🟢 Nifty Analysis EOD – June 17, 2025 – Tuesday 🔴

⚠️ Resistance Rejection at 25K – Pause or Warning Sign?

Yesterday’s note rightly anticipated today’s challenge near 25K — and that’s exactly how the session unfolded.

Nifty opened at 24,977.85, right inside the critical resistance zone of 24,972–25,000, and formed a near O=H (Open = High) structure. The index quickly lost ground, dropping 135 points within the first hour to mark a day low of 24,813.70, forming a medium-sized Initial Balance (IB) within a wide CPR — conditions known for range-bound or tricky days.

Throughout the session, Nifty hovered largely inside the CPR and IB, with a false breakdown attempt around 12:50 PM. Such setups (wide CPR + higher value + medium IB) often result in false moves or low-conviction sessions, and today was no exception.

By day’s end, Nifty closed at 24,853.40, logging a modest −93.10 point dip, forming what can be termed as a healthy pullback — but the real test remains.

If bulls want to take charge again, they must breach and close above 25,025. On the flip side, if 24,800–24,820 gives way, it could trigger a slide toward 24,725 and 24,660 in the coming sessions.

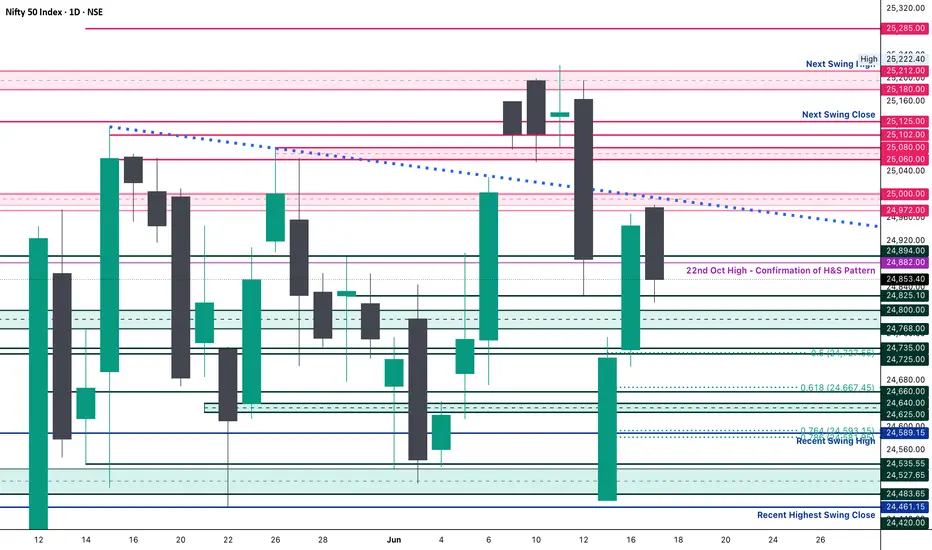

🕯 Daily Time Frame Chart

🕯 Daily Candle Breakdown

Open: 24,977.85

High: 24,982.05

Low: 24,813.70

Close: 24,853.40

Change: −93.10 (−0.37%)

📊 Candle Structure Breakdown

Real Body: 124.45 pts → 🔻 Red Candle

Upper Wick: 4.20 pts

Lower Wick: 39.70 pts

🔍 Interpretation

Opened near the day’s high but selling dominated soon after.

Small upper wick shows minimal buyer strength; recovery attempts were mild.

Lower wick indicates some support emerged at day’s low, but overall tone remained bearish.

🕯 Candle Type

🟥 Bearish Candle – strong real body, minor lower wick — reflects steady intraday selling, though not overly aggressive.

📌 Key Insight

Nifty has now rejected the 25K zone two days in a row, turning it into short-term resistance.

If 24,800 breaks, expect pressure to mount — next watch: 24,725 → 24,660.

Bulls need a close above 25,025 to regain command.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 258.48

IB Range: 131.60 → Medium IB

Market Structure: ⚖️ Balanced

Trades:🚫 No Trade Triggered by System

📌 Support & Resistance Zones

Resistance Levels

24,894 ~ 24,882

24,972 ~ 25,000

25,060 ~ 25,080

25,102 ~ 25,125

Support Levels

24,825 ~ 24,847

24,725 ~ 24,735

24,660

24,590

💭 Final Thoughts

Today’s session didn’t break anything major — but it also didn’t conquer anything new.Stuck between major support and resistance, the index is coiling for a move. Bulls have the burden of proof now.

🧠 “Markets don’t pause forever — compression leads to expansion. Be ready when it chooses its direction.”

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

⚠️ Resistance Rejection at 25K – Pause or Warning Sign?

Yesterday’s note rightly anticipated today’s challenge near 25K — and that’s exactly how the session unfolded.

Nifty opened at 24,977.85, right inside the critical resistance zone of 24,972–25,000, and formed a near O=H (Open = High) structure. The index quickly lost ground, dropping 135 points within the first hour to mark a day low of 24,813.70, forming a medium-sized Initial Balance (IB) within a wide CPR — conditions known for range-bound or tricky days.

Throughout the session, Nifty hovered largely inside the CPR and IB, with a false breakdown attempt around 12:50 PM. Such setups (wide CPR + higher value + medium IB) often result in false moves or low-conviction sessions, and today was no exception.

By day’s end, Nifty closed at 24,853.40, logging a modest −93.10 point dip, forming what can be termed as a healthy pullback — but the real test remains.

If bulls want to take charge again, they must breach and close above 25,025. On the flip side, if 24,800–24,820 gives way, it could trigger a slide toward 24,725 and 24,660 in the coming sessions.

🕯 Daily Time Frame Chart

🕯 Daily Candle Breakdown

Open: 24,977.85

High: 24,982.05

Low: 24,813.70

Close: 24,853.40

Change: −93.10 (−0.37%)

📊 Candle Structure Breakdown

Real Body: 124.45 pts → 🔻 Red Candle

Upper Wick: 4.20 pts

Lower Wick: 39.70 pts

🔍 Interpretation

Opened near the day’s high but selling dominated soon after.

Small upper wick shows minimal buyer strength; recovery attempts were mild.

Lower wick indicates some support emerged at day’s low, but overall tone remained bearish.

🕯 Candle Type

🟥 Bearish Candle – strong real body, minor lower wick — reflects steady intraday selling, though not overly aggressive.

📌 Key Insight

Nifty has now rejected the 25K zone two days in a row, turning it into short-term resistance.

If 24,800 breaks, expect pressure to mount — next watch: 24,725 → 24,660.

Bulls need a close above 25,025 to regain command.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 258.48

IB Range: 131.60 → Medium IB

Market Structure: ⚖️ Balanced

Trades:🚫 No Trade Triggered by System

📌 Support & Resistance Zones

Resistance Levels

24,894 ~ 24,882

24,972 ~ 25,000

25,060 ~ 25,080

25,102 ~ 25,125

Support Levels

24,825 ~ 24,847

24,725 ~ 24,735

24,660

24,590

💭 Final Thoughts

Today’s session didn’t break anything major — but it also didn’t conquer anything new.Stuck between major support and resistance, the index is coiling for a move. Bulls have the burden of proof now.

🧠 “Markets don’t pause forever — compression leads to expansion. Be ready when it chooses its direction.”

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Read my blogs here:

substack.com/@kzatakia

Follow me on Telegram:

t.me/swingtraderhub

Follow me on X:

x.com/kzatakia

substack.com/@kzatakia

Follow me on Telegram:

t.me/swingtraderhub

Follow me on X:

x.com/kzatakia

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Read my blogs here:

substack.com/@kzatakia

Follow me on Telegram:

t.me/swingtraderhub

Follow me on X:

x.com/kzatakia

substack.com/@kzatakia

Follow me on Telegram:

t.me/swingtraderhub

Follow me on X:

x.com/kzatakia

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.