Good morning, Friends! 🌞

Here are the market directions and levels for June 24:

Market Overview

Due to ongoing global issues, the markets are showing high volatility. Structurally, both the global and our local markets are still moving within a range.

However, Gift Nifty is indicating a strong gap-up of around 250 points.

So, what can we expect today?

In the previous session, both Nifty and Bank Nifty witnessed sharp ups and downs. Even with those swings, they still ended within a range.

However, today’s gap-up might break that previous range—if it holds.

We should wait for clear confirmation before expecting any continuation.

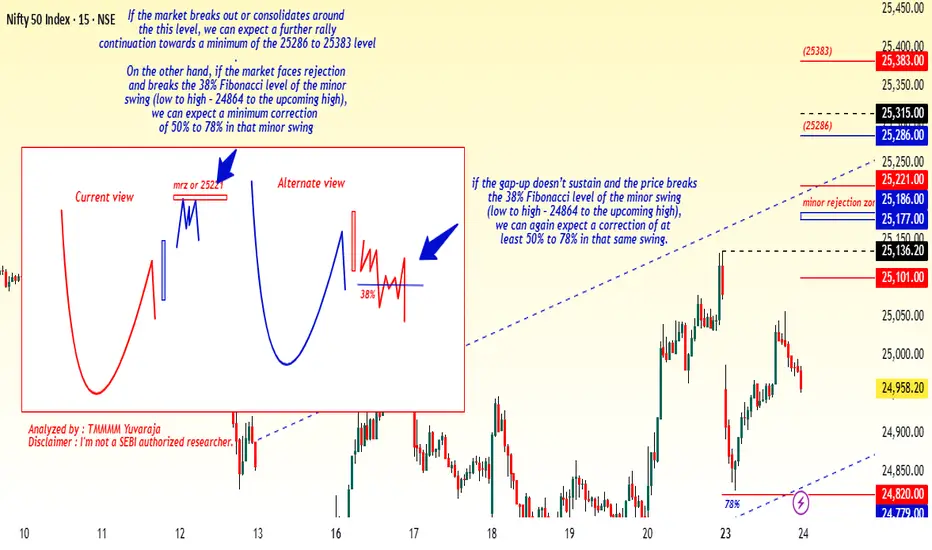

That means, if the market breaks the resistance with a solid candle or consolidates around the resistance zone, we can expect the rally to continue.

On the other hand, if the market faces rejection at the resistance, it may re-enter the range and move back within the channel.

Let’s look at the chart for more clarity.

Both Nifty and Bank Nifty appear to be showing a similar structure.

Current View

As already discussed:

If the market breaks out or consolidates around the rejection zone, we can expect a further rally continuation towards a minimum of the 78% Fibonacci level — for Bank Nifty and for Nifty, around the 25,286 to 25,383 zone.

On the other hand, if the market faces rejection and breaks the 38% Fibonacci level of the minor swing:

Then we can expect a minimum correction of 50% to 78% in that minor swing.( to use fib

Nifty: Low to High – 24,864 to the upcoming high)

Alternate View

If the gap-up doesn’t sustain and the market breaks the 38% Fibonacci level of the minor swing:

Then again, we can expect a correction of at least 50% to 78% in the same swing..( to use fib

Nifty: Low to High – 24,864 to the upcoming high)

Here are the market directions and levels for June 24:

Market Overview

Due to ongoing global issues, the markets are showing high volatility. Structurally, both the global and our local markets are still moving within a range.

However, Gift Nifty is indicating a strong gap-up of around 250 points.

So, what can we expect today?

In the previous session, both Nifty and Bank Nifty witnessed sharp ups and downs. Even with those swings, they still ended within a range.

However, today’s gap-up might break that previous range—if it holds.

We should wait for clear confirmation before expecting any continuation.

That means, if the market breaks the resistance with a solid candle or consolidates around the resistance zone, we can expect the rally to continue.

On the other hand, if the market faces rejection at the resistance, it may re-enter the range and move back within the channel.

Let’s look at the chart for more clarity.

Both Nifty and Bank Nifty appear to be showing a similar structure.

Current View

As already discussed:

If the market breaks out or consolidates around the rejection zone, we can expect a further rally continuation towards a minimum of the 78% Fibonacci level — for Bank Nifty and for Nifty, around the 25,286 to 25,383 zone.

On the other hand, if the market faces rejection and breaks the 38% Fibonacci level of the minor swing:

Then we can expect a minimum correction of 50% to 78% in that minor swing.( to use fib

Nifty: Low to High – 24,864 to the upcoming high)

Alternate View

If the gap-up doesn’t sustain and the market breaks the 38% Fibonacci level of the minor swing:

Then again, we can expect a correction of at least 50% to 78% in the same swing..( to use fib

Nifty: Low to High – 24,864 to the upcoming high)

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.