I had posted my weekly view yesterday

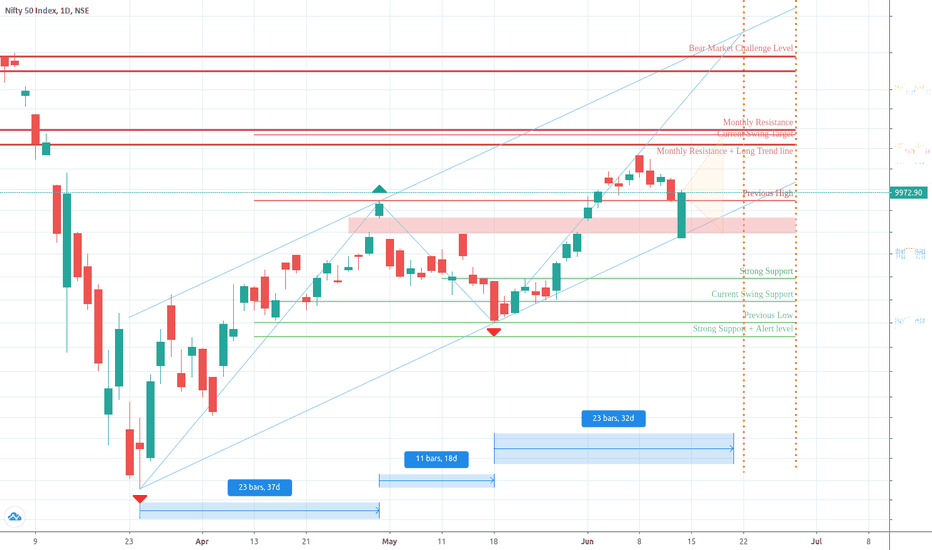

1. The touch of 9730 has happened today.

2. NIFTY has closed 1st time below 9824-9843, an important level which I watch closely.

My trades today

1. Once again simple trade worked. I sold 9800 CALL when opening range was broken out and then covered it on first sign of weakness.

2. As mentioned in weekly update, I have also created 9300/9400 and 9500/9600 Credit spreads.

Market Action today

1. NIFTY closed 1.6% lower. It was 6th day of bearish action.

2. BANK NIFTY fell 3.59%.

3. VIX rose 5.69%. High volatility during the day.

4. Market wide advance decline ratio is neutral, in NIFTY 8 advances for 42 Declines.

5. 9500 to 10000 is the range traders are expecting. 10200-10500 is likely resistance zone.

My readings of today's market action

1. I still think it is consolidation day. I do not have much bearish bias for tomorrow.

2. I think NIFTY is likely to touch the other end of range ~ 10000.

3. Depending on how it reacts near that level will decide the next course of action.

4. There was some congestion in the small range of 9788 - 9870. This is likely to be some low volume action, also occurred near end of the day.

5. 12th June candle is important ~ candle with large body ~ surprise candle. Close above 9972, bullish and close below 9545 is bearish. till then its consolidation inside the big candle.

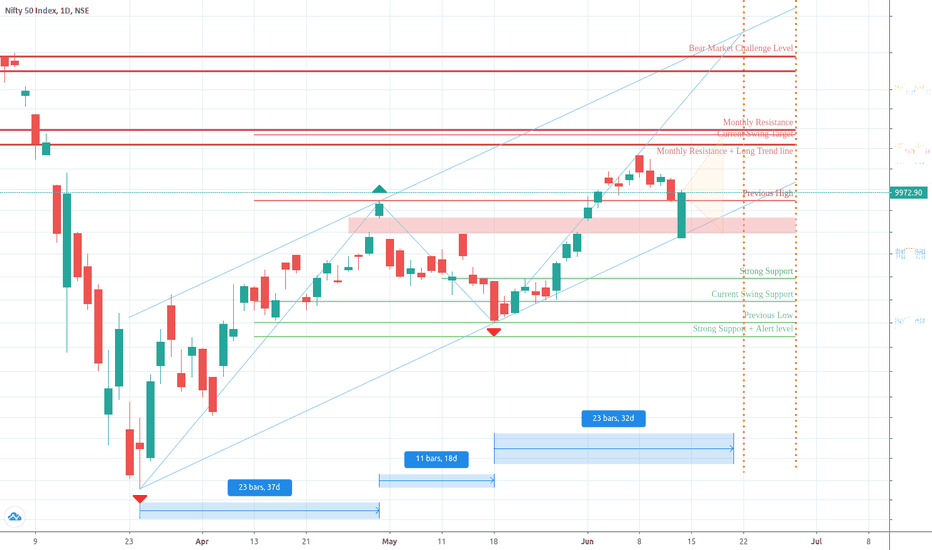

1. The touch of 9730 has happened today.

2. NIFTY has closed 1st time below 9824-9843, an important level which I watch closely.

My trades today

1. Once again simple trade worked. I sold 9800 CALL when opening range was broken out and then covered it on first sign of weakness.

2. As mentioned in weekly update, I have also created 9300/9400 and 9500/9600 Credit spreads.

Market Action today

1. NIFTY closed 1.6% lower. It was 6th day of bearish action.

2. BANK NIFTY fell 3.59%.

3. VIX rose 5.69%. High volatility during the day.

4. Market wide advance decline ratio is neutral, in NIFTY 8 advances for 42 Declines.

5. 9500 to 10000 is the range traders are expecting. 10200-10500 is likely resistance zone.

My readings of today's market action

1. I still think it is consolidation day. I do not have much bearish bias for tomorrow.

2. I think NIFTY is likely to touch the other end of range ~ 10000.

3. Depending on how it reacts near that level will decide the next course of action.

4. There was some congestion in the small range of 9788 - 9870. This is likely to be some low volume action, also occurred near end of the day.

5. 12th June candle is important ~ candle with large body ~ surprise candle. Close above 9972, bullish and close below 9545 is bearish. till then its consolidation inside the big candle.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.