🟢 Nifty Analysis EOD – July 21, 2025 – Monday 🔴

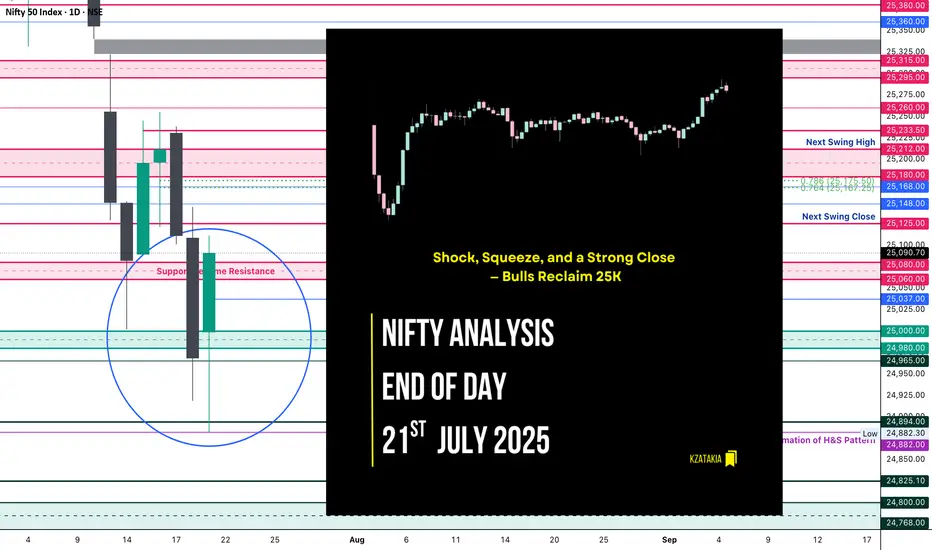

“Shock, Squeeze, and a Strong Close — Bulls Reclaim 25K”

Today’s move was nothing short of shocking. In the first 45 minutes, Nifty plunged more than 150 points, breaking through key levels and touching 24,882. But what followed was a V-shaped recovery that caught both Friday’s shorts and those who shorted below PDC/PDL completely off guard.

The index powered up to mark a day high of 25,080, and sustained above CPR and VWAP throughout most of the session. A final push came around 2:55 PM, breaking the intraday trendline and CDH, registering a fresh high before closing near the top at 25,090.70.

✅ Bulls not only held 25K — they dominated the battlefield all day, recovering almost everything lost during Friday’s drop.

🕯 5 Min Time Frame Chart with Intraday Levels

🕯 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 24,999.00

High: 25,111.40

Low: 24,882.30

Close: 25,090.70

Change: +122.30 (+0.49%)

📊 Candle Structure Breakdown

Real Body: 91.70 points → strong bullish body

Upper Wick: 20.70 points → slight hesitation near highs

Lower Wick: 116.70 points → deep intraday buying from the lows

🔍 Interpretation

Mildly negative open, followed by a sharp 150-point fall

Buyers stepped in strongly near 24,880, triggering a sharp reversal

V-shape recovery sustained above CPR & VWAP, closing near high

Close is not just above open — it’s above Friday’s close and 25K mark

🕯 Candle Type

Hammer-like Bullish Reversal Candle — Long lower wick with green body, signaling strong dip buying and possible short-term trend reversal

📌 Key Insight

Strong defense at 24,880–24,900 created the base for reversal

Close above 25,090 shifts near-term bias in favor of bulls

25,110–25,140 is the next resistance to watch

As long as we stay above 24,900, buyers hold the edge

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 186.31

IB Range: 166.8 → Wide IB

Market Structure: 🟡 Balanced

📉 Trades Triggered:

10:09 AM – Long Trade → ❌ SL Hit

📌 Support & Resistance Levels

Resistance Levels:

Support Levels:

💭 Final Thoughts

🧠 “Volatility doesn’t confuse the market — it reveals who’s in control.”Today’s V-shaped reversal erased all doubts from Friday’s fall. Buyers didn’t just defend — they counterattacked and reclaimed 25K with authority.Follow-through above 25,125 on Monday could confirm trend resumption.

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

“Shock, Squeeze, and a Strong Close — Bulls Reclaim 25K”

Today’s move was nothing short of shocking. In the first 45 minutes, Nifty plunged more than 150 points, breaking through key levels and touching 24,882. But what followed was a V-shaped recovery that caught both Friday’s shorts and those who shorted below PDC/PDL completely off guard.

The index powered up to mark a day high of 25,080, and sustained above CPR and VWAP throughout most of the session. A final push came around 2:55 PM, breaking the intraday trendline and CDH, registering a fresh high before closing near the top at 25,090.70.

✅ Bulls not only held 25K — they dominated the battlefield all day, recovering almost everything lost during Friday’s drop.

🕯 5 Min Time Frame Chart with Intraday Levels

🕯 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 24,999.00

High: 25,111.40

Low: 24,882.30

Close: 25,090.70

Change: +122.30 (+0.49%)

📊 Candle Structure Breakdown

Real Body: 91.70 points → strong bullish body

Upper Wick: 20.70 points → slight hesitation near highs

Lower Wick: 116.70 points → deep intraday buying from the lows

🔍 Interpretation

Mildly negative open, followed by a sharp 150-point fall

Buyers stepped in strongly near 24,880, triggering a sharp reversal

V-shape recovery sustained above CPR & VWAP, closing near high

Close is not just above open — it’s above Friday’s close and 25K mark

🕯 Candle Type

Hammer-like Bullish Reversal Candle — Long lower wick with green body, signaling strong dip buying and possible short-term trend reversal

📌 Key Insight

Strong defense at 24,880–24,900 created the base for reversal

Close above 25,090 shifts near-term bias in favor of bulls

25,110–25,140 is the next resistance to watch

As long as we stay above 24,900, buyers hold the edge

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 186.31

IB Range: 166.8 → Wide IB

Market Structure: 🟡 Balanced

📉 Trades Triggered:

10:09 AM – Long Trade → ❌ SL Hit

📌 Support & Resistance Levels

Resistance Levels:

- 25,080 ~ 25,060

- 25,125

- 25,168

- 25,180 ~ 25,212

Support Levels:

- 25,037

- 25,000 ~ 24,980

- 24,965

- 24,894 ~ 24,882

- 24,825

- 24,800 ~ 24,768

💭 Final Thoughts

🧠 “Volatility doesn’t confuse the market — it reveals who’s in control.”Today’s V-shaped reversal erased all doubts from Friday’s fall. Buyers didn’t just defend — they counterattacked and reclaimed 25K with authority.Follow-through above 25,125 on Monday could confirm trend resumption.

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Read my blogs here:

substack.com/@kzatakia

Follow me on Telegram:

t.me/swingtraderhub

Follow me on X:

x.com/kzatakia

substack.com/@kzatakia

Follow me on Telegram:

t.me/swingtraderhub

Follow me on X:

x.com/kzatakia

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Read my blogs here:

substack.com/@kzatakia

Follow me on Telegram:

t.me/swingtraderhub

Follow me on X:

x.com/kzatakia

substack.com/@kzatakia

Follow me on Telegram:

t.me/swingtraderhub

Follow me on X:

x.com/kzatakia

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.