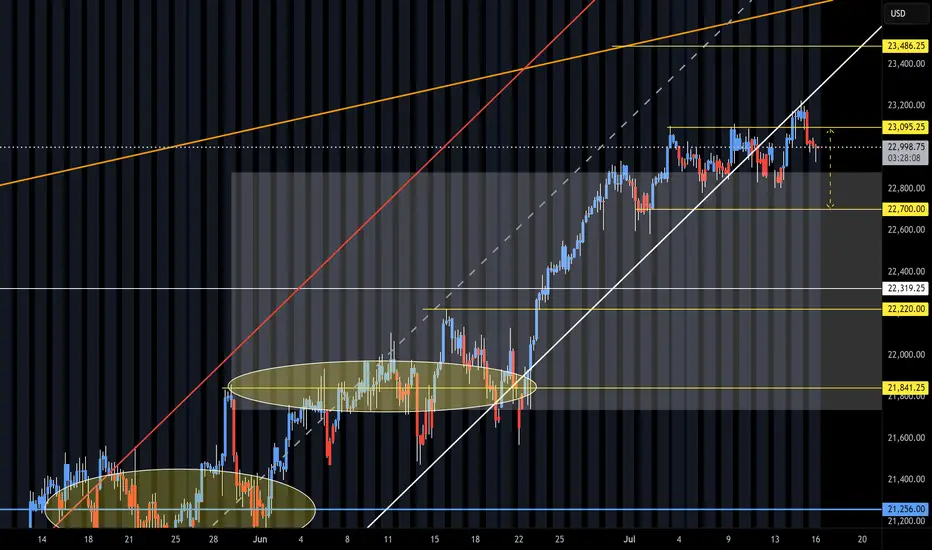

NAZ again can't hold on the Monday off session pump during the Reg Session and does hit lower zone of 22,920. Next trick is Gov't controlled news (released in off session of course) should that not lift it then KL's 881-780 may be next.

The NAZ will go lower under 780 and will be a Strong Short under 22,700. The issue is with getting past the off session propping/rigging (up). Circles to the left are drop target zones that are likely to be revisited as ultimately the NAZ goes sideways in a larger range. The current 14 day sideways moves feels like an Long Mop up or Long Trap. The NAZ will need Tweets, O/N Prop moves and Dead Zone magic lifting to stay away from the Danger Zone of sell orders near 22,881-780.

The NAZ will go lower under 780 and will be a Strong Short under 22,700. The issue is with getting past the off session propping/rigging (up). Circles to the left are drop target zones that are likely to be revisited as ultimately the NAZ goes sideways in a larger range. The current 14 day sideways moves feels like an Long Mop up or Long Trap. The NAZ will need Tweets, O/N Prop moves and Dead Zone magic lifting to stay away from the Danger Zone of sell orders near 22,881-780.

Note

Give me some big strong moves in the Reg Sessions and not just Overnight and I will stop looking Short. Until that, it just appears fake/rigged or gamed. Note

The Magic reference applies to the NAZ usually being Flat near Key Trading Zones (such as the Close or O/N). This is usually after a Reg Session sell off. Off Session Magic would be with the constant lift in the Overnight. Then you have the Friday-Monday usually Long Move. Trading Magic = Rigged Markets or some type of Trap Set Up (in the opposite direction). BTD/FOMO Forever (or Tuesday).Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.