🚀 Trade Idea: NMM (Navios Maritime Partners LP) - Bullish Shipping Play with Strong Upside

📈 Trading Setup

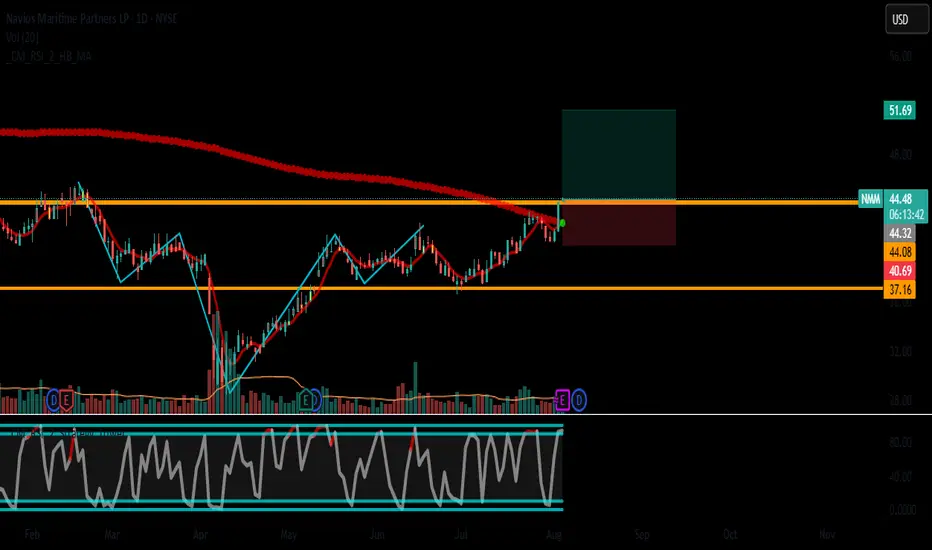

Entry: $44.35 (Breakout above consolidation)

Stop Loss: $40.70 (8.2% risk)

Take Profit: $51.70 (+16.5% upside)

Risk/Reward Ratio: 1:2

🔍 Why NMM Now?

✅ Fundamental Catalysts

Shipping Rates Recovery: Baltic Dry Index up 22% MTD

Dividend Yield: 3.8% (Paid quarterly)

Valuation:

P/E 4.2 vs industry avg 8.6

P/B 0.67 (Deep value territory)

Fleet Utilization: 98% (Industry-leading efficiency)

📊 Technical Triggers

Pattern:

Ascending triangle breakout (Daily chart)

Bull flag forming on 4H timeframe

Key Levels:

Resistance Break: $44.35 (YTD high)

Next Resistance: $51.70 (2022 swing high)

Momentum:

RSI: 62 (Healthy momentum)

MACD: Bullish histogram expansion

🎯 Trade Execution Plan

Entry Confirmation:

Wait for >3% volume spike on $44.35 break

Ideal entry on pullback to $43.80

Position Management:

50% position at breakout

50% on retest of $44 as support

Profit Strategy:

TP1: $48.00 (Partial profit)

TP2: $51.70 (Full position)

Stop Adjustment:

Trail to $42.50 after $46 break

⚠️ Risk Considerations

Commodity Sensitivity: Iron ore/coal demand fluctuations

Fuel Costs: Bunker price volatility

Dividend Safety: Payout ratio at 85% (Monitor cash flow)

📌 Sector Context

Dry Bulk Outlook:

China stimulus boosting industrial demand

Fleet growth at 20-year lows (Bullish supply/demand)

Peer Performance:

SALT +18% MTD

GOGL +12% MTD

Best For:

Swing traders (2-8 week hold)

Dividend investors seeking cyclical exposure

#NMM #Shipping #Breakout #ValueInvesting

*Chart Note: The 50-day MA ($41.20) aligns with stop level - adds confluence to risk management. Always verify live market conditions before trading.*

Pro Tip: Track Capesize rates (5TC index) for fundamental confirmation. Current rates at $18,750/day (Above break-even for most operators).

📈 Trading Setup

Entry: $44.35 (Breakout above consolidation)

Stop Loss: $40.70 (8.2% risk)

Take Profit: $51.70 (+16.5% upside)

Risk/Reward Ratio: 1:2

🔍 Why NMM Now?

✅ Fundamental Catalysts

Shipping Rates Recovery: Baltic Dry Index up 22% MTD

Dividend Yield: 3.8% (Paid quarterly)

Valuation:

P/E 4.2 vs industry avg 8.6

P/B 0.67 (Deep value territory)

Fleet Utilization: 98% (Industry-leading efficiency)

📊 Technical Triggers

Pattern:

Ascending triangle breakout (Daily chart)

Bull flag forming on 4H timeframe

Key Levels:

Resistance Break: $44.35 (YTD high)

Next Resistance: $51.70 (2022 swing high)

Momentum:

RSI: 62 (Healthy momentum)

MACD: Bullish histogram expansion

🎯 Trade Execution Plan

Entry Confirmation:

Wait for >3% volume spike on $44.35 break

Ideal entry on pullback to $43.80

Position Management:

50% position at breakout

50% on retest of $44 as support

Profit Strategy:

TP1: $48.00 (Partial profit)

TP2: $51.70 (Full position)

Stop Adjustment:

Trail to $42.50 after $46 break

⚠️ Risk Considerations

Commodity Sensitivity: Iron ore/coal demand fluctuations

Fuel Costs: Bunker price volatility

Dividend Safety: Payout ratio at 85% (Monitor cash flow)

📌 Sector Context

Dry Bulk Outlook:

China stimulus boosting industrial demand

Fleet growth at 20-year lows (Bullish supply/demand)

Peer Performance:

SALT +18% MTD

GOGL +12% MTD

Best For:

Swing traders (2-8 week hold)

Dividend investors seeking cyclical exposure

#NMM #Shipping #Breakout #ValueInvesting

*Chart Note: The 50-day MA ($41.20) aligns with stop level - adds confluence to risk management. Always verify live market conditions before trading.*

Pro Tip: Track Capesize rates (5TC index) for fundamental confirmation. Current rates at $18,750/day (Above break-even for most operators).

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.