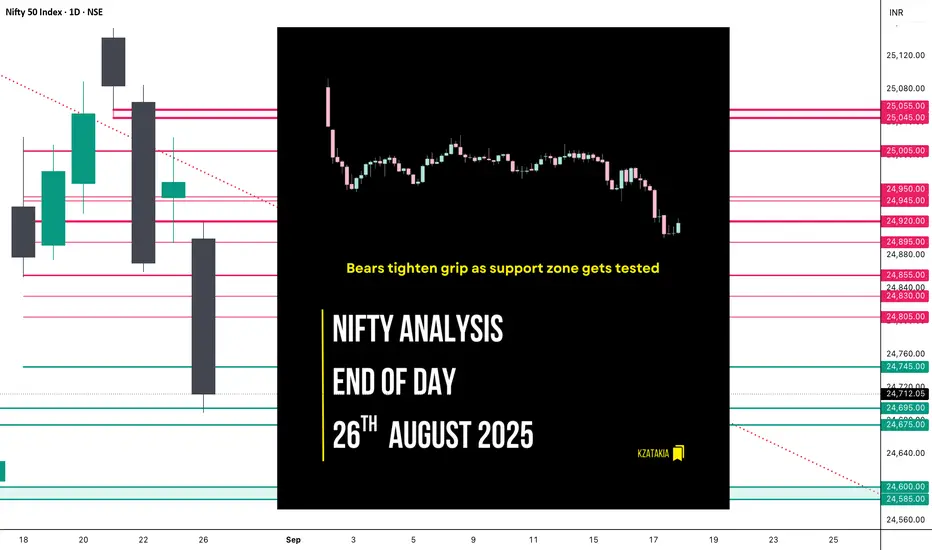

🟢 Nifty Analysis EOD – August 26, 2025 – Tuesday 🔴

Bears tighten grip as support zone gets tested

📰 Nifty Summary

Nifty opened with a 72-point gap-down and extended the fall by more than 150 points, finding support at 24,755.

Despite a few recovery attempts, the index mostly hovered around VWAP. Around 3 PM, Nifty broke the day’s low to hit 24,689.60 before a minor 21-point bounce, finally closing at 24,710.70.

Monday’s upmove proved to be just a dead-cat bounce of Friday’s fall. After forming an Inside Bar on the daily chart, today’s breakdown extended the weakness. Now, holding the 24,585–24,600 zone will be crucial for any base-building attempts.

🛡 5 Min Intraday Chart with Levels

📊 Intraday Walk

📉 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

🏗️ Structure Breakdown

📚 Interpretation

Candle type:

Bearish Marubozu-like, signaling bear dominance.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

📌 Support & Resistance Levels

Resistance Zones:

Support Zones:

🔮 What’s Next?

💭 Final Thoughts

“Markets don’t reverse on hope, they reverse on structure.”

With today’s close hugging the support zone, the next few sessions will decide if Nifty can stabilize—or if bears extend their grip further.

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Bears tighten grip as support zone gets tested

📰 Nifty Summary

Nifty opened with a 72-point gap-down and extended the fall by more than 150 points, finding support at 24,755.

Despite a few recovery attempts, the index mostly hovered around VWAP. Around 3 PM, Nifty broke the day’s low to hit 24,689.60 before a minor 21-point bounce, finally closing at 24,710.70.

Monday’s upmove proved to be just a dead-cat bounce of Friday’s fall. After forming an Inside Bar on the daily chart, today’s breakdown extended the weakness. Now, holding the 24,585–24,600 zone will be crucial for any base-building attempts.

🛡 5 Min Intraday Chart with Levels

📊 Intraday Walk

- Opened with a 72-point gap-down.

- Sharp selling → tested 24,755 support.

- Multiple recovery attempts, stuck around VWAP.

- 3 PM breakdown → new day low at 24,689.60.

- Closed weak at 24,710.70, right at support.

📉 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

- Open: 24,899.50

- High: 24,919.65

- Low: 24,689.60

- Close: 24,712.05

- Change: −255.70 (−1.02%)

🏗️ Structure Breakdown

- Strong red candle (Close < Open).

- Body: 187.45 points → decisive selling.

- Upper wick: 20 points → no buying strength.

- Lower wick: 22 points → negligible bounce.

📚 Interpretation

- Market opened lower, weak recovery above 24,919.

- Continuous selling dragged it near the day’s low.

- Confirms bearish follow-through after rejection at 25,000 on Aug 22.

Candle type:

Bearish Marubozu-like, signaling bear dominance.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

- ATR: 201.98

- IB Range: 164.05 → Medium

- Market Structure: ImBalanced

- Trade Highlights: No trade triggered by the system

today.

📌 Support & Resistance Levels

Resistance Zones:

- 24,805 ~ 24,830

- 24,855

- 24,895

- 24,920

- 24,945 ~ 24,950

Support Zones:

- 24,695 ~ 24,675

- 24,600 ~ 24,585

🔮 What’s Next?

- Short-term resistance now sits at 24,920, acting as a ceiling.

- Support lies at 24,695–24,675, already tested today.

- If broken, the next key zone is 24,585–24,600, crucial for base-building.

- Trend clearly shifted from buying fatigue → decisive selling.

💭 Final Thoughts

“Markets don’t reverse on hope, they reverse on structure.”

With today’s close hugging the support zone, the next few sessions will decide if Nifty can stabilize—or if bears extend their grip further.

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Read my blogs here:

substack.com/@kzatakia

Follow me on Telegram:

t.me/swingtraderhub

Follow me on X:

x.com/kzatakia

substack.com/@kzatakia

Follow me on Telegram:

t.me/swingtraderhub

Follow me on X:

x.com/kzatakia

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Read my blogs here:

substack.com/@kzatakia

Follow me on Telegram:

t.me/swingtraderhub

Follow me on X:

x.com/kzatakia

substack.com/@kzatakia

Follow me on Telegram:

t.me/swingtraderhub

Follow me on X:

x.com/kzatakia

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.