Everything we discussed in yesterday’s commentary played out beautifully:

1. We noted that sellers were stronger than buyers — and the market opened gap down, just as expected.

2. I also highlighted that the Intraday chart looked bullish — and yes, we saw a solid bounce intraday.

3. Later in the day, the market reversed again — exactly how the red flag on the daily chart warned us.

This kind of price behavior confirms one thing: the market is flowing in sync with our planning.

And when that happens, it becomes the perfect ground for my trading style. I’ll continue focusing on my momentum setups with full confidence.

Now let’s come back to the market:

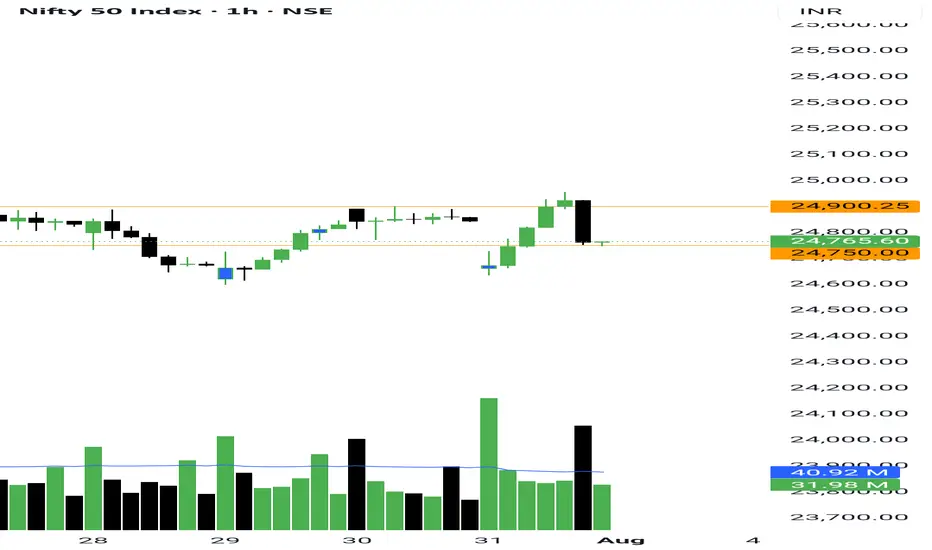

NIFTY has shown strong resilience. Despite all the noise around the Trump news, it managed to close above the key support of 24700 — a sign of strength.

NIFTY has shown strong resilience. Despite all the noise around the Trump news, it managed to close above the key support of 24700 — a sign of strength.

Pivot has now shifted to 24786, and Pivot Percentile is just 0.07%.

This tells us that any sustained move above 24796 can unleash a sharp directional move.

Support remains firm at 24750.

More importantly, buyers have outnumbered sellers by 28 million — setting a strong tone as we step into August.

BANKNIFTY also looks primed.

BANKNIFTY also looks primed.

Pivot Percentile is at an ultra-tight 0.02%, and buyer volume leads by 29 million.

Support is placed at 55550, with resistance around 55976. A breakout here could kickstart a fresh trend.

Sector-wise, Construction and CNXREALTY are gaining traction.

CNXREALTY are gaining traction.

Oil & Energy is also showing promising signs.

Keep an eye on ASHOKLEY over the next few sessions — something’s brewing there.

ASHOKLEY over the next few sessions — something’s brewing there.

Today I traded just one setup — BELRISE .

BELRISE .

Booked a clean 2% intraday gain, though the stock went on to give over 5% after exit. Still, a green trade is a good trade.

That’s all for the day.

Take care and have a profitable tomorrow.

1. We noted that sellers were stronger than buyers — and the market opened gap down, just as expected.

2. I also highlighted that the Intraday chart looked bullish — and yes, we saw a solid bounce intraday.

3. Later in the day, the market reversed again — exactly how the red flag on the daily chart warned us.

This kind of price behavior confirms one thing: the market is flowing in sync with our planning.

And when that happens, it becomes the perfect ground for my trading style. I’ll continue focusing on my momentum setups with full confidence.

Now let’s come back to the market:

Pivot has now shifted to 24786, and Pivot Percentile is just 0.07%.

This tells us that any sustained move above 24796 can unleash a sharp directional move.

Support remains firm at 24750.

More importantly, buyers have outnumbered sellers by 28 million — setting a strong tone as we step into August.

Pivot Percentile is at an ultra-tight 0.02%, and buyer volume leads by 29 million.

Support is placed at 55550, with resistance around 55976. A breakout here could kickstart a fresh trend.

Sector-wise, Construction and

Oil & Energy is also showing promising signs.

Keep an eye on

Today I traded just one setup —

Booked a clean 2% intraday gain, though the stock went on to give over 5% after exit. Still, a green trade is a good trade.

That’s all for the day.

Take care and have a profitable tomorrow.

TrendX INC

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

TrendX INC

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.