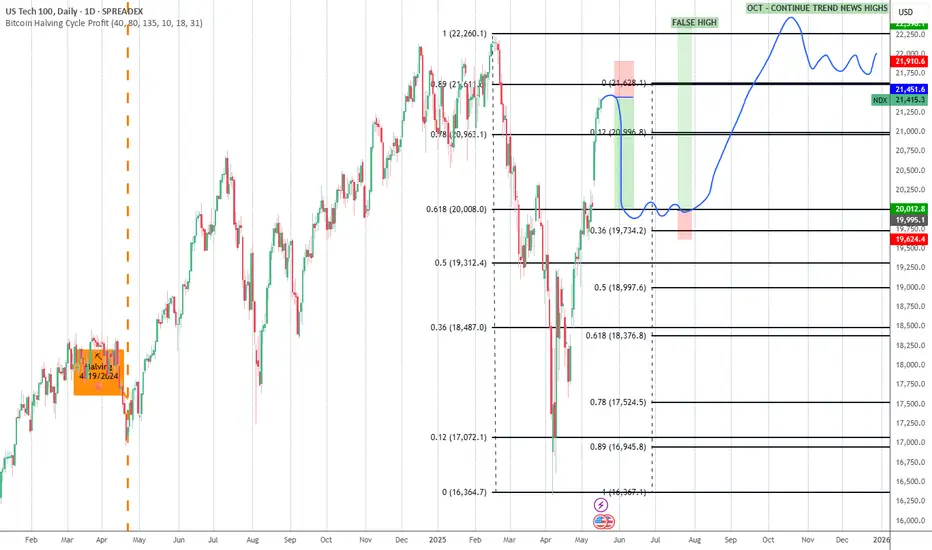

We’re currently braced for an 8–9% pullback in the Nasdaq 100 before we attempt what could prove to be a bull‑trap breakout above last cycle’s all‑time high. Historically, the ‘summer swoon’ is supported by data showing that, since 2000, the Nasdaq 100 has experienced an average decline of roughly 5–7% between June and August as institutional investors trim positions ahead of mid‑year portfolio rebalances. With selling pressure typically peaking in July—when mutual funds lock in gains for window dressing—we’re unlikely to see a committed uptrend until the back‑to‑school season around late September to early October. Even if we see a short‑lived bounce on positive headlines or better‑than‑expected earnings, the broader bias remains sideways to down until seasonal headwinds abate and real money players rotate back into large‑cap tech.

Trade active

Note

I’m not trading the NDX—I share these analyses because I have significant exposure to the index. But if you’re short and sitting on profits, I recommend you protect your positions. As for me, I’ve already exited the NDX and am now invested exclusively in defensive stocks until mid-September or, at the latest, early October.Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.