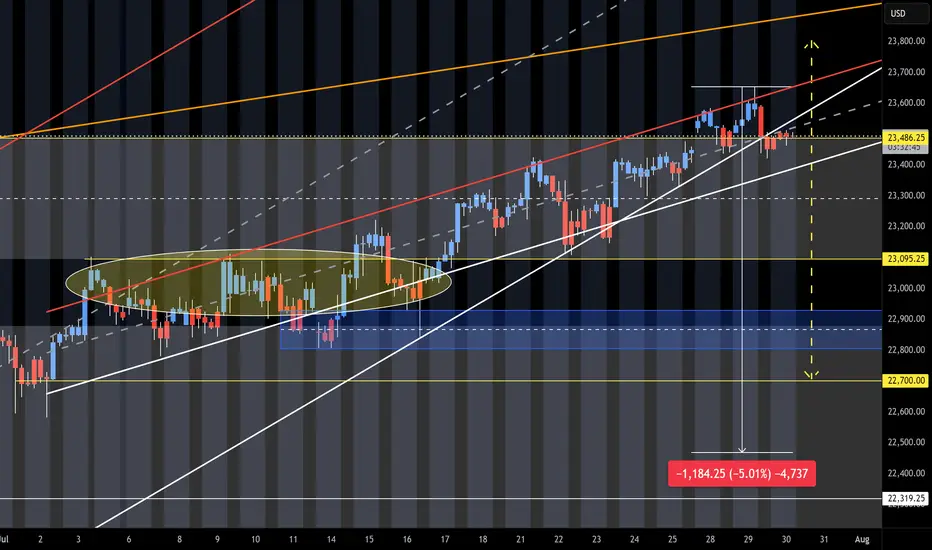

NAZ is at upper target and Turn Zone from May 12th post. Failure here should see a 5% drop test. The idea is that buyers will need some sellers in order to get higher. The sellers will help to test the level strength. Month end into a Friday-Monday Long play and a break in this long standing pattern may create the opposite. Current danger zone is the 23,486 KL. Look Long above and short below. Scalping Shorts should turn to holding shorts and scalping Longs. Expect timely Tweets and same old Tricks near or under the DZ. O/N is still The BOSS until both the O/N and Reg Session sell (on same day).

Note

Started yesterday, Lower highs and lower lows. Yesterday was a near ODR. Sell orders OMG. BTD/FOMO with the Trick Tweeter is on pause.Note

Looks like the buyers only need a tiny dip to pull in sellers, was expecting a much deeper drop. Just can't get past the O/N lift Team. Note

7/31 Update, The same pattern is continuing with most Long (vertical) move in the off session. These usually lead to the result of a slight pump/dump into the reg session and open drive, then sideways (with slight lift) to the close. NAZ did hit TL and circle is MAX lift or turn zone. Sticking with Short Scalping, now more than ever as we see the apparent long trap really playing out. Black swan could be the firing of Powell and Tariff deals breaking down, you never know but can imagine. Note

5 year on the NDX with Covid drop to the right. The current 40% pop (with 2 -3 major trick moves) is back at TL. 50% or so of the 40% came with 2 moves that are air pockets. The M may form to the right side and a hold on drop will become the W. Current 40% move is major and sticks out like a " Turd in a Punchbowl" (Porky's fan's). Note

Steps back lower when the drop shows up. You can see that the Pop out of the Top Box and Danger Zone level 23,486 was placed in the O/N (2 times). This level is key on any drop retest. They gapped it on a weekend and popped it after a Fed Day. Back under this one should get the lower move going. Note

800-486 is range here.Note

Up in Days and Down in hours/minutes. BTD/FOMO Boss may of just got FIRED. We shall see what the O/N and F-M Long play does. Trade closed manually

Going into the Close and O/N, if Meta and MSFT were not up so much the index would be well below this level. The Range today is 500 points and this is significant. I highly doubt that the NAZ will recover or break above today high. Tweets, Tricks and Games will need to show up near the Close or O/N. Turd Alert and Long Trap is most likely playing out here. Note

Today's volume may be the highest in past 30 trading days. Other signals with a direction change: 30 points away from ODR now (after 500 point drop), heavy selling volume and TL hit and rejection. Should the O/N redirect this and take it back up, that would be nearly illegal and may get some Pro's ready to punish it. We may see a new BOSS.Note

Correction: 485 is yesterday close and can be ODR based on the NAZ closing below that. I use prior day low which is better gage. So, technically we are under 485 and in an ODR. 485 is also the DANGER ZONE.Note

We had lower Reg Session, need to see a lower O/N now.Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.