Highlights of 2024:

a) Single digit return for Nifty in 2024. Nifty and Sensex rise 9% each.

b) Mid and Small Cap both rise 24% each.

c) Pharma and Real Estate both rise 40% each.

d) Trent, M&M and Bharti Airtel are the best performing Nifty stocks.

e) Asian Paints, Indusind Bank and Nestle are the worst performing Nifty stocks.

f) Dixon, BSE, OFSS and RVNL are the best performing Midcap stocks.

g) Vodafone Idea, AU SFB & Bandhan Bank are top Mid cap loosers.

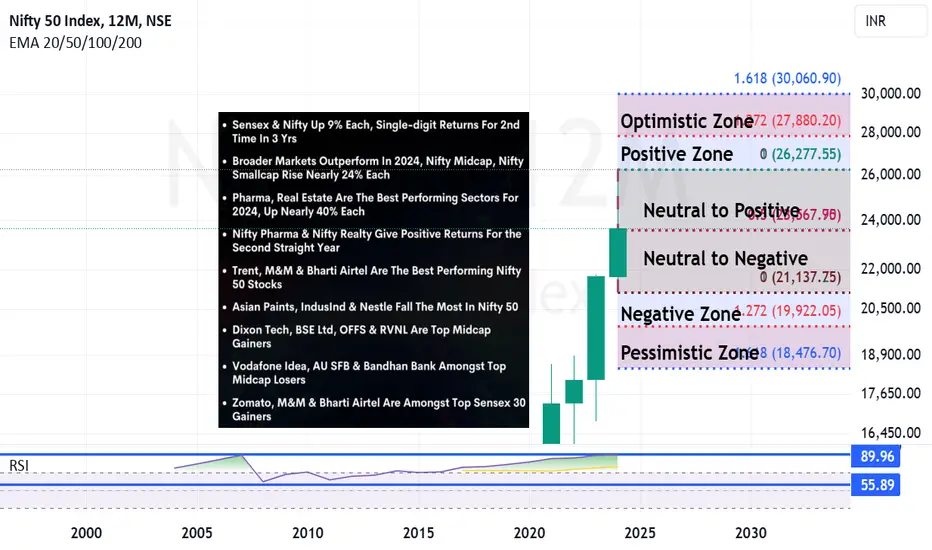

Zones Where Nifty can form base and give closing in 2025.

Pessimistic Zone: In case of very negative year and some global catastrophe we can find Nifty forming a bottom between 19922 to 18476. *(Looks very unlikely as of now)*

Negative Zone: In case we have a negative closing for the year we may find Nifty closing the year between 21137 to 19922. *(Possible but we might get a bottom here and then the index might move upwards)*

Neutral Zone: The combination of Neutral to negative and neutral to Positive zone ranges from 26277 to 21137. Nifty can consolidate in this range. *(These are the lows and high of 2024).*

Positive Zone: We can see Nifty making a new high above 26277 and 27880. After which we can see a dip and further consolidation. *(A probable scenario)*

Optimistic Zone: In case we have a fantastic year we might see Nifty making a major peak between 27880 and 30060. *(This is a very optimistic scenario and less likely but you can never say never)*

Above assumptions of Nifty in 2025 are made based on Fibonacci Retracement applied from top to bottom and Bottom to top on the 2024 candle.

Disclaimer: The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock. We do not guarantee any success in highly volatile market or otherwise. Stock market investment is subject to market risks which include global and regional risks. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message.

a) Single digit return for Nifty in 2024. Nifty and Sensex rise 9% each.

b) Mid and Small Cap both rise 24% each.

c) Pharma and Real Estate both rise 40% each.

d) Trent, M&M and Bharti Airtel are the best performing Nifty stocks.

e) Asian Paints, Indusind Bank and Nestle are the worst performing Nifty stocks.

f) Dixon, BSE, OFSS and RVNL are the best performing Midcap stocks.

g) Vodafone Idea, AU SFB & Bandhan Bank are top Mid cap loosers.

Zones Where Nifty can form base and give closing in 2025.

Pessimistic Zone: In case of very negative year and some global catastrophe we can find Nifty forming a bottom between 19922 to 18476. *(Looks very unlikely as of now)*

Negative Zone: In case we have a negative closing for the year we may find Nifty closing the year between 21137 to 19922. *(Possible but we might get a bottom here and then the index might move upwards)*

Neutral Zone: The combination of Neutral to negative and neutral to Positive zone ranges from 26277 to 21137. Nifty can consolidate in this range. *(These are the lows and high of 2024).*

Positive Zone: We can see Nifty making a new high above 26277 and 27880. After which we can see a dip and further consolidation. *(A probable scenario)*

Optimistic Zone: In case we have a fantastic year we might see Nifty making a major peak between 27880 and 30060. *(This is a very optimistic scenario and less likely but you can never say never)*

Above assumptions of Nifty in 2025 are made based on Fibonacci Retracement applied from top to bottom and Bottom to top on the 2024 candle.

Disclaimer: The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock. We do not guarantee any success in highly volatile market or otherwise. Stock market investment is subject to market risks which include global and regional risks. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.