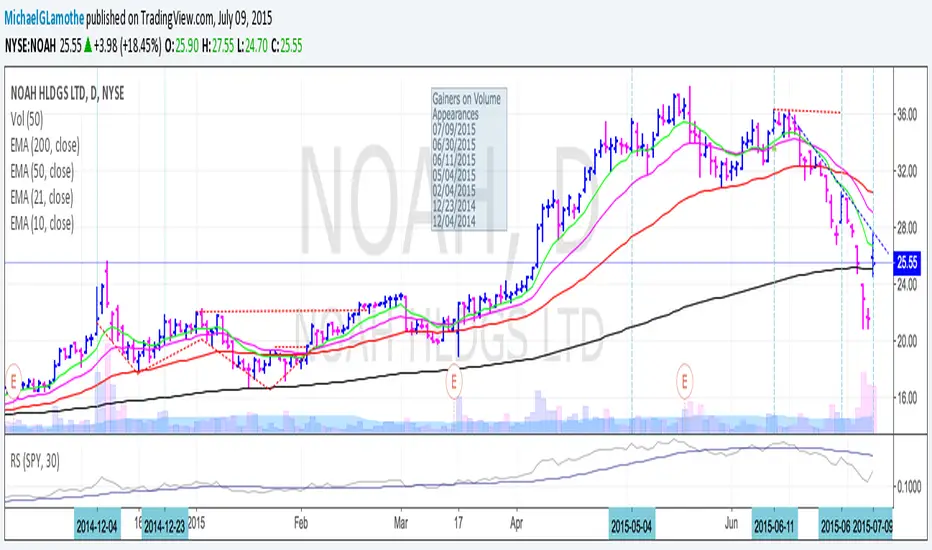

-Shakeout below major support (200dma) And recovery

-Support established consistently (back to back days at $21)

-Day two (in this case Wednesday) showed support by closing in the middle of its range

-Small distance between entry and exit (if entering at close do day Tuesday at $22.22 vs $21 exit)

Today

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.