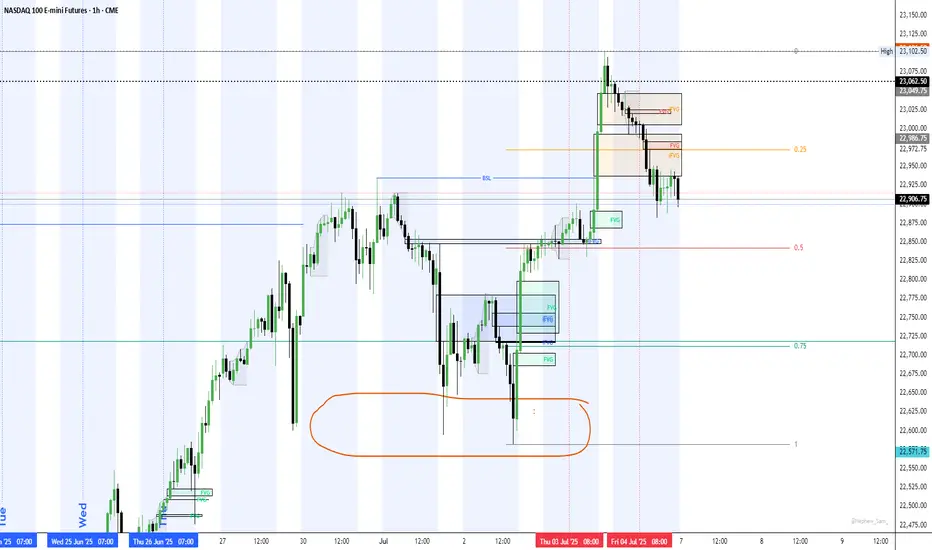

🧠 NASDAQ 100 (NQ) Weekly Outlook – July 8–12, 2025

📍Liquidity Sweep Before Expansion?

After the rejection near 23,100, NQ appears to be entering a rebalancing phase, with potential downside liquidity grabs before any continuation to the upside.

📊 Key Technical Levels:

🔸 High: 23,102.50 → Major buy-side liquidity zone.

🔸 Equal Lows: 22,675 – 22,725 → Potential draw on liquidity.

🔸 0.75–1.00 retracement zone (from the recent bullish leg) overlaps with a clear demand area.

🔸 Multiple open Fair Value Gaps (FVGs) remain above and below current price.

📈 Primary Scenario:

✅ Bullish bias, after a potential liquidity sweep below the Equal Lows.

🔻 A downside sweep into the 22,675–22,725 zone would open up opportunities to go long on bullish confirmation, targeting:

22,975 (FVG fill)

23,050 (intermediate resistance)

23,102+ (liquidity above previous high)

⚠️ Alternate Scenario:

If the market fails to sweep the lows and begins pushing higher early in the week, I’ll look for breakout-retest setups above 22,975 to participate in continuation plays.

🎯 Weekly Game Plan:

Plan A: Wait for a liquidity sweep below the equal lows, then look for a bullish reaction and structure shift to go long.

Plan B: In the absence of a sweep, only consider longs above 22,975 after confirmation of strength.

📌 This outlook is based on price action, market structure, liquidity zones, and FVG analysis. Not financial advice.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.