🟢 Nifty Analysis EOD – June 13, 2025 – Friday 🔴

🕊️ Gap-Down on Geopolitical Tension – Buyers Step In at Crucial Support

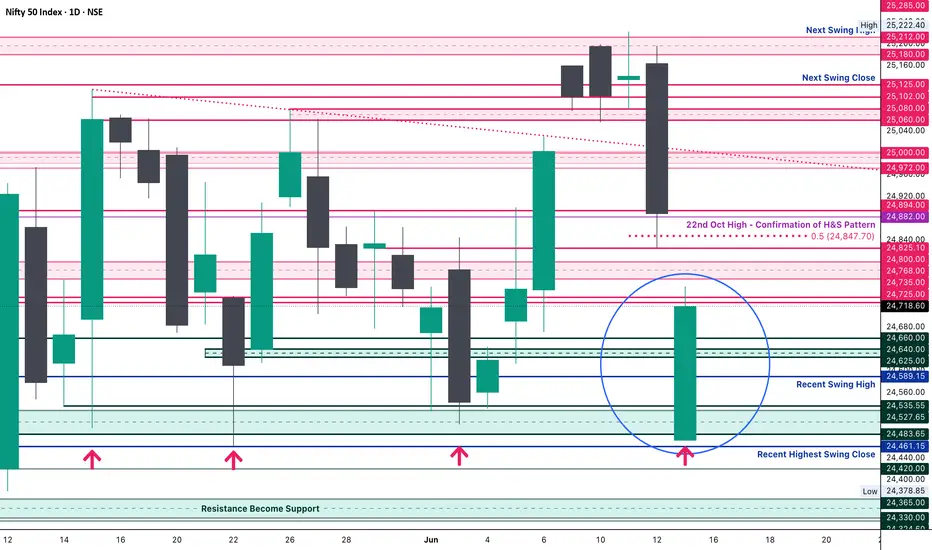

Nifty opened with a massive gap-down of 415 points at 24,473 triggered by overnight geopolitical tensions — testing a crucial swing low from May 22. Interestingly, the market formed an OL (Open = Low) pattern and staged a powerful 281-point intraday recovery, closing near the day’s high at 24,718.60.

While the adjusted close still reflects a −0.68% drop, the price action was dominantly bullish. The strong bounce from the 24,460–24,520 demand zone — a region that had acted as a reversal zone multiple times earlier — reaffirms its significance.

🧭 If global cues stabilize or turn positive, this could pave the way for a bounce back toward 25,000. But if Friday’s low is breached, sentiment damage may deepen further. For now, intraday opportunities are preferable over positional plays, as uncertainty persists.

📝 A reminder from the May 22 note:

“Is the retracement run finished? Technically, YES. A bold call, but unless global headwinds reappear, today’s low must sustain.”

https://tradingview.sweetlogin.com/chart/NIFTY/jeF8X2ld-Nifty-Analysis-EOD-May-22-2025-Thursday/

Nifty has once again honored this level — but the coming sessions will determine whether this bounce was genuine or temporary.

🛡 5 Min Chart with Levels

🕯 Daily Time Frame Chart

🕯 Daily Candle Breakdown

Open: 24,473.00

High: 24,754.35

Low: 24,473.00

Close: 24,718.60

Net Change: −169.60 (−0.68%)

📊 Candle Structure Breakdown

Real Body: 245.60 pts → 🟢 Strong Green Candle

Upper Wick: 35.75 pts

Lower Wick: None (OL Formation)

🔍 Interpretation

Despite the gap-down, bulls took control right from the open.

The absence of a lower wick signals firm intraday confidence.

Closing near the high reinforces the buying strength, even on a net down day.

🔦 Candle Type

💚 Bullish Marubozu–like (OL) Candle– Represents a strong intra-session reversal, where buyers dominated from the very first tick.

📌 Key Insight

Price respected the 24,460–24,520 zone, once again validating it as key support.

If the next session crosses and sustains above 24,750–24,770, a short-term reversal confirmation could follow.

However, a breakdown below 24,473 may renew bearish pressure.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 269.05

IB Range: 145.05 → Medium IB

Market Structure: Balanced

Trades:✅ 10:20 AM – Long Triggered → Target Achieved, Trailing SL Hit (RR: 1:1.7)

📌 Support & Resistance Zones

Resistance Levels

24,725 ~ 24,735

24,825 ~ 24,847 (Fibonacci 0.5 retracement level)

24,882 ~ 24,894

24,972 ~ 25,000

25,060 ~ 25,080

Support Levels

24,660

24,640 ~ 24,625

24,420

24,365 ~ 24,330

24,245 ~ 24,220

💭 Final Thoughts

Friday’s session was a battle between fear and resilience — and bulls showed up just in time. The key test ahead: can the index reclaim 25K or will the bounce fade away?

🧠 “Great rebounds are born from great fear — but follow-through is what separates noise from reversal.”

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

🕊️ Gap-Down on Geopolitical Tension – Buyers Step In at Crucial Support

Nifty opened with a massive gap-down of 415 points at 24,473 triggered by overnight geopolitical tensions — testing a crucial swing low from May 22. Interestingly, the market formed an OL (Open = Low) pattern and staged a powerful 281-point intraday recovery, closing near the day’s high at 24,718.60.

While the adjusted close still reflects a −0.68% drop, the price action was dominantly bullish. The strong bounce from the 24,460–24,520 demand zone — a region that had acted as a reversal zone multiple times earlier — reaffirms its significance.

🧭 If global cues stabilize or turn positive, this could pave the way for a bounce back toward 25,000. But if Friday’s low is breached, sentiment damage may deepen further. For now, intraday opportunities are preferable over positional plays, as uncertainty persists.

📝 A reminder from the May 22 note:

“Is the retracement run finished? Technically, YES. A bold call, but unless global headwinds reappear, today’s low must sustain.”

https://tradingview.sweetlogin.com/chart/NIFTY/jeF8X2ld-Nifty-Analysis-EOD-May-22-2025-Thursday/

Nifty has once again honored this level — but the coming sessions will determine whether this bounce was genuine or temporary.

🛡 5 Min Chart with Levels

🕯 Daily Time Frame Chart

🕯 Daily Candle Breakdown

Open: 24,473.00

High: 24,754.35

Low: 24,473.00

Close: 24,718.60

Net Change: −169.60 (−0.68%)

📊 Candle Structure Breakdown

Real Body: 245.60 pts → 🟢 Strong Green Candle

Upper Wick: 35.75 pts

Lower Wick: None (OL Formation)

🔍 Interpretation

Despite the gap-down, bulls took control right from the open.

The absence of a lower wick signals firm intraday confidence.

Closing near the high reinforces the buying strength, even on a net down day.

🔦 Candle Type

💚 Bullish Marubozu–like (OL) Candle– Represents a strong intra-session reversal, where buyers dominated from the very first tick.

📌 Key Insight

Price respected the 24,460–24,520 zone, once again validating it as key support.

If the next session crosses and sustains above 24,750–24,770, a short-term reversal confirmation could follow.

However, a breakdown below 24,473 may renew bearish pressure.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 269.05

IB Range: 145.05 → Medium IB

Market Structure: Balanced

Trades:✅ 10:20 AM – Long Triggered → Target Achieved, Trailing SL Hit (RR: 1:1.7)

📌 Support & Resistance Zones

Resistance Levels

24,725 ~ 24,735

24,825 ~ 24,847 (Fibonacci 0.5 retracement level)

24,882 ~ 24,894

24,972 ~ 25,000

25,060 ~ 25,080

Support Levels

24,660

24,640 ~ 24,625

24,420

24,365 ~ 24,330

24,245 ~ 24,220

💭 Final Thoughts

Friday’s session was a battle between fear and resilience — and bulls showed up just in time. The key test ahead: can the index reclaim 25K or will the bounce fade away?

🧠 “Great rebounds are born from great fear — but follow-through is what separates noise from reversal.”

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Read my blogs here:

substack.com/@kzatakia

Follow me on Telegram:

t.me/swingtraderhub

Follow me on X:

x.com/kzatakia

substack.com/@kzatakia

Follow me on Telegram:

t.me/swingtraderhub

Follow me on X:

x.com/kzatakia

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Read my blogs here:

substack.com/@kzatakia

Follow me on Telegram:

t.me/swingtraderhub

Follow me on X:

x.com/kzatakia

substack.com/@kzatakia

Follow me on Telegram:

t.me/swingtraderhub

Follow me on X:

x.com/kzatakia

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.