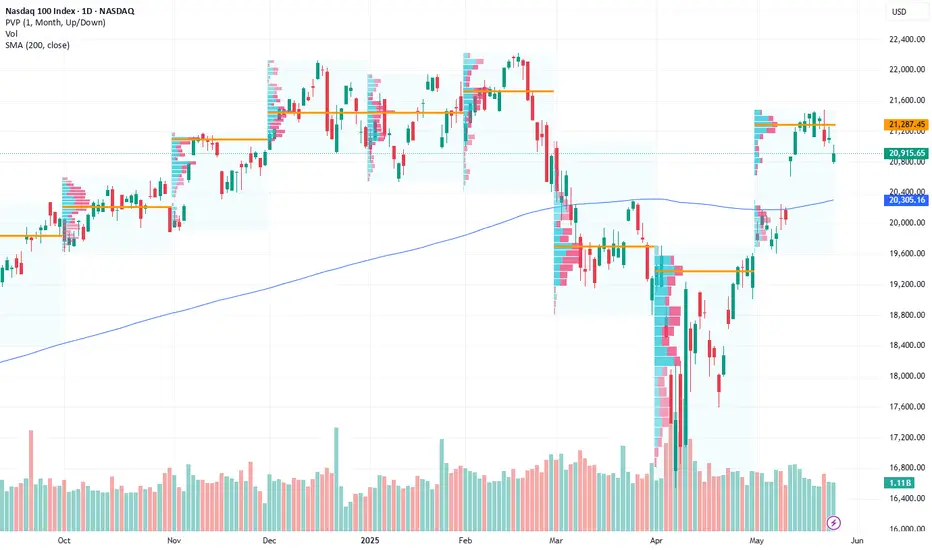

- Key Insights: The NASDAQ has entered a historically oversold state, presenting

a high-probability opportunity for a short-term rebound. While bearish

signals persist due to recent momentum shifts, long-term institutional

activity indicates underlying support. Traders should look for defensive

buying near support zones to capitalize on upward moves. Critical levels

must be monitored closely for confirmation.

- Price Targets:

- Next Week Targets:

- T1: 21,000

- T2: 21,479

- Stop Levels:

- S1: 20,426

- S2: 20,250

- Recent Performance: The NASDAQ has faced four consecutive days of declines,

breaking below key technical levels that signal bearish pressures. However,

institutional support and broader bullish indicators remain intact, keeping

the index positioned as the strongest major U.S. equity index in the longer

term. Historically oversold conditions provide optimism for a potential

bounce next week.

- Expert Analysis: Despite short-term bearish momentum, expert outlook continues

to align with NASDAQ’s long-term resilience above major moving averages.

Institutional liquidity flow and ongoing interest in technology continue to

support the index, though caution is warranted around immediate support

barriers to avoid deeper pullbacks. Monitoring liquidity gaps is crucial.

- News Impact: NVIDIA earnings are anticipated to be a pivotal event next week

and could drive volatility in NASDAQ tech sectors depending on the outcome.

Elevated volatility levels, as evidenced by the VIX, further warrant caution

while underscoring potential opportunities for rebound plays. Additionally,

NASDAQ’s move to expand zero-day options trading has drawn mixed responses

but could influence short-term speculative activity in its top tech stocks

like Apple, Microsoft, Amazon, and Alphabet.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.