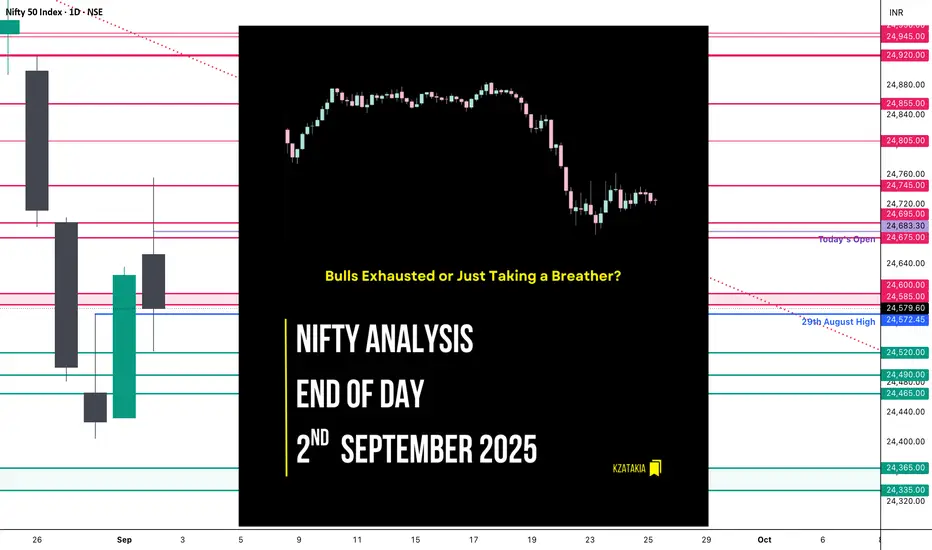

🟢 Nifty Analysis EOD – September 2, 2025 – Tuesday 🔴

Bulls Exhausted or Just Taking a Breather?

🗞 Nifty Summary

Nifty opened with a 62-point gap-up above the previous day’s high, but the excitement didn’t last long. The index quickly rushed to fill the gap, pulled back, and initially tried to extend the bullish sentiment from yesterday. However, the 24,750 hurdle proved too strong.

After multiple failed attempts to break above it, Nifty slipped below key supports — mean, CDL, PDH, PDC, and the 24,600–24,585 support zone — finally taking a pause around 24,520.

The big question: Was this just a weekly expiry adjustment or early signs of bullish momentum exhaustion?

For the upcoming sessions, the critical range is 24,750 ~ 24,500.

🛡 5 Min Intraday Chart with Levels

📉 Daily Time Frame Chart with Intraday Levels

🕯️ Daily Candle Breakdown

🏗️ Structure Breakdown

This created a long upper wick → intraday bullish attempt got rejected.

🕯Candle Type

Shooting Star–like red candle → reflects bullish exhaustion and supply pressure.

📚 Interpretation

📉 Short-Term View

👉 If bulls reclaim 24,750+, momentum revives.

👉 If 24,520 breaks, sellers may gain the upper hand.

In short: Market is in a tug-of-war zone between 24,750 and 24,520.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

📌 Support & Resistance Levels

Resistance Zones:

Support Zones:

💭 Final Thoughts

The index showed signs of exhaustion near 24,750. Whether this is just expiry-related or a genuine pause in momentum, tomorrow’s action will confirm.

"Markets don’t lie, they whisper. Today’s rejection was one such whisper — respect it."

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Bulls Exhausted or Just Taking a Breather?

🗞 Nifty Summary

Nifty opened with a 62-point gap-up above the previous day’s high, but the excitement didn’t last long. The index quickly rushed to fill the gap, pulled back, and initially tried to extend the bullish sentiment from yesterday. However, the 24,750 hurdle proved too strong.

After multiple failed attempts to break above it, Nifty slipped below key supports — mean, CDL, PDH, PDC, and the 24,600–24,585 support zone — finally taking a pause around 24,520.

The big question: Was this just a weekly expiry adjustment or early signs of bullish momentum exhaustion?

For the upcoming sessions, the critical range is 24,750 ~ 24,500.

🛡 5 Min Intraday Chart with Levels

📉 Daily Time Frame Chart with Intraday Levels

🕯️ Daily Candle Breakdown

- Open: 24,653.00

- High: 24,756.10

- Low: 24,522.35

- Close: 24,579.60

- Change: −45.45 (−0.18%)

🏗️ Structure Breakdown

- Red candle (Close < Open).

- Body: 73.40 points → moderate.

- Upper wick: 103.10 points (strong rejection near high).

- Lower wick: 57.25 points (buyers attempted defense).

This created a long upper wick → intraday bullish attempt got rejected.

🕯Candle Type

Shooting Star–like red candle → reflects bullish exhaustion and supply pressure.

📚 Interpretation

- Gap-up open above previous close (24,625 → 24,653).

- Bulls attempted to break 24,750, but failed multiple times.

- Sellers dominated late, dragging the index red.

- Strong rejection shows supply pressure near 24,750.

📉 Short-Term View

- Resistance: 24,750 (rejection zone).

- Support: 24,520 (today’s low).

- Context: Yesterday’s bullish Marubozu was negated by today’s failure.

👉 If bulls reclaim 24,750+, momentum revives.

👉 If 24,520 breaks, sellers may gain the upper hand.

In short: Market is in a tug-of-war zone between 24,750 and 24,520.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

- ATR: 205.07

- IB Range: 98.85 → Medium

- Market Structure: Balanced

- Trade Highlight:

- 13:50 Short Trigger → Target Hit (R:R = 1:1.5)

📌 Support & Resistance Levels

Resistance Zones:

- 24,675 ~ 24,695

- 24,745

- 24,805

- 24,855

Support Zones:

- 24,575

- 24,520

- 24,490 ~ 24,465

💭 Final Thoughts

The index showed signs of exhaustion near 24,750. Whether this is just expiry-related or a genuine pause in momentum, tomorrow’s action will confirm.

"Markets don’t lie, they whisper. Today’s rejection was one such whisper — respect it."

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Read my blogs here:

substack.com/@kzatakia

Follow me on Telegram:

t.me/swingtraderhub

Follow me on X:

x.com/kzatakia

substack.com/@kzatakia

Follow me on Telegram:

t.me/swingtraderhub

Follow me on X:

x.com/kzatakia

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Read my blogs here:

substack.com/@kzatakia

Follow me on Telegram:

t.me/swingtraderhub

Follow me on X:

x.com/kzatakia

substack.com/@kzatakia

Follow me on Telegram:

t.me/swingtraderhub

Follow me on X:

x.com/kzatakia

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.