I started to follow NOK lately again, as first of all I think it is really undervalued in G10

(well, it has been undervalued and hated for 2 years now), and also because its volatility has become very low. Basically NOK has been trading in a very thin range.

So if we see some short opportunity in EURNOK, why not to examine NOKSEK too?

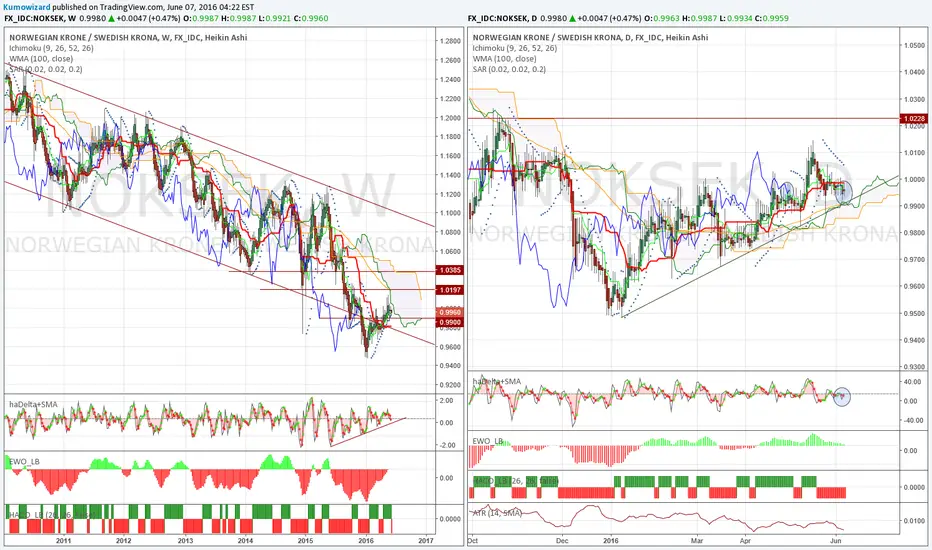

Weekly:

- Ichimoku setup has changed to neutral: Kumo shades price ahead, Price is above Tenkan and Kijun, Tenkan/Kijun is weak bullish. Future Kumo started to tighten. 100wma is also down to 1,0180.

- Lower supp/res level is 0,98, upper resistances are ard 1,02 and 1,0385, finally at 1,08 (major long term trendline)

- EWO has managed to climb back to zero! It has not been here since May/2015!

- Heikin-Ashi weekly candle shows consolidation after bullish run from 0,98 to 1,01. haDelta/SMA3 is above zero line!

Daily:

- Short term trend is bullish!

- Ichimoku setup is bullish biased too, but needs to regain momentum. That would happen with a Price cross above Kijun Sen (1,00). Chikou Span is still above past candles.

- Heikin-Ashi shows indecision, with possible bullish continuation ahead. In case it prints a green candle and crosses back above Kijun, next target can be 1,02+

- EWO decreased, but still above zero.

Based on the daily chart I think 0,9930-0,9990 is a good risk/reward buy zone.

Initial stop below 0,9880

(well, it has been undervalued and hated for 2 years now), and also because its volatility has become very low. Basically NOK has been trading in a very thin range.

So if we see some short opportunity in EURNOK, why not to examine NOKSEK too?

Weekly:

- Ichimoku setup has changed to neutral: Kumo shades price ahead, Price is above Tenkan and Kijun, Tenkan/Kijun is weak bullish. Future Kumo started to tighten. 100wma is also down to 1,0180.

- Lower supp/res level is 0,98, upper resistances are ard 1,02 and 1,0385, finally at 1,08 (major long term trendline)

- EWO has managed to climb back to zero! It has not been here since May/2015!

- Heikin-Ashi weekly candle shows consolidation after bullish run from 0,98 to 1,01. haDelta/SMA3 is above zero line!

Daily:

- Short term trend is bullish!

- Ichimoku setup is bullish biased too, but needs to regain momentum. That would happen with a Price cross above Kijun Sen (1,00). Chikou Span is still above past candles.

- Heikin-Ashi shows indecision, with possible bullish continuation ahead. In case it prints a green candle and crosses back above Kijun, next target can be 1,02+

- EWO decreased, but still above zero.

Based on the daily chart I think 0,9930-0,9990 is a good risk/reward buy zone.

Initial stop below 0,9880

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.