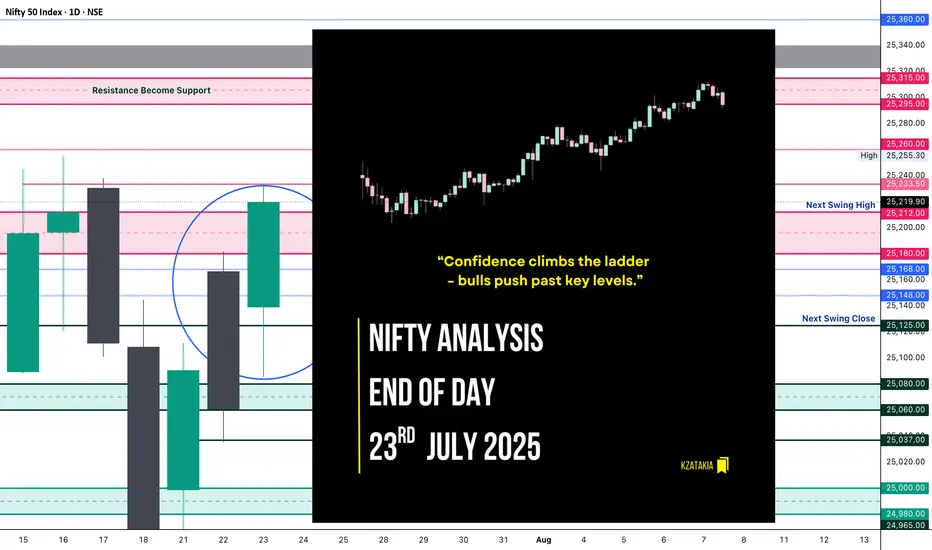

🟢 Nifty Analysis EOD – July 23, 2025 – Wednesday 🔴

“Confidence climbs the ladder – bulls push past key levels.”

Nifty opened with a Gap Up of 78 points and initially retraced 54 points, finding solid footing around the CPR Zone. Once reclaimed VWAP, the index climbed in a methodical, low-volatility uptrend, breaking one resistance after another: CDH, R1, 25150, PDH, and the key zone 25200~25212 — finally touching the anticipated resistance at 25333, and closing just below that at 25219.90, close to the day’s high.

📌 Flashback from Yesterday's Note:

“If this is truly a retracement, 25K must hold in upcoming sessions, and bulls will need to reclaim 25,200 to regain their grip.”

👉 This expectation played out to perfection today — gradual yet confident bullish strength led Nifty to reclaim 25200 and close above it.

🔍 Today’s close of 25220 is higher than the last 7 sessions, suggesting a bullish shift in structure. However, bulls now face the real test — breaching the 25300 ~ 25350 resistance zone.

🕯 5 Min Time Frame Chart with Intraday Levels

🕯 Daily Time Frame Chart with Intraday Levels

🕯️ Daily Candle Breakdown

Open: 25,139.35

High: 25,233.50

Low: 25,085.50

Close: 25,219.90

Change: +159.00 (+0.63%)

Candle structure analysis:

Real body: Green body = 80.55 pts → strong bullish body

Upper wick: 13.60 pts → very small

Lower wick: 53.85 pts → moderate

Candle Interpretation:

The session opened stable, dipped to 25,085, but strong buyers showed up, helping price climb throughout the day and close near high. A firm green candle, signaling buyers in control.

Candle Type:

A Bullish Marubozu–like candle, not perfectly clean but represents strong continuation momentum.

Key Insight:

Close above 25200 confirms a bullish grip

If price holds above 25220–25250, next push could be towards 25280–25330

Immediate support now moves to 25,120–25,140

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 181.35

IB Range: 64.35 → Medium

Market Structure: Balanced

Trades Triggered:

⏱️ 10:45 AM – Long Entry → Trailing SL Hit (1:2.65 RR)

🔁 Support & Resistance Levels

Resistance Zones:

Support Zones:

🧠 Final Thoughts

“Momentum is not magic—it’s built one level at a time.”

Bulls showed strength with control and consistency today. With 25200 reclaimed, they now hold the ball — next challenge lies at the gates of 25300–25350. Will they break through or pause for breath? Tomorrow holds the answer.

✏️ Disclaimer:

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

“Confidence climbs the ladder – bulls push past key levels.”

Nifty opened with a Gap Up of 78 points and initially retraced 54 points, finding solid footing around the CPR Zone. Once reclaimed VWAP, the index climbed in a methodical, low-volatility uptrend, breaking one resistance after another: CDH, R1, 25150, PDH, and the key zone 25200~25212 — finally touching the anticipated resistance at 25333, and closing just below that at 25219.90, close to the day’s high.

📌 Flashback from Yesterday's Note:

“If this is truly a retracement, 25K must hold in upcoming sessions, and bulls will need to reclaim 25,200 to regain their grip.”

👉 This expectation played out to perfection today — gradual yet confident bullish strength led Nifty to reclaim 25200 and close above it.

🔍 Today’s close of 25220 is higher than the last 7 sessions, suggesting a bullish shift in structure. However, bulls now face the real test — breaching the 25300 ~ 25350 resistance zone.

🕯 5 Min Time Frame Chart with Intraday Levels

🕯 Daily Time Frame Chart with Intraday Levels

🕯️ Daily Candle Breakdown

Open: 25,139.35

High: 25,233.50

Low: 25,085.50

Close: 25,219.90

Change: +159.00 (+0.63%)

Candle structure analysis:

Real body: Green body = 80.55 pts → strong bullish body

Upper wick: 13.60 pts → very small

Lower wick: 53.85 pts → moderate

Candle Interpretation:

The session opened stable, dipped to 25,085, but strong buyers showed up, helping price climb throughout the day and close near high. A firm green candle, signaling buyers in control.

Candle Type:

A Bullish Marubozu–like candle, not perfectly clean but represents strong continuation momentum.

Key Insight:

Close above 25200 confirms a bullish grip

If price holds above 25220–25250, next push could be towards 25280–25330

Immediate support now moves to 25,120–25,140

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 181.35

IB Range: 64.35 → Medium

Market Structure: Balanced

Trades Triggered:

⏱️ 10:45 AM – Long Entry → Trailing SL Hit (1:2.65 RR)

🔁 Support & Resistance Levels

Resistance Zones:

- 25,180 ~ 25,212

- 25,233

- 25,260

- 25,295 ~ 25,315

- 25,340 ~ 25,322 (Gap Zone)

Support Zones:

- 25,168

- 25,125

- 25,080 ~ 25,060

- 25,037

🧠 Final Thoughts

“Momentum is not magic—it’s built one level at a time.”

Bulls showed strength with control and consistency today. With 25200 reclaimed, they now hold the ball — next challenge lies at the gates of 25300–25350. Will they break through or pause for breath? Tomorrow holds the answer.

✏️ Disclaimer:

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Read my blogs here:

substack.com/@kzatakia

Follow me on Telegram:

t.me/swingtraderhub

Follow me on X:

x.com/kzatakia

substack.com/@kzatakia

Follow me on Telegram:

t.me/swingtraderhub

Follow me on X:

x.com/kzatakia

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Read my blogs here:

substack.com/@kzatakia

Follow me on Telegram:

t.me/swingtraderhub

Follow me on X:

x.com/kzatakia

substack.com/@kzatakia

Follow me on Telegram:

t.me/swingtraderhub

Follow me on X:

x.com/kzatakia

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.