Do I have to recap the current geopolitics for you? Germany is navigating to its black-out because the gas supply from Russia is being capped (stupid German politicians but okay). Because of the lack of nuclear energy, the Europeans will have a certain electricity problem - at least Germany in the coming winter. So, they will import US natural gas on a large scale.

That's the story in a nutshell. The FED and ECB have bloated the circulating money so that some inflation will play its part too.

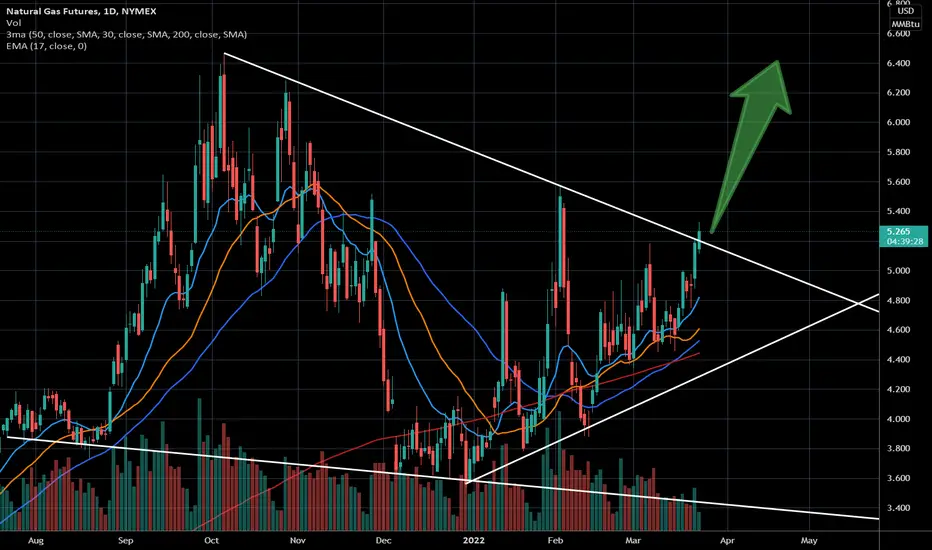

Looking at the technicals:

We are about to break this triangle formation to the upside. If this breakout gets confirmed, I'm expecting perhaps a re-test of the trendline or breakout level and then a further upward move.

According to the seasonality of the last ten years, Natural Gas has the first spike at the end of April, after this a little bit higher after the middle of May before dropping hard at the beginning of June.

Honestly, I don't know if the seasonality in these global circumstances plays a dominant role. It depends on how strong the inflation kicks in. So I'll decide later if I exit my position in May or if I hodl until October/November.

No investment advice - just my 2 cents on this topic. ;)

That's the story in a nutshell. The FED and ECB have bloated the circulating money so that some inflation will play its part too.

Looking at the technicals:

We are about to break this triangle formation to the upside. If this breakout gets confirmed, I'm expecting perhaps a re-test of the trendline or breakout level and then a further upward move.

According to the seasonality of the last ten years, Natural Gas has the first spike at the end of April, after this a little bit higher after the middle of May before dropping hard at the beginning of June.

Honestly, I don't know if the seasonality in these global circumstances plays a dominant role. It depends on how strong the inflation kicks in. So I'll decide later if I exit my position in May or if I hodl until October/November.

No investment advice - just my 2 cents on this topic. ;)

Note

Is Natural Gas now breaking and going down down down? It's Spring. Getting Summer. Perhaps it's over for the next months to be bullish on NG?Well, I DON'T KNOW IT EITHER, but we got some solid arguments for the bullish case:

➡ In 2008 the high was reached at the end of June at ~13.70 USD. Therefore, we've got some time to go and some room to the upside. Of course, only if you consider the current situation as worse as 2008.

➡ We've cut through a weekly trendline on the closing prices on the chart below.

Trade active

Still long ...Trade active

Okay, another update on this idea:You see below the line chart on a weekly timeframe of the NG1!. The price is still inside the resistance cluster between ~8.40 and ~8.75 USD. If we surpass these levels, a further rise to ~13.50 USD will start. If the current resistance cluster rejects the price, I'm confident that the upper price target will be reached in fall.

Trade closed manually

It seems like we are about to exit CONTANGO for BACKWARDATION now. It could be that the price keeps on rising - but it's just not to lose any money. The last time this happened, the price (orange line in the chart below) went down. As I was slightly overleveraged, I closed my position completely (otherwise, I would have closed only 50 % or so).However, I'm expecting the price to rise even further but not necessarily during the summer. So I will start entering long again in a few weeks ...

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.