🟢 Nifty Analysis EOD – June 16, 2025 – Monday 🔴

📈 Expected Follow-Through Plays Out – Bulls Eye 25K Hurdle Next

Nifty opened flat-to-positive at 24,737, briefly dipped to the day’s low of 24,703.60, and then reversed smartly to touch an intraday high of 24,967.10 by 13:40. After that, the index spent the rest of the day consolidating in a narrow 40-point band and closed at 24,940.95 intraday (adjusted close: 24,946.50), delivering a solid +227.90 point gain.

As anticipated, the 24,768–24,800 support zone provided the launchpad for further upside, confirming the bullish follow-up from Friday's recovery. The rally tested 24,967, just shy of the crucial resistance at 24,972, which remains a key watch for the next session.

🔍 However, going forward, the bulls face major challenges around 25,000–25,080. This zone has acted as a hurdle in the past and could either stall the rally or serve as a breakout trigger. Watch price behavior carefully around these levels to assess conviction.

🛡 5 Min Chart with Levels

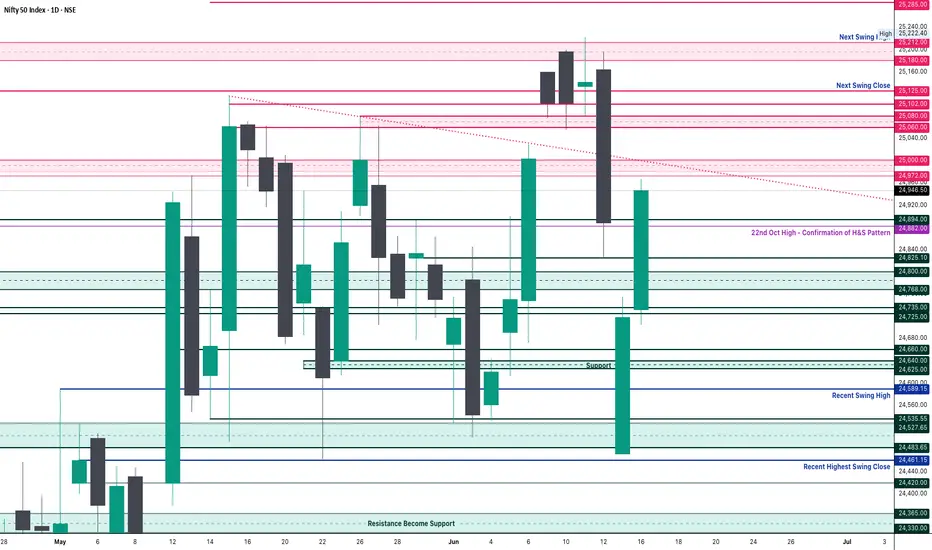

🕯 Daily Time Frame Chart

🕯 Daily Candle Breakdown

Open: 24,732.35

High: 24,967.10

Low: 24,703.60

Close: 24,946.50

Change: +227.90 (+0.92%)

📊 Candle Structure Breakdown

Real Body: 214.15 pts → 🟢 Strong Green Candle

Upper Wick: 20.60 pts

Lower Wick: 28.75 pts

🔍 Interpretation

Opened near day’s low, closed near day’s high — classic bullish sentiment.

Small wicks show controlled buying with minimal resistance and shakeouts.

Reinforces the bulls’ momentum after Friday’s OL recovery candle.

🔦 Candle Type

💚 Bullish Marubozu–type / Bullish Continuation Candle– Often found during the middle leg of a bullish swing, signaling strong trend momentum.

📌 Key Insight

Today's price action confirmed continuation of the recovery.

Close above 24,950–25,000 in the next session could ignite fresh upside.

Rejection around 25,060–25,080 would indicate caution — stay nimble.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 268.49

IB Range: 114.05 → Medium IB

Market Structure: ⚖️ Unbalanced

Trades:

✅ 10:20 AM – Long Triggered → Target Achieved, Trailing SL Hit (RR: 1:3.28)

📌 Support & Resistance Zones

Resistance Levels

Support Levels

💭 Final Thoughts

The market played exactly as mapped — now it’s about decision time near 25K. Will the bulls charge ahead or pause? Either way, the structure favors short-term bullishness — but profit booking pressure near resistance must be expected.

🧠 “Momentum is a gift – but without volume and conviction, it fades at resistance.”

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

📈 Expected Follow-Through Plays Out – Bulls Eye 25K Hurdle Next

Nifty opened flat-to-positive at 24,737, briefly dipped to the day’s low of 24,703.60, and then reversed smartly to touch an intraday high of 24,967.10 by 13:40. After that, the index spent the rest of the day consolidating in a narrow 40-point band and closed at 24,940.95 intraday (adjusted close: 24,946.50), delivering a solid +227.90 point gain.

As anticipated, the 24,768–24,800 support zone provided the launchpad for further upside, confirming the bullish follow-up from Friday's recovery. The rally tested 24,967, just shy of the crucial resistance at 24,972, which remains a key watch for the next session.

🔍 However, going forward, the bulls face major challenges around 25,000–25,080. This zone has acted as a hurdle in the past and could either stall the rally or serve as a breakout trigger. Watch price behavior carefully around these levels to assess conviction.

🛡 5 Min Chart with Levels

🕯 Daily Time Frame Chart

🕯 Daily Candle Breakdown

Open: 24,732.35

High: 24,967.10

Low: 24,703.60

Close: 24,946.50

Change: +227.90 (+0.92%)

📊 Candle Structure Breakdown

Real Body: 214.15 pts → 🟢 Strong Green Candle

Upper Wick: 20.60 pts

Lower Wick: 28.75 pts

🔍 Interpretation

Opened near day’s low, closed near day’s high — classic bullish sentiment.

Small wicks show controlled buying with minimal resistance and shakeouts.

Reinforces the bulls’ momentum after Friday’s OL recovery candle.

🔦 Candle Type

💚 Bullish Marubozu–type / Bullish Continuation Candle– Often found during the middle leg of a bullish swing, signaling strong trend momentum.

📌 Key Insight

Today's price action confirmed continuation of the recovery.

Close above 24,950–25,000 in the next session could ignite fresh upside.

Rejection around 25,060–25,080 would indicate caution — stay nimble.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 268.49

IB Range: 114.05 → Medium IB

Market Structure: ⚖️ Unbalanced

Trades:

✅ 10:20 AM – Long Triggered → Target Achieved, Trailing SL Hit (RR: 1:3.28)

📌 Support & Resistance Zones

Resistance Levels

- 24,972 ~ 25,000

- 25,060 ~ 25,080

- 25,102 ~ 25,125

Support Levels

- 24,894 ~ 24,882

- 24,825 ~ 24,847

- 24,725 ~ 24,735

- 24,660

💭 Final Thoughts

The market played exactly as mapped — now it’s about decision time near 25K. Will the bulls charge ahead or pause? Either way, the structure favors short-term bullishness — but profit booking pressure near resistance must be expected.

🧠 “Momentum is a gift – but without volume and conviction, it fades at resistance.”

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Read my blogs here:

substack.com/@kzatakia

Follow me on Telegram:

t.me/swingtraderhub

Follow me on X:

x.com/kzatakia

substack.com/@kzatakia

Follow me on Telegram:

t.me/swingtraderhub

Follow me on X:

x.com/kzatakia

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Read my blogs here:

substack.com/@kzatakia

Follow me on Telegram:

t.me/swingtraderhub

Follow me on X:

x.com/kzatakia

substack.com/@kzatakia

Follow me on Telegram:

t.me/swingtraderhub

Follow me on X:

x.com/kzatakia

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.