Nifty Trading Plan for 28-Oct-2024

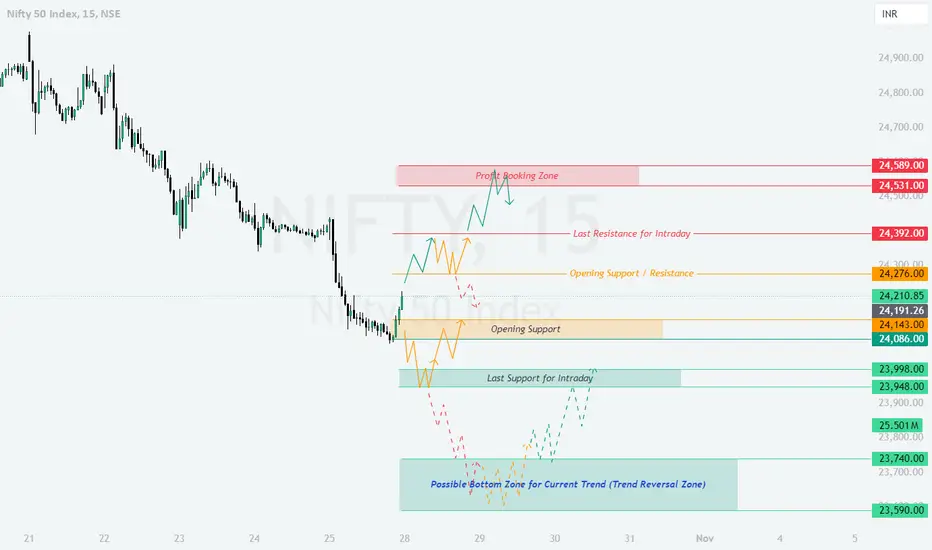

**Previous Day Recap**: Nifty experienced volatility yesterday, with a downward bias. Major support levels held around the **24080-24100** mark, indicating potential buying interest. However, resistance levels remain active, with **24,276** serving as a pivot zone. For today, trends are illustrated as follows:

- **Yellow** trend signifies a sideways market.

- **Green** trend indicates a bullish outlook.

- **Red** trend reflects a bearish sentiment.

Opening Scenarios for 28-Oct-2024

Risk Management Tips for Options Trading:

- Always define your stop-loss levels based on the nearest support/resistance zones to manage risk effectively.

- Avoid aggressive positions in high-volatility scenarios like gap openings. Start small and scale up if the trend confirms.

- Be cautious of time decay when trading options, especially if the price is near critical support or resistance zones.

- Consider hedging positions if holding overnight, given the volatility in global markets.

Summary and Conclusion

For 28th October 2024, key zones to watch are **24,276** on the upside and **23,998** on the downside. A breakout or breakdown from these levels could determine the day’s trend. Remember that the market may consolidate before choosing a direction, and it’s wise to wait for confirmation at these levels before entering trades.

Disclaimer: I am not a SEBI-registered analyst. This analysis is for educational purposes only. Always consult a financial advisor before making any trading decisions.

**Previous Day Recap**: Nifty experienced volatility yesterday, with a downward bias. Major support levels held around the **24080-24100** mark, indicating potential buying interest. However, resistance levels remain active, with **24,276** serving as a pivot zone. For today, trends are illustrated as follows:

- **Yellow** trend signifies a sideways market.

- **Green** trend indicates a bullish outlook.

- **Red** trend reflects a bearish sentiment.

Opening Scenarios for 28-Oct-2024

- Gap Up Opening (+100 points or more)

If Nifty opens with a gap up of 100+ points:

- Immediate resistance can be seen at **24,276**. A break above this may push the index towards the **24,392** level, which acts as the Last Resistance for Intraday.

- Consider booking profits if Nifty approaches the **24,531 - 24,589** zone (highlighted as Profit Booking Zone) as sellers might attempt to re-enter.

- If resistance at **24,276** holds and shows weakness, expect a potential pullback towards **24,143** for support.

- Flat Opening

In case of a flat opening near **24,210**:

- Initial support is at **24,191**, followed by a stronger base around **24,143**.

- If Nifty moves up from these levels, the next resistance can be expected at **24,276**. Watch closely for consolidation in this area, as a breakout could trigger a rally toward **24,392**.

- A failure to hold support at **24,143** could signal a downtrend, targeting **23,998** and below. - Gap Down Opening (-100 points or more)

For a gap down opening of -100 points or more:

- Initial support will likely emerge around **23,998**. If this holds, a bounce is expected toward **24,143**.

- If **23,998** breaks, the next significant support level sits at **23,740**, marked as the Possible Bottom Zone for Current Trend. This is a critical level; a breach could lead to a deeper correction towards **23,590**.

- A recovery from this lower level may indicate reversal buying, ideal for intraday long positions up to **24,086**.

Risk Management Tips for Options Trading:

- Always define your stop-loss levels based on the nearest support/resistance zones to manage risk effectively.

- Avoid aggressive positions in high-volatility scenarios like gap openings. Start small and scale up if the trend confirms.

- Be cautious of time decay when trading options, especially if the price is near critical support or resistance zones.

- Consider hedging positions if holding overnight, given the volatility in global markets.

Summary and Conclusion

For 28th October 2024, key zones to watch are **24,276** on the upside and **23,998** on the downside. A breakout or breakdown from these levels could determine the day’s trend. Remember that the market may consolidate before choosing a direction, and it’s wise to wait for confirmation at these levels before entering trades.

Disclaimer: I am not a SEBI-registered analyst. This analysis is for educational purposes only. Always consult a financial advisor before making any trading decisions.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.