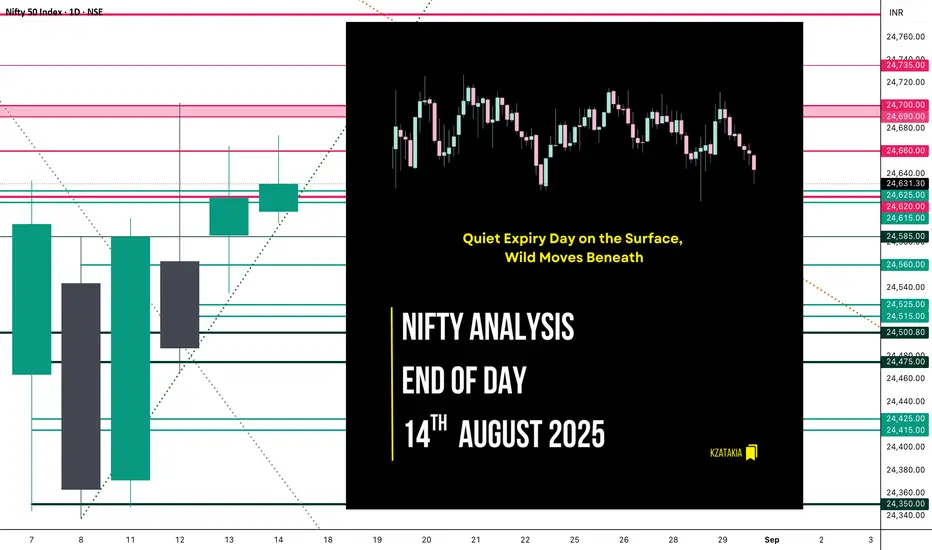

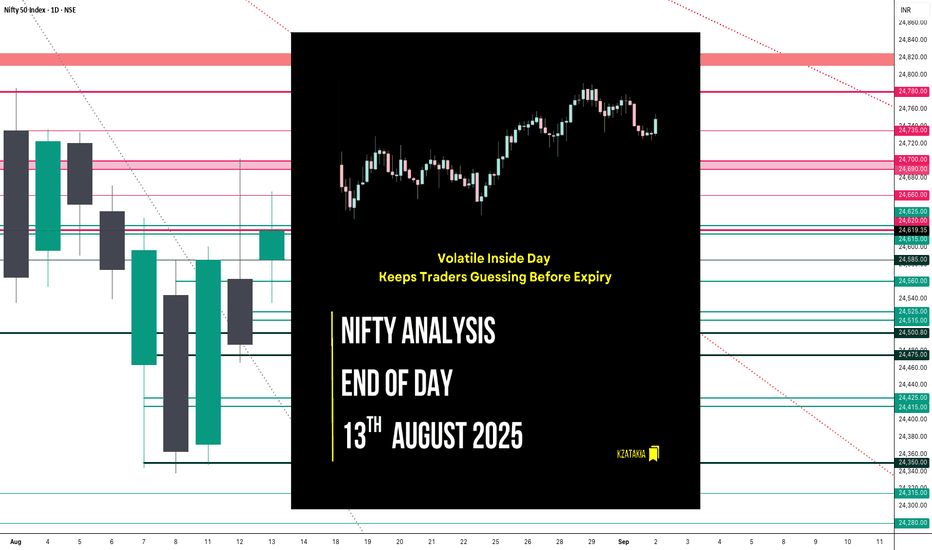

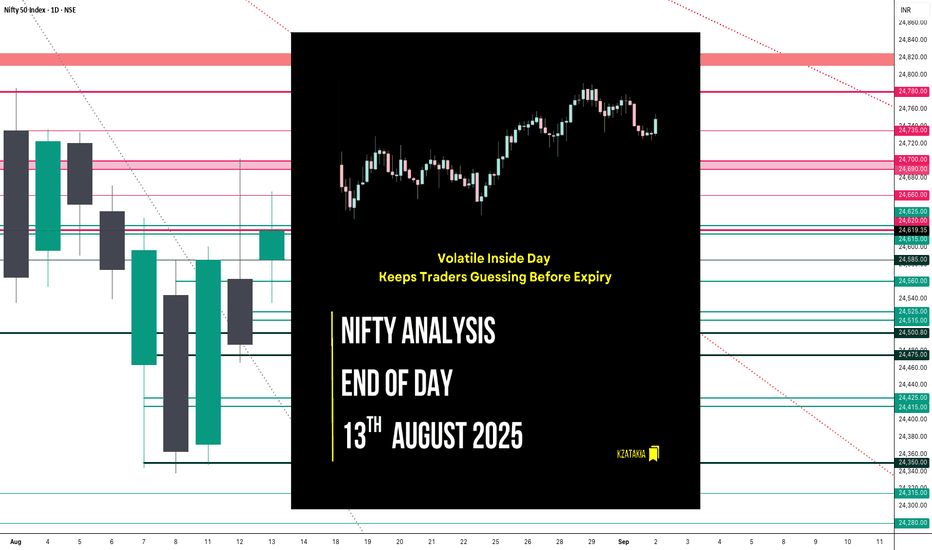

🟢 Nifty Analysis EOD – August 14, 2025 – Thursday 🔴

Quiet Expiry Day on the Surface, Wild Moves Beneath

🗞 Nifty Summary

Nifty opened neutral, and within the first 1 minute carved a 60-point range — a range that turned out to be almost the entire day’s action. For the rest of the session, the index stayed locked inside this band, repeatedly attempting to break above the PDH + R1 zone, but each time failing to sustain. Similarly, the lower boundary provided reliable support, keeping Nifty trapped.

While the overall weekly expiry felt silent in terms of range, the price action inside the band was anything but quiet — wild intraday swings offered ample opportunities for scalpers and quick traders. Structurally, today’s range stayed inside the previous day’s range, aside from a few points of false breakout shadows.

The game plan for the next session remains the same as discussed yesterday — we’re still waiting for a decisive breakout from this coiling structure.

Refere the game plan here:

🛡 5 Min Intraday Chart with Levels

📉 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Candle Data:

Structure Breakdown:

Green candle (Close > Open)

Body size: 24.05 points → very small → low momentum

Upper wick: 42.35 points

Lower wick: 10.35 points

Interpretation:

Market opened near yesterday’s close, tried pushing higher but failed to hold gains.

Small green body signals sideways indecision; buyers still defended the 24,600 zone.

Longer upper wick vs lower wick → selling pressure near highs.

Candle Type:

Small-bodied Spinning Top / Doji-like candle → indecision, no clear trend control.

📊 Short-Term View

Consolidation persists in 24,600–24,650 zone.

Break above 24,675 = bullish strength.

Break below 24,595 = bearish momentum toward 24,535–24,460.

Range & Bias:

Support: 24,595 – 24,535

Resistance: 24,675 – 24,700

Bias: Neutral-to-mildly bullish above 24,600

🛡 5 Min Intraday Chart

⚔ Gladiator Strategy Update

ATR: 199.36

IB Range: 68.25 → Medium

Market Structure: Balanced

Trade Highlight: No Trade Triggered

📌 Support & Resistance Levels

Resistance Zones:

Support Zones:

💡 Final Thoughts

"The tighter the coil, the sharper the breakout."

Nifty is compressing hard — a breakout is inevitable, and expiry’s quietness might just be the calm before a directional move.

✏️ Disclaimer

This is a personal market observation, not financial advice.

Quiet Expiry Day on the Surface, Wild Moves Beneath

🗞 Nifty Summary

Nifty opened neutral, and within the first 1 minute carved a 60-point range — a range that turned out to be almost the entire day’s action. For the rest of the session, the index stayed locked inside this band, repeatedly attempting to break above the PDH + R1 zone, but each time failing to sustain. Similarly, the lower boundary provided reliable support, keeping Nifty trapped.

While the overall weekly expiry felt silent in terms of range, the price action inside the band was anything but quiet — wild intraday swings offered ample opportunities for scalpers and quick traders. Structurally, today’s range stayed inside the previous day’s range, aside from a few points of false breakout shadows.

The game plan for the next session remains the same as discussed yesterday — we’re still waiting for a decisive breakout from this coiling structure.

Refere the game plan here:

🛡 5 Min Intraday Chart with Levels

📉 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Candle Data:

- Open: 24,607.25

- High: 24,673.65

- Low: 24,596.90

- Close: 24,631.30

- Change: +11.95 (+0.05%)

Structure Breakdown:

Green candle (Close > Open)

Body size: 24.05 points → very small → low momentum

Upper wick: 42.35 points

Lower wick: 10.35 points

Interpretation:

Market opened near yesterday’s close, tried pushing higher but failed to hold gains.

Small green body signals sideways indecision; buyers still defended the 24,600 zone.

Longer upper wick vs lower wick → selling pressure near highs.

Candle Type:

Small-bodied Spinning Top / Doji-like candle → indecision, no clear trend control.

📊 Short-Term View

Consolidation persists in 24,600–24,650 zone.

Break above 24,675 = bullish strength.

Break below 24,595 = bearish momentum toward 24,535–24,460.

Range & Bias:

Support: 24,595 – 24,535

Resistance: 24,675 – 24,700

Bias: Neutral-to-mildly bullish above 24,600

🛡 5 Min Intraday Chart

⚔ Gladiator Strategy Update

ATR: 199.36

IB Range: 68.25 → Medium

Market Structure: Balanced

Trade Highlight: No Trade Triggered

📌 Support & Resistance Levels

Resistance Zones:

- 24,660

- 24,690 ~ 24,700

- 24,735

- 24,780

Support Zones:

- 24,585

- 24,560

- 24,525 ~ 24,515

- 24,500

- 24,475

💡 Final Thoughts

"The tighter the coil, the sharper the breakout."

Nifty is compressing hard — a breakout is inevitable, and expiry’s quietness might just be the calm before a directional move.

✏️ Disclaimer

This is a personal market observation, not financial advice.

Read my blogs here:

substack.com/@kzatakia

Follow me on Telegram:

t.me/swingtraderhub

Follow me on X:

x.com/kzatakia

substack.com/@kzatakia

Follow me on Telegram:

t.me/swingtraderhub

Follow me on X:

x.com/kzatakia

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Read my blogs here:

substack.com/@kzatakia

Follow me on Telegram:

t.me/swingtraderhub

Follow me on X:

x.com/kzatakia

substack.com/@kzatakia

Follow me on Telegram:

t.me/swingtraderhub

Follow me on X:

x.com/kzatakia

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.