hello?

Welcome, traders.

By "following", you can always get new information quickly.

Please also click "Like".

Have a good day.

-------------------------------------

(NEARUSDT 1W Chart)

The key is whether the price can be maintained above the 2.792-3.545 range.

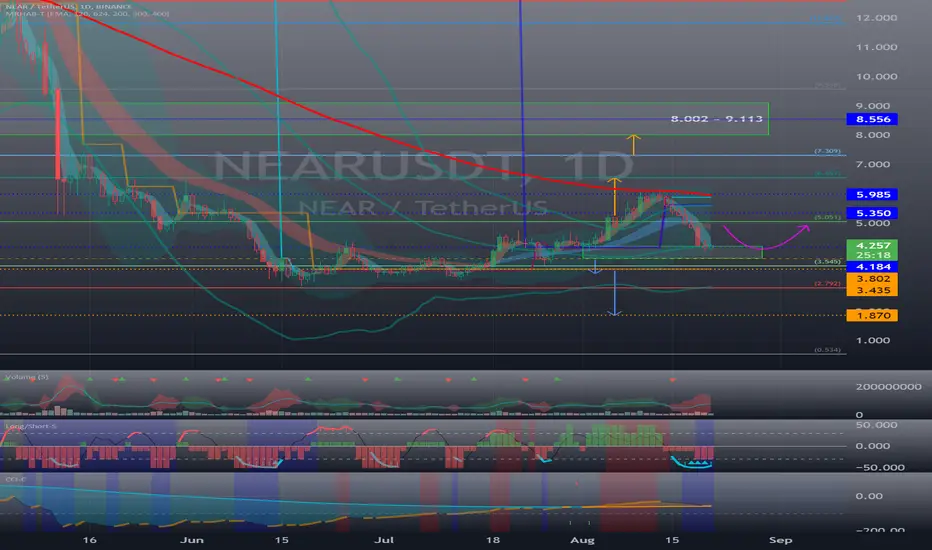

(1D chart)

Resistance: 5.051

1st support: 3.802-4.184

2nd support: 2.792-3.545

We need to see if we can support near the 3.802-4.184 section and rise above 5.051.

- The RSI, Stoch RSI and CCI(9) indicators are entering the oversold zone.

So, it's a good idea to see where you find support and resistance until you break out of the oversold zone.

------------------------------------------------------------ -------------------------------------------

** All descriptions are for reference only and do not guarantee a profit or loss in investment.

** The MRHAB-T indicator, which is inactive on the chart, contains indicators that indicate support and resistance points.

** Background color of Long/Short-S indicator: RSI oversold and overbought sections

** Background color of CCI-C indicator: When the short-term CCI line is below -100 and above +100, oversold and overbought sections are displayed.

** The OBV index was re-created by applying a formula to the DepthHouse Trading index, an index disclosed by oh92. (Thanks for this.)

(Short-term Stop Loss can be said to be a point where profit and loss can be preserved or additional entry through split trading. It is a short-term investment perspective.)

---------------------------------

Welcome, traders.

By "following", you can always get new information quickly.

Please also click "Like".

Have a good day.

-------------------------------------

(NEARUSDT 1W Chart)

The key is whether the price can be maintained above the 2.792-3.545 range.

(1D chart)

Resistance: 5.051

1st support: 3.802-4.184

2nd support: 2.792-3.545

We need to see if we can support near the 3.802-4.184 section and rise above 5.051.

- The RSI, Stoch RSI and CCI(9) indicators are entering the oversold zone.

So, it's a good idea to see where you find support and resistance until you break out of the oversold zone.

------------------------------------------------------------ -------------------------------------------

** All descriptions are for reference only and do not guarantee a profit or loss in investment.

** The MRHAB-T indicator, which is inactive on the chart, contains indicators that indicate support and resistance points.

** Background color of Long/Short-S indicator: RSI oversold and overbought sections

** Background color of CCI-C indicator: When the short-term CCI line is below -100 and above +100, oversold and overbought sections are displayed.

** The OBV index was re-created by applying a formula to the DepthHouse Trading index, an index disclosed by oh92. (Thanks for this.)

(Short-term Stop Loss can be said to be a point where profit and loss can be preserved or additional entry through split trading. It is a short-term investment perspective.)

---------------------------------

※ Follow X to check out the posts.

※ X를 팔로우하고 게시물을 확인하세요.

◆ t.me/readCryptoChannel

[HA-MS Indicator]

bit.ly/3YxHgvN

[OBV Indicator]

bit.ly/4dcyny3

※ X를 팔로우하고 게시물을 확인하세요.

◆ t.me/readCryptoChannel

[HA-MS Indicator]

bit.ly/3YxHgvN

[OBV Indicator]

bit.ly/4dcyny3

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

※ Follow X to check out the posts.

※ X를 팔로우하고 게시물을 확인하세요.

◆ t.me/readCryptoChannel

[HA-MS Indicator]

bit.ly/3YxHgvN

[OBV Indicator]

bit.ly/4dcyny3

※ X를 팔로우하고 게시물을 확인하세요.

◆ t.me/readCryptoChannel

[HA-MS Indicator]

bit.ly/3YxHgvN

[OBV Indicator]

bit.ly/4dcyny3

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.