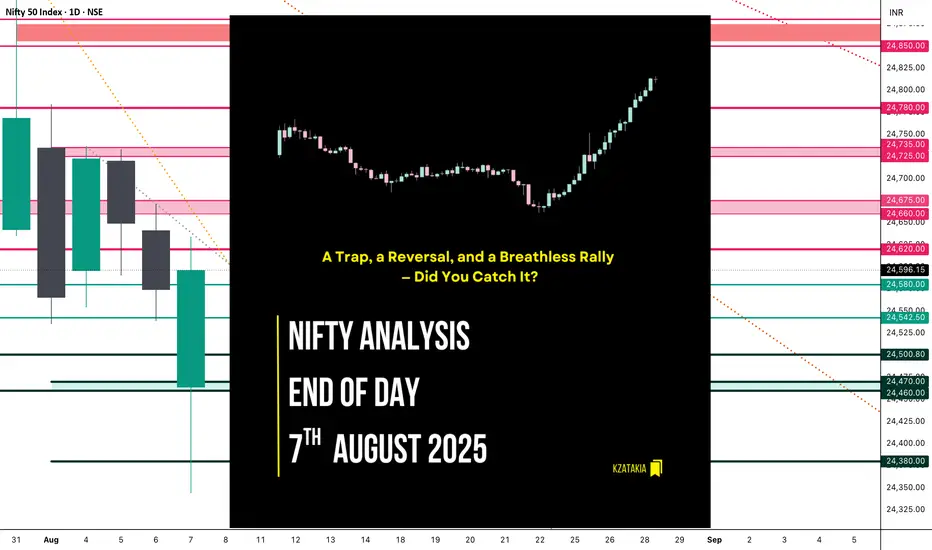

🟢 Nifty Analysis EOD – August 7, 2025 – Thursday 🔴

A Trap, a Reversal, and a Breathless Rally — Did You Catch It?

🗞 Nifty Summary

Today was expected to be volatile, but few were prepared for how wildly Nifty behaved.

After a gap-down of 110 points on the back of negative global cues, Nifty immediately started filling the gap and reached the Previous Day Low (PDL). However, strong rejection at PDL sent prices tumbling — slicing below the Open, IB Low, and even the Current Day Low, marking a sharp low at 24,387.

Then came the bear trap.

A brief breakdown to 24,344.15 looked like a breakdown, but instead triggered a sharp liquidity grab, launching a vertical move upward. From that bottom, Nifty surged in a breathtaking rally — not a single 5-min candle broke its previous candle’s low, signaling relentless buying. Almost every resistance zone — Swing High, VWAP, PDL/S1, CPR, Weekly Low — got taken out in one single breath.

Did you ride it?

Honestly — I didn’t. I was frozen watching this dramatic reversal unfold.

Still, today’s super recovery puts the index back within its known range. Now, bulls need a close above 24,660–24,675 to confirm momentum.

📉 Intraday 5 Min Chart Overview

🧭 Intraday Price Action Flow

📉 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

🔍 Candle Structure:

Real Body: Green → +131.95 pts

Upper Wick: 38.05 pts

Lower Wick: 120.05 pts

🧠 Interpretation:

Strong rejection from intraday lows near 24,344

Long lower wick shows dip buying strength

Closed near the highs = bulls dominated the end

Still within larger range → needs breakout above 24,675 for follow-through

🔥 Candle Type:

A bullish recovery candle, hammer-like, but within a sideways structure — shows aggressive buying near important demand zone (24,340–24,380).

📈 Updated Short-Term View – 7th August 2025

Support Zone: 24,340 – 24,380

Resistance Zone: 24,620 – 24,675

Bias: Neutral with a bullish tilt, unless 24,340 breaks decisively.

🎯 Trading Insight

A close above 24,660–24,675 may lead to further upside — possibly testing 24,735–24,780

Failure to hold above 24,460 will shift bias back to bearish

🛡 5 Min Intraday Chart

🥷 Gladiator Strategy Update

ATR: 205.09

IB Range: 82.85 → Medium

Market Structure: ImBalanced

⚔️ Trade Summary:

🕙 10:25 AM – Short Entry → Trail SL Hit (R:R = 1:1.8)

🧱 Support & Resistance Levels

🔼 Resistance Zones:

🔽 Support Zones:

💬 Final Thoughts

"Markets reward patience and punish rigidity."

Today was a masterclass in trap-reversal-breakout structure. While many were either trapped or missed the move, this type of price action reminds us — be ready, but never rigid.

Now all eyes on 24,675 — can bulls push above it and sustain?

✏️ Disclaimer:

This analysis reflects personal views and is not trading advice. Please consult your financial advisor before making decisions.

A Trap, a Reversal, and a Breathless Rally — Did You Catch It?

🗞 Nifty Summary

Today was expected to be volatile, but few were prepared for how wildly Nifty behaved.

After a gap-down of 110 points on the back of negative global cues, Nifty immediately started filling the gap and reached the Previous Day Low (PDL). However, strong rejection at PDL sent prices tumbling — slicing below the Open, IB Low, and even the Current Day Low, marking a sharp low at 24,387.

Then came the bear trap.

A brief breakdown to 24,344.15 looked like a breakdown, but instead triggered a sharp liquidity grab, launching a vertical move upward. From that bottom, Nifty surged in a breathtaking rally — not a single 5-min candle broke its previous candle’s low, signaling relentless buying. Almost every resistance zone — Swing High, VWAP, PDL/S1, CPR, Weekly Low — got taken out in one single breath.

Did you ride it?

Honestly — I didn’t. I was frozen watching this dramatic reversal unfold.

Still, today’s super recovery puts the index back within its known range. Now, bulls need a close above 24,660–24,675 to confirm momentum.

📉 Intraday 5 Min Chart Overview

🧭 Intraday Price Action Flow

- 9:15 AM: Opens 110 points down at 24,467.10

- 9:15–10:30 AM: Recovers swiftly to PDL, but fails there.

- 10:25 AM – 11:05 PM: Sharp fall — breaches CDL & IB Low → makes new day low at 24,387

- 1:20 PM Onwards: Attempts consolidation; false breakdown at 24,344.15

- 2:00 PM – 3:30 PM: Monster rally → No candle breaks prior low; bulls dominate to close at 24,626.65

📉 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

- Open: 24,464.20

- High: 24,634.20

- Low: 24,344.15

- Close: 24,596.15

- Change: +21.95 (+0.09%)

🔍 Candle Structure:

Real Body: Green → +131.95 pts

Upper Wick: 38.05 pts

Lower Wick: 120.05 pts

🧠 Interpretation:

Strong rejection from intraday lows near 24,344

Long lower wick shows dip buying strength

Closed near the highs = bulls dominated the end

Still within larger range → needs breakout above 24,675 for follow-through

🔥 Candle Type:

A bullish recovery candle, hammer-like, but within a sideways structure — shows aggressive buying near important demand zone (24,340–24,380).

📈 Updated Short-Term View – 7th August 2025

Support Zone: 24,340 – 24,380

Resistance Zone: 24,620 – 24,675

Bias: Neutral with a bullish tilt, unless 24,340 breaks decisively.

🎯 Trading Insight

A close above 24,660–24,675 may lead to further upside — possibly testing 24,735–24,780

Failure to hold above 24,460 will shift bias back to bearish

🛡 5 Min Intraday Chart

🥷 Gladiator Strategy Update

ATR: 205.09

IB Range: 82.85 → Medium

Market Structure: ImBalanced

⚔️ Trade Summary:

🕙 10:25 AM – Short Entry → Trail SL Hit (R:R = 1:1.8)

🧱 Support & Resistance Levels

🔼 Resistance Zones:

- 24,620

- 24,660 ~ 24,675

- 24,725 ~ 24,735

- 24,780 ~ 24,795

- 24,860 ~ 24,880

🔽 Support Zones:

- 24,542 ~ 24,535

- 24,500

- 24,470 ~ 24,460

- 24,380 ~ 24,344

💬 Final Thoughts

"Markets reward patience and punish rigidity."

Today was a masterclass in trap-reversal-breakout structure. While many were either trapped or missed the move, this type of price action reminds us — be ready, but never rigid.

Now all eyes on 24,675 — can bulls push above it and sustain?

✏️ Disclaimer:

This analysis reflects personal views and is not trading advice. Please consult your financial advisor before making decisions.

Read my blogs here:

substack.com/@kzatakia

Follow me on Telegram:

t.me/swingtraderhub

Follow me on X:

x.com/kzatakia

substack.com/@kzatakia

Follow me on Telegram:

t.me/swingtraderhub

Follow me on X:

x.com/kzatakia

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Read my blogs here:

substack.com/@kzatakia

Follow me on Telegram:

t.me/swingtraderhub

Follow me on X:

x.com/kzatakia

substack.com/@kzatakia

Follow me on Telegram:

t.me/swingtraderhub

Follow me on X:

x.com/kzatakia

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.