Intro:

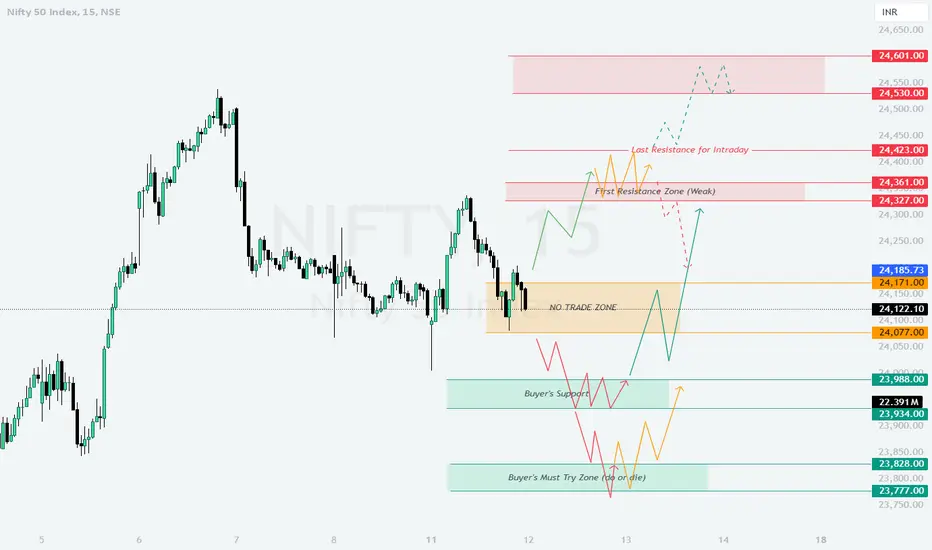

In the previous session, Nifty traded within a defined range, testing key levels without strong directional movement. We observed a sideways trend (yellow) near 24,122 - 24,171, while the bullish trend (green) highlighted potential resistance points, and the bearish trend (red) indicated key support zones. Today's session will focus on reactions near these levels to identify any possible breakouts or breakdowns.

Opening Scenarios:

Risk Management Tips for Options Trading:

Use appropriate stop-loss levels (24,100, 24,327, 24,423) to safeguard against unexpected moves.

Limit position sizes to manage potential risks, particularly during volatile conditions.

Consider using options spreads, like debit or credit spreads, to cap potential losses while still allowing for profit.

Avoid chasing trades in the No Trade Zone; wait for confirmed breakouts or breakdowns to enter options positions.

Summary and Conclusion:

The key levels to watch for 12-Nov-2024 are 24,171 (No Trade Zone upper boundary), 24,361 (First Resistance Zone), and 23,988 (Buyer’s Support). Observing price action near these levels can provide trading opportunities. Manage risks carefully, especially in options, to navigate through volatile market conditions effectively.

Disclaimer:

I am not a SEBI-registered analyst. This trading plan is based on technical analysis and personal insights. Traders should conduct their own analysis or consult a certified financial advisor before making any trading decisions.

In the previous session, Nifty traded within a defined range, testing key levels without strong directional movement. We observed a sideways trend (yellow) near 24,122 - 24,171, while the bullish trend (green) highlighted potential resistance points, and the bearish trend (red) indicated key support zones. Today's session will focus on reactions near these levels to identify any possible breakouts or breakdowns.

Opening Scenarios:

- Gap Up Opening (100+ Points Above)

If Nifty opens above the 24,171 level, it may initially face resistance in the First Resistance Zone at 24,327 - 24,361. A breakout above this weak resistance level could open the path to the Last Resistance for Intraday at 24,423. Further strength above 24,423 could lead to a move toward the Profit Booking Zone at 24,530 - 24,601.

Traders may consider long positions if the price sustains above 24,327, aiming for targets at the higher resistance zones, but they should exercise caution if Nifty struggles to hold above 24,361.

Conservative traders might look for pullbacks near support levels before entering long positions. - Flat Opening

In the event of a flat opening around 24,122, the No Trade Zone 24,100 - 24,171 should be monitored closely. Price movement within this zone could indicate consolidation.

A breakout above 24,171 could signal bullish intent, leading to targets at 24,327 - 24,361. Conversely, a breakdown below 24,100 might drive the index toward the Buyer’s Support at 23,988.

Flat openings generally suggest patience, so traders may wait for a breakout from the No Trade Zone before initiating positions. - Gap Down Opening (100+ Points Below)

If Nifty opens below 24,100, it may find support in the Buyer’s Support Zone around 23,988. If this support holds, a recovery move back towards 24,100 is likely. A failure to hold above 23,988 could bring Nifty down to the Buyer’s Must Try Zone (Do or Die) at 23,828 - 23,777.

Traders might look for shorting opportunities if Nifty breaks below 23,988, with a target near the Buyer’s Must Try Zone. Alternatively, a bounce from the Buyer’s Support level could provide a chance for long trades towards 24,100.

In gap-down scenarios, trading with a cautious mindset is crucial, and it’s often wise to wait for clear price action signals before entering trades.

Risk Management Tips for Options Trading:

Use appropriate stop-loss levels (24,100, 24,327, 24,423) to safeguard against unexpected moves.

Limit position sizes to manage potential risks, particularly during volatile conditions.

Consider using options spreads, like debit or credit spreads, to cap potential losses while still allowing for profit.

Avoid chasing trades in the No Trade Zone; wait for confirmed breakouts or breakdowns to enter options positions.

Summary and Conclusion:

The key levels to watch for 12-Nov-2024 are 24,171 (No Trade Zone upper boundary), 24,361 (First Resistance Zone), and 23,988 (Buyer’s Support). Observing price action near these levels can provide trading opportunities. Manage risks carefully, especially in options, to navigate through volatile market conditions effectively.

Disclaimer:

I am not a SEBI-registered analyst. This trading plan is based on technical analysis and personal insights. Traders should conduct their own analysis or consult a certified financial advisor before making any trading decisions.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.